By Tina Barrett

As a child I loved a good roller coaster. The ups and downs, the twists and turns, even going upside down. It was exciting and gave me energy. It is still fun, but they now give me a headache, make my stomach upset for hours and drain my energy. I do not get on roller coasters often anymore, but I get the same feelings from keeping up with the rapidly changing environment around the agricultural industry. The last 15 years of the farm economy have seemed to take the ride to an extreme coaster level, and it is hard to keep up. The unknowns, rapid changes and need for quick decisions do not seem to be going away. So, how can a producer be prepared for sustainability?

Be Prepared and Flexible

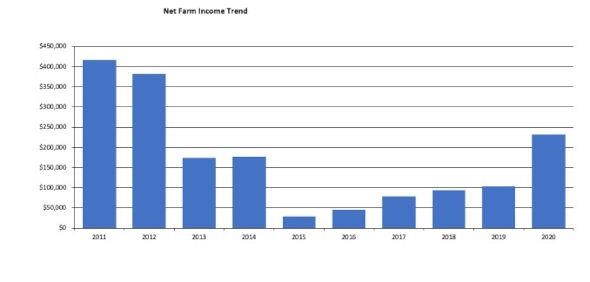

When looking at the accrual net income trends for the past 10 years, you can see the extreme highs and lows. The average net income over those 10 years was $173,433. The reality of an average is that no one is average, so it is important to look deeper. If an operation did things the same way throughout these ten years as they did in 2011, it is likely they did not survive through the low years. If the operation instead was very conservative through these years and took no chances, they also probably did not see the extreme highs. How do you take advantage of the good things while protecting from failure?

The key is knowing your numbers: your cost of production, your financial ratios and your financial statements. You unfortunately cannot find these at the coffee shop, from your input dealers, or even on Twitter. The data we collect annually shows a cost of production range for corn of over $3/bushel and over $6/bushel for beans. Costs and yields are widely different, not just from one region to another, but even across the road from one operation to another. This information is not always “easy” to get. It takes better record-keeping than you need for an average tax return. It may not be fun, and it may not be easy, but the information gathered is empowering to make good decisions.

Figure 1. Net Farm Income Trend, 2011-2020

Liquidity

The largest lesson learned during the farm crisis of the 80’s was to protect net worth and not to over-inflate it by increasing land values. I think the big lesson that the last 10-15 years taught us was to protect liquidity.

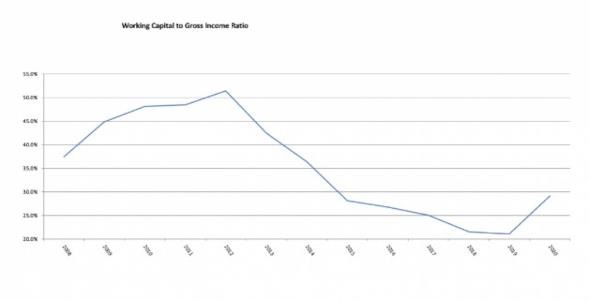

Figure 2 shows the Working Capital to Gross Income Ratio trend from 2008-2020. This ratio measures working capital as a percentage of accrual gross income so we can tell how much of the operation’s operating needs are available from the farm vs. how much will be needed from a lender. We saw this number grow rapidly from 2008 to 2012 as prices of grains shot up and then fell rapidly as prices and profitability fell off as debt increased. Remember that during the years of 2013–2018, many operations needed to refinance operating debt to a longer term to keep this number in a healthy range. This means that the reality of the drop of this ratio was even more extreme, but many individual numbers were “fixed” by that refinancing.

Figure 2. Working Capital to Gross Income Ratio, 2008-2020

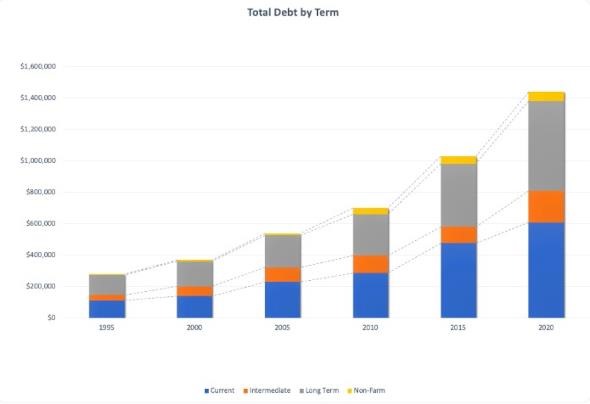

The result of some of that refinancing was the rapidly increasing total debt carried by an average operation. This chart shows the total debt measured each year by term. From 2010 to 2020, the total debt climbed from $700,000 to over $1.4 million. Every category of debt contributed to the increase, but the largest categories were current and long-term.

There are two ways to improve liquidity. You can increase current assets (what happens when prices go up) or you can decrease current liabilities (this includes current payments on intermediate and long term debt). Good marketing and production can help control the increase in asset value, but as we saw in 2013-2019, there is very little control over the general price of commodities so the best way an individual producer can control their liquidity is to reduce debt.

Figure 3. Total Debt by Term, 1995-2020

Reduce Debt

I often hear from producers that they have two financial goals. The first is to get out of debt and the second is to not pay any taxes. My usual response is pick one as I cannot do both. There are three main things that are not deductible on a tax return: income taxes, family living costs and principal payments. If your taxable income is not high enough to cover these things, then you must be increasing debt. It seems very much counterintuitive that you must pay tax to get out of debt but that is a reality. Prepaying expenses and deferring sales are great tools to minimize the ups and downs of taxable income, but they create a deferred tax liability. In other words, you are not getting out of tax, you are kicking the can down the road to a time when you may have to pay a higher percentage of tax on the same dollars. For most operations, the amount of deferred tax liability is pretty scary. For very simple math, look at your balance sheet and add up the value of your prepaid expense, accounts receivable, and grain/livestock inventory and take that number times 40%. That would be a rough estimate of the federal tax you have deferred. The only way to erase that completely is to die as an active farmer. The best way to reduce that is to pay a little tax over time. Obviously, this is a very generic example, and everyone’s tax scenario is very different so if you want a more accurate guess, ask your tax preparer to help you calculate your number.

Law Change

One of the hardest changes to manage has been the law changes. Whether is has been tax reform, stimulus programs, or farm program payments, the government has been giving this roller coaster ride more than a few hard twists and turns and they seem to have a few more in the works. This is not something that producers can control but it is important to stay informed and be prepared. Good records have been vital to program eligibility the past few years. It may be that we need to measure gross receipts reduction, or we need to know payroll costs and some of these have been needed in a very short timeframe. As the discussions for changes to the estate, gifting and transfer taxes continue, it’s important to be prepared to make decisions that may affect the transition planning for your operation. It is probably not a good time to lock assets in irrevocable structures or make major changes to your estate plan if it can wait. It is a good time to make sure that you know what your transition goals are so if and when rules get put in place, we can quickly make flexible plans that accomplish your goals and protect the future of your operation.

To Do List

1) Know Your Financials: Take your record-keeping to the next level so you have good information to make informed decisions from. You should have a working cash flow that will give you an educated guess on what the year’s profitability on an accrual basis looks like (this is different than tax planning.) You should also have current and accurate balance sheets and income statements. Once you have these, you can track your ratios and watch your trends.

2) Know your Cost of Production: It may seem like a waste of time when prices are high to know your cost of production, but that number can climb quickly when it is not monitored (think about your weight!). Knowing it is increasing is only half the battle. You also must be willing to make changes when they are needed.

3) Protect Your Liquidity: Be careful in your decision making that will affect your liquidity in the long term. Buying assets to control your tax bill with borrowed money could make that liquidity tight if prices fall during the term of the loan.

4) Pay Taxes: Paying taxes is one of the most hated things, but the reality is if you are making money, you get to pay taxes and profitability is a good goal. This also gives you available cash to reduce debt and keep you in control of your liquidity.

5) Stay Informed: Stay up to date on the law changes that are coming from Washington D.C. Do not panic over rumors but do formulate what you want your transition plan to look like. Even if you have another 30 years of farming planned, think about what you would want to happen if you were not here next week or if you were unable to farm. These are not fun things to think about but if you have a plan, your team of advisors will be able to help you reach that rather than giving you a canned plan that works for “most operations”.

Source : unl.edu