By Larry Van Tassell

A student came to my office a while back excited about the opportunity to purchase 80 acres of farmland close to his family’s farm. His father offered to let him use the family machinery and equipment in exchange for labor. The student had properly worked his cost-and-return estimates for field corn and was excited that the undertaking looked like a profitable venture. So, we took a look at the annual principal and interest payments that would be due over a 20-year and 30-year loan life given the price of the land and his available 25% down payment. Sadly, the deal did not even come close to cash flowing at the $4.25 per bushel corn price and cost of production he had assumed. Corn prices would need to be nearly $8.00 per bushel, at the same cost of production, for the deal to cash flow, even with the machinery-for-labor trade.

Profitability vs. Feasibility

Profitability implies that the present value of the return flows over the life of the investment is greater than the present value of the cost flows over the life of the investment, where present value is the discounted (current) value of the flows. The cash inflows include annual returns from the investment, tax savings from depreciation and interest, and the salvage value, or selling price, of the asset at the conclusion of the investment.

Conversely, financial feasibility relates to the investment generating sufficient cash flows at the right time to meet the required cash outflows. An investment may be profitable, but not financially feasible. For example, given favorable prices, it may be profitable to purchase heifer calves, have them bred, and produce calves over their productive life. But if you do not have available cash during the first two or so years before that first calf is sold, you will not be able to make loan payments or meet the necessary operating costs before returns start rolling in. Thus, the project may be financially infeasible even though it may be profitable.

The Paradox of Purchasing Farmland

While owning farmland can be a very profitable venture over the long-term, farmland will typically never cash flow when purchased with substantial borrowed capital. The reason has to do with the non-depreciable and capital gains nature of farmland.

Land is competitively priced in the economy. If land is providing a greater return on investment than other assets, more people will want to purchase land, which will drive the price of land upward (and the rate of return downward) until the rate of return on land is equal with other investment opportunities (and vice versa). Given that land is non-depreciable, or in other words, the salvage value of land is 100%, a lower annual rate of return is required to make land a profitable investment compared to a building, tractor or livestock, which will normally depreciate or lose value over its useful life.

Land also generally appreciates over time and returns a capital gain to the owner upon being sold. This characteristic also contributes to land not needing a large annual return to be a profitable investment in the long-run.

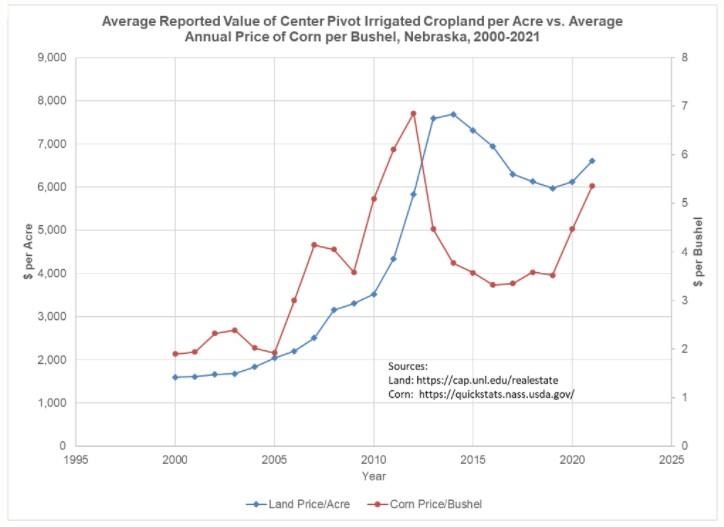

The relatively short life of loans used to acquire land compared to land’s infinite life makes it very difficult for land to cash flow. The buyer must either have a large down payment and/or an alternative source of cash flow to make the principal and interest payments on the land over the terms most often required by lenders. This is especially problematic for beginning farmers given the increase in land prices associated with a boom in commodity prices (see figure).

Many associate the inability of land to pay for itself as simply a farm income problem. But as discussed, as farm income increases and is capitalized into the price of farmland, the cash flow problem for those desiring to purchase land still exists. Someone lucky enough to purchase land before an increase in commodity prices and the associated net returns, such as occurred in the early 2000s, will more easily cash flow that land. But anyone purchasing land after that additional income has been capitalized into the price of the land will have the same cash flow concerns.

The adage that farmers live poor but die rich has roots in the feasibility issue. With the increasing age of farm operators, being able to successfully transfer land to the next generation of farmers is a concern that is not easily addressed. Government-supported farm transitioning programs that more closely match loan repayment schedules with the economic characteristics of land, and the development of estate tax laws for the intergenerational transfer of farmland that recognizes the feasibility issues associated with land procurement, are paramount in having a healthy farm and rural sector.

Source : unl.edu