By Joe Janzen

The most recent USDA World Agricultural Supply and Demand Estimates (WASDE) released on March 11, 2025, offered little in the way of news on grain market supply and demand conditions. Both the US corn and soybean balance sheets for the current 2024/25 marketing year were left unchanged. Only minor revisions were made to the US wheat balance sheet.

A ‘no change’ USDA announcement like March 2025 may spark questions about why market watchers pay attention to USDA reports at all. Typically, when USDA releases ‘quiet’ reports the farm media release a set of perfunctory articles noting the occasion. Market analysts, especially those skeptical of veracity of USDA information provision, offer up words of exasperation or dismissal on social media.

To understand the merit of monthly USDA report releases and inform expectations about future USDA report releases, this article reviews the historical range of changes in corn, soybean, and wheat balance sheets by time of year. Certain periods of the crop marketing year do tend to be relatively quiet regarding changes in commodity production and use. As was the case this year, the March report rarely contains major changes to the US corn and soybean balance sheets. Changes in production exhibit stronger seasonality than changes in use, in part because the size of the crop is largely known shortly after harvest is complete whereas commodity use can change throughout the marketing year.

However, the tendency for certain USDA reports to contain few changes to balance sheet quantities is just that: a tendency, not a rule. The USDA has made material changes to its balance sheets at all times of the year and may make changes sooner than ‘usual’ when conditions merit. Monthly report releases are likely necessary to keep the world’s benchmark commodity balance sheets current. Like a farmer with a proactive grain marketing plan, the WASDE calendar defines a set of periodic decision points at which the state of the world is reviewed, and changes are made if necessary.

Reviewing Historic Changes in Balance Sheet Quantities

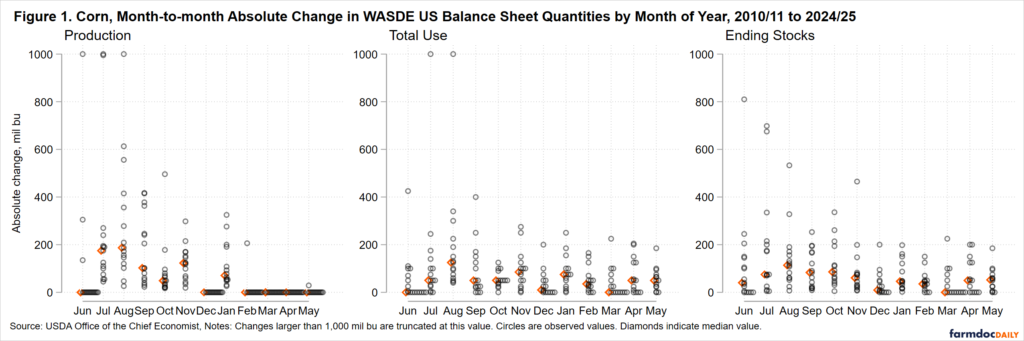

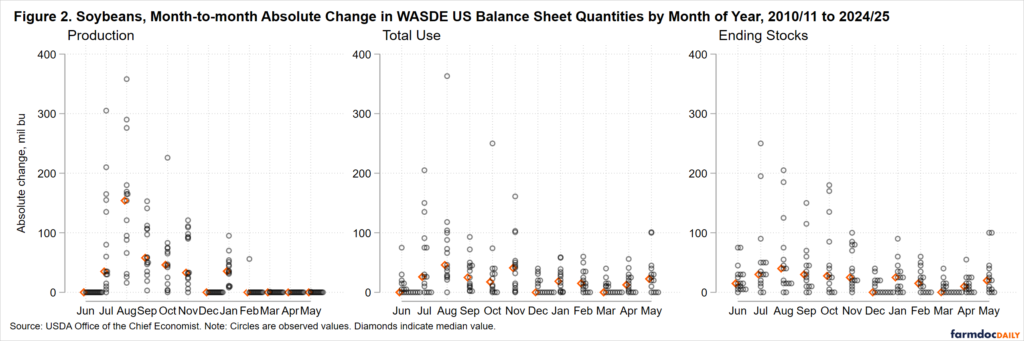

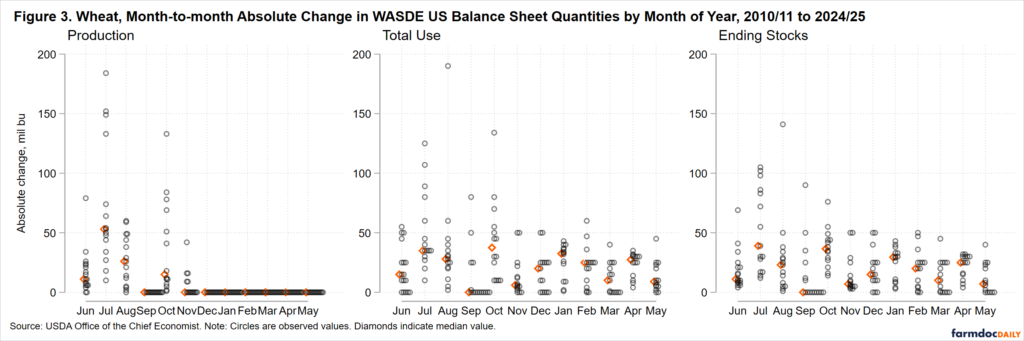

USDA first provides US corn, soybean, and wheat balance sheet projections for a given marketing year in the May WASDE prior to the start of the marketing year. For example, the first WASDE 2025/26 US corn balance sheet will be released in May 2025. To consider the size of WASDE updates, I calculate the month-to-month absolute change in three major balance sheet quantities production, total use, and ending stocks for each month of the year beginning with the initial change from May to June and ending with the change from April to May of the following calendar year. Absolute changes measure magnitude without regard to sign and indicate the degree to which a balance sheet change may be newsworthy regardless of whether the quantity increased or decreased.

Figures 1-3 plot the changes in major balance sheet quantities for corn, soybeans, and wheat, respectively for every WASDE report since the 2010/11 marketing year. The plots indicate both observed values and median value for a given month across marketing years. Note the scale of the y-axis is measured in the same units as the balance sheet, millions of bushels. Changes are significantly larger for corn than soybeans (and larger for soybeans than wheat) due to the relative scale of US production for each crop. The figures give a rough sense of a ‘normal’ change in the balance sheet. It is relatively rare to see changes over roughly 300 million bushels for corn, 150 million bushels for soybeans, or 75 million bushels for wheat. Changes in excess of these thresholds occurred in only 5-8% of report releases since June 2010, depending on the crop.

When Does USDA Release ‘Quiet’ Reports?

The largest changes to USDA’s corn, soybeans, and wheat balance sheets occur early in the reporting cycle. Figures 1-3 show the largest changes in all balance sheet quantities tend to occur in earlier months. Production updates are extremely rare after November for wheat and after January for corn and soybeans. Early WASDE report months cover the crop growing season. Shortly after harvest is complete, USDA’s National Agricultural Statistics Service releases its final production estimate for each crop, and these are subsequently taken as given in WASDE balance sheets. There is little relevant information generated about the size of the crop outside the growing season and the USDA’s statistical data generating infrastructure is only brought to bear on the problem of estimating crop size when it is most productive to do so. As such, Figures 1-3 show zero production changes in later months.

Changes in production are the largest changes to the balance sheet and these changes are correlated with changes in current marketing year total use and with change in ending stocks. Changes are correlated across categories because the balance sheet must equate commodity availability with disposition. Later in the marketing year when production is essentially fixed, changes in current total use can offset changes in ending stocks and so these two quantities are also correlated.

The median change in production, total use, and ending stocks estimates shown in Figures 1-3 is an indicator of the novelty and informativeness of a month’s WASDE report. Months with a zero or near zero median value and many zero values are those where USDA tends not to modify its balance sheet projections. For corn and soybeans, December and March are especially quiet months. For instance, soybean total use and stocks changes rarely exceed 50 million bushels in these months. September, November, and March are quiet months for wheat. However, changes have occurred to each crop balance sheet in all months. For instance, USDA rarely updates corn and soybean production in its June WASDE report. However, in three of the last fifteen years, corn production projections were changed in the June report and in one case, the change exceeded one billion bushels.

Concluding Thoughts

Following commodity markets requires a certain amount of skepticism, given the amount of noise contained in commodity market news and analysis. Such skepticism should include limited expectations about the size of changes to crop commodity balance sheets in the USDA WASDE report, especially at particular times of year. The recent March 2025 WASDE report provides a case in point; March WASDE reports make small changes, if any, to corn and soybean supply and demand estimates. Past experience suggests there may be limited news from WASDE report releases until the

However, the historical record suggests USDA does make material changes to crop balance sheets at all times of year. The value of a monthly WASDE report is the ability for USDA’s data collection and analysis infrastructure to do its work in a timely manner. Note that the WASDE report covers many agricultural commodities beyond wheat, oilseeds like soybeans, and feed grains like corn. The production calendar for these other commodities may mean the WASDE report is newsworthy for other crops even when it is uninformative about corn, soybeans, and wheat.

What was novel about USDA’s March 2025 WASDE report was the notice given that the report did not attempt to forecast changes in commodity trade resulting from widely anticipated forthcoming changes in US and foreign tariff policies. Instead, USDA analysts “only consider trade policies that are in effect at the time of publication.” A monthly WASDE allows for this kind of periodic, systematic review the state of commodity supply and demand and the documentation of the state of the world at a given point in time. Market analysts will continue to watch the report, even if news stories generated by the report release are not particularly newsworthy.

Source : illinois.edu