By Gary Schnitkey and Krista Swanson et.al

Department of Agricultural and Consumer Economics

University of Illinois

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

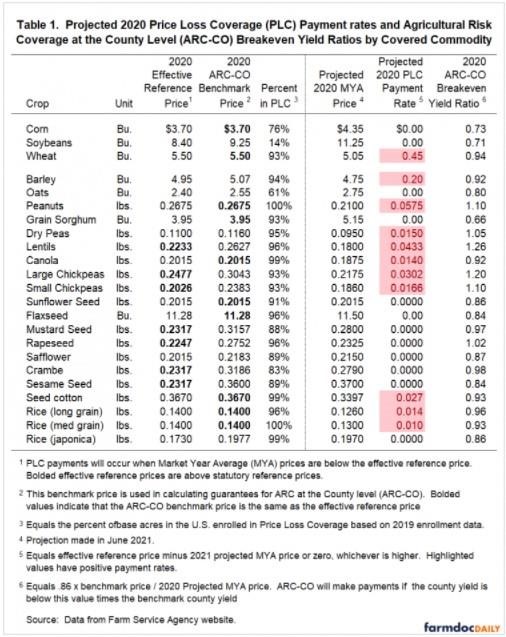

Given increases in prices since the late summer of 2020, commodity title payments for the 2020 marketing year will be limited. Price Loss Coverage (PLC) payments are not projected for corn and soybeans. Agriculture Risk Coverage at the county level (ARC-CO) likely will not make payments in most counties because large declines from ARC-CO benchmark yields are needed to trigger payment. Wheat is projected to make PLC payments for the 2020 year. Other crops projected to have PLC payments are barley, peanuts, dry peas, lentils, canola, large chickpeas, small chickpeas, seed cotton, long-grain rice, and medium and small grain rice.

Projected 2020 PLC Payment Rates and ARC-CO Breakeven Yield Ratios

Table 1 provides information on the likelihood and size of commodity title payments by giving projected 2020 PLC payment rates and ARC-CO breakeven yield ratios. This information is given in 23 rows, one each for each covered commodity. Columns in the table give:

Covered commodity: This is the name of the covered commodity.

Unit: The unit for prices are given for the particular covered commodities. The unit is either bushels (Bu.) or pounds (lbs.). For example, the unit for corn is bushels.

2020 Effective Reference Price: PLC will make payments when the 2020 market year average (MYA) price is below the effective reference price. The 2020 effective reference price is the higher of statutory reference price or 85% of the five-year Olympic moving average of MYA prices from 2014 to 2018. The 2018 Farm Bill has the effective reference prices capped at 115% of the statutory reference prices. None of the covered commodities reach this cap. As indicated by bold values in Table 1, seven crops have an effective reference price above the statutory reference price: lentils, large chickpeas, small chickpeas, mustard seed, rapeseed, crambe, and sesame seed.

2020 ARC-CO Benchmark Price: The ARC-CO benchmark price is used in calculating the ARC-CO guarantee. The 2020 benchmark price is the Olympic average of the higher of the MYA prices or the effective reference price from 2014 to 2018. The ARC-CO benchmark price equals the effective reference price for ten crops (bolded in table 1), indicating that the prices entering into the benchmark price calculation are at or below the effective reference price.

Percent in PLC: Values give the percent of 2019 base acres enrolled in PLC. Given that the commodity title decisions were the same for 2019 and 2020, the 2019 values will be very close to 2020 enrollment percentages. Corn has 76% of its enrollment in PLC, meaning that 24% (1 – .76) is enrolled in ARC, either at the county or individual levels.

2020 Projected MYA Price: The marketing year is not over for many covered crops, so projections made by U.S.D.A. in June are used for 2020 MYA prices. The $4.35 per bushel price for corn, $11.25 per bushel price for soybeans, and the $5.05 price for wheat are the same as in the June edition of the World Agricultural Supply and Demand Estimates (WASDE) report.

Projected 2020 PLC Rate: When the projected price is below the effective reference price, PLC will make a payment on eligible bushels equal to the effective reference price minus the MYA price. Here we estimate the rates using 2020 MYA price projections.

ARC-CO Benchmark Yield Ratio: This ratio indicates the relative size of the county yield needed to trigger a 2020 ARC-CO payment. Take the .73 factor for corn as an example. A county’s corn yield must be lower than .73 times the benchmark county yield. The benchmark county yield for non-irrigated corn in Champaign County is 230.10 bushels per acre. For an ARC-CO payment to occur in 2020, the county yield would have to be below 167.97 bushels per acre (230.10 benchmark yield x .73 yield ratio).

Commentary

Overall, commodity title payments will be limited for the 2020 marketing year.

Corn: A $4.35 MYA price is well above the $3.70 effective reference price. County yields would have to be below .73 of a county’s benchmark yield. FSA has not released county yields yet, and those county yields will be based on crop insurance data from the Risk Management Agency (RMA). Overall, though, most counties will not have a 28% (i.e., 1 – .73) decline from the benchmark yield.

Soybeans: The $11.25 MYA price projection is well above the $8.40 effective reference price. Yields would have to be lower than .71 of benchmark yields for ARC-CO to make payments. The majority of counties will not have declines in yields large enough to trigger ARC-CO payments.

Wheat: PLC is projected to make payments for wheat, having a projected PLC rate of $.45 per base bushel. Given that 93% of wheat acres are enrolled in PLC, most eligible acres will receive wheat payments.

Other Crops: Given current MYA projected prices, PLC is projected to make payments for:

- Barley

- Peanuts

- Dry peas,

- Lentils,

- Canola,

- Large chickpeas,

- Small chickpeas,

- Seed cotton,

- Long-grain rice, and

- Medium and small grain rice.

Summary

Commodity title payments will be limited for corn and soybeans, with the only possibility being ARC payments in very low-yielding areas. PLC payments will be made on wheat. Ten other covered crops likely will have PLC payments.

Source : illinois.edu