By A. Bryan Endres and Jessica Guarino et.al

Department of Agricultural and Consumer Economics

University of Illinois

In 2003, Illinois significantly revised its Grain Code to provide additional protection to famers in the event a state-licensed grain dealer or warehouse fails. A grain elevator that stores grain for a farmer acts as a warehouse, while an elevator that buys grain from the farmer is acting as a grain dealer. Farmers typically will sell grain to an elevator under three general arrangements: an immediate payment sale in which the farmer sells the grain at the current price and receives payment; a deferred payment sale in which the farmer delivers and sells the grain at the current price but payment is delayed until a future date; or a price later contract in which gain is delivered and the elevator takes ownership, but the price and payment is determined at some future date.[1]

If a grain elevator fails, the Illinois Grain Insurance Fund (IGIF) will guarantee payments to farmers up to preset limits and restrictions based on the type of sales contract. For price later sales, the IGIF will guarantee 85% of the payment, up to a cap of $250,000. In order for a claim to qualify, either completion of delivery or the date of pricing must be within 160 days of the elevator’s failure. In addition, either the date of the execution of the contract or delivery of the grain must be no more than within 365 days of the elevator’s failure.[2] These eligibility requirements are known as the 160-day and 365-day Rules.

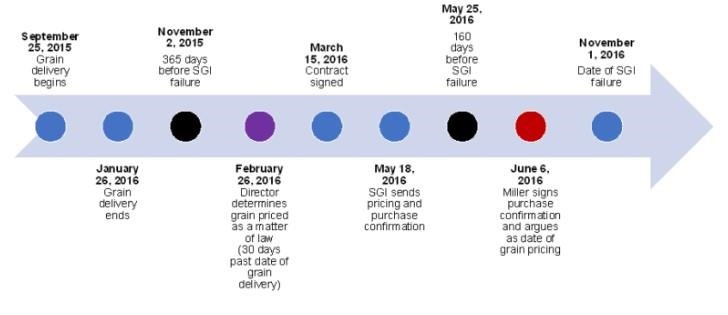

Illinois’ Fourth Circuit Court of Appeals recently interpreted the application of the 160-day rule for price later contracts in the case Miller v. Department of Agriculture.[3] The plaintiff, Robert Miller, was a grain producer who applied for reimbursement from the IGIF after the failure of SGI Agri-Marketing, LLC, an Illinois-licensed grain dealer.[4] Though Miller entered multiple price later contracts with SGI, at issue was Price Later Contact 215, which was fully executed on March 15, 2016.[5] On Contract 215, a box was checked “showing the grain was delivered between the handwritten dates of September 25, 2015, and January 26, 2016.” The basis by which the contract identified the sale price of the grain was for the contract price of July 2016 futures at the Chicago Board of Trade to be set on any business day between the date of the contract and June 25, 2016. On May 18, 2016, SGI sent pricing and purchase confirmation for about 15,000 bushels of grain, which Miller signed on June 6, 2016. On November 1, 2016, the Department determined SGI failed its contractual obligations and Miller received a letter from The Department’s Bureau of Warehouses notifying him of SGI’s failure on November 16, 2016. A graphic of the timeline is below.

Miller filed a claim for reimbursement from the Grain Insurance Fund on November 22, 2016, which ultimately was denied. The Fourth Circuit Court of Appeals reversed the trial court’s order denying Miller’s claim for compensation, holding that the lower court erroneously interpreted portions of the Grain Code.[6] Primarily, the Fourth Circuit addressed Section 10-15(e) of the Grain Code and whether its language sets a pricing date as a matter of law when the parties do not enter a price later contract within 30 days of grain delivery.[7]

Section 10-15(e) of the Grain Code provides, in relevant part:

[I]f a price later contract is not signed by all parties within 30 days of the last date of delivery of grain intended to be sold by price later contract, then the grain intended to be sold by price later contract shall be priced on the next business day after 30 days from the last date of delivery of grain intended to be sold by price later contract at the market price of the grain at the close of the next business day after the 29th day. When the grain is priced under this subsection, the grain dealer shall send notice to the seller of the grain within 10 days.[8]

Department argued that “if the parties fail to enter into a contract within 30 days of the last delivery, the grain ‘shall be priced on the next business day’” and that the “statute does not indicate who prices the grain, and, therefore, the plain meaning of the provision is that the grain is priced automatically on the thirtieth day.”[9] In contrast, Miller argued that nothing in the language of Section 10-15(e) required automatic pricing.[10] The Fourth Circuit agreed with Miller, noting that the statute’s plain language “dictates an individual or entity shall set a price on or find out the price of the grain”[11] and that entity is the grain dealer.[12]

In addition to the textual analysis, an observer could view the Court’s decision as, in close cases, liberally interpreting the Grain Code to protect claimants from failed grain elevators. But as noted in a farmdoc article from almost 20 years ago,[13] farmers need to understand the risks and benefits of price later sales and follow good practices to maximize their protection under the Illinois Grain Code. This includes (1) always collecting with 160 days of delivering or pricing the grain; and within 365 days of the later of delivering the grain or entering into the price later contract; and (2) never letting the uncollected value of a price later sale to exceed $250,000.

Source : illinois.edu