By William E. Maples

As soybean producers prepare for the upcoming growing season, global soybean stocks are exerting a bearish influence on the market. Currently, USDA projects the 2024/25 marketing year to have a record-high level of ending stocks at 131.87 million metric tons. If realized, this would be 17.62 million metric tons greater than the previous record high in 2018. The final estimate for ending stocks will depend on how the South American crop concludes. So far, Brazil has experienced favorable weather conditions, making it likely that it will achieve its estimated record soybean production this year. The outlook for Argentina is less certain.

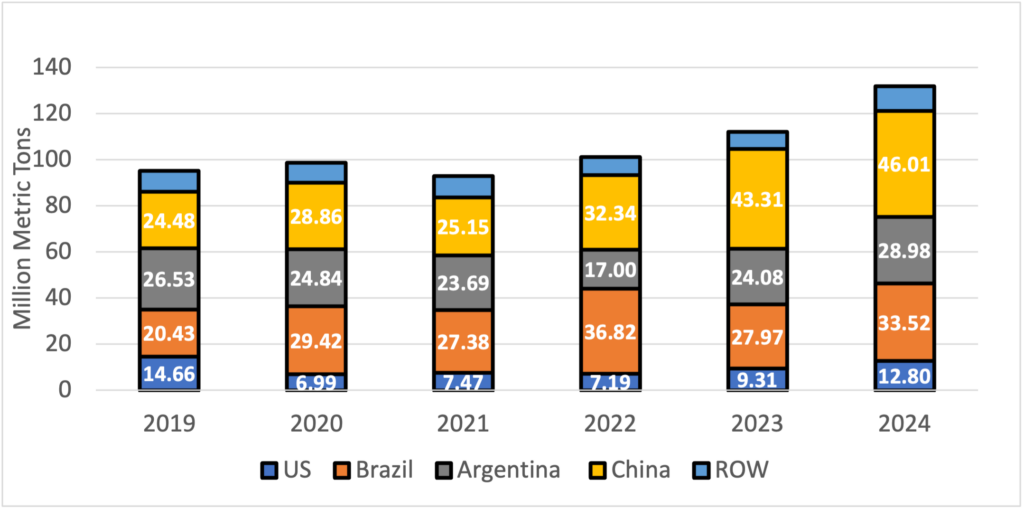

The majority of the increase in global soybean stocks can be attributed to one country (Figure 1). China holds the largest share of these stocks, with 46.01 million metric tons, marking an 83% increase since 2021. This growth accounts for 53% of the overall increase in global stocks during the same period. Brazil and Argentina have seen a 22% increase in ending stocks since 2021. In contrast, of the four major countries in soybean markets, the United States maintains the smallest amount of stocks at 12.8 million metric tons, but this still reflects a 71% increase since 2021.

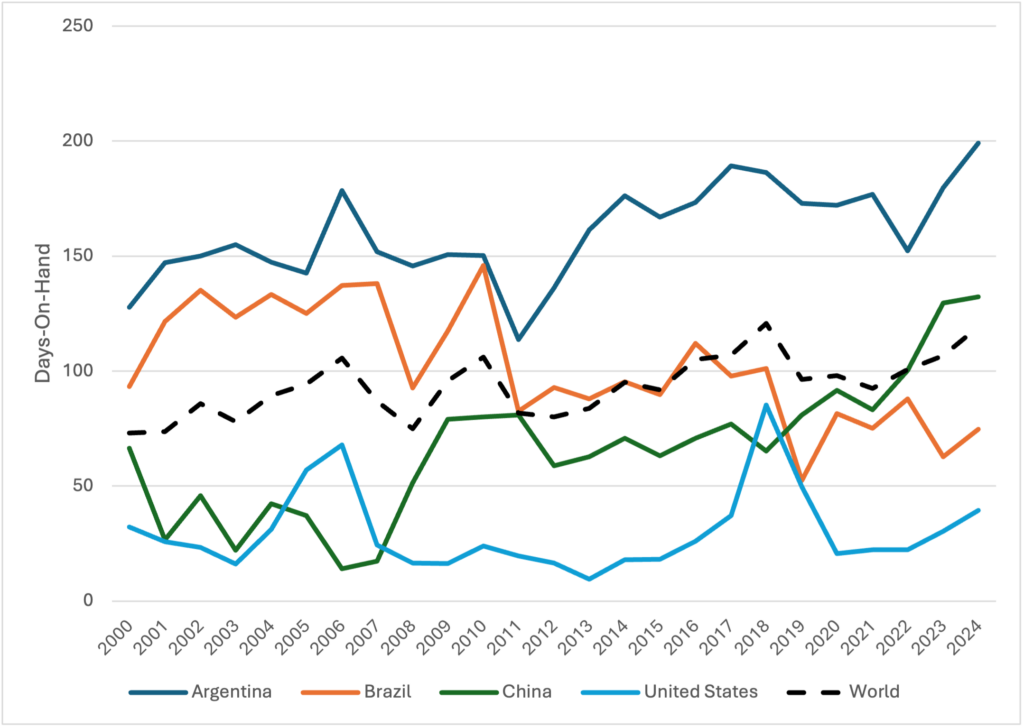

Another way to analyze ending stocks is by comparing them to a country’s annual usage, which can be illustrated through the concept of days-on-hand. Figure 2 shows the days-on-hand globally and for Argentina, Brazil, China, and the United States. Global days-on-hand are projected at 119 days, the second highest on record. Before 2022, China never had more than 92 days on hand but is currently projected to have a record 132 days of soybeans on hand. Argentina has increased from a decade-low of 152 days on hand in 2022 to a record 199 days on hand in 2024. The United States is projected to have 119 days of soybeans on hand, the second-highest figure since days-on-hand peaked during the 2018 trade war with China.

Due to the current high levels of stocks projected by the USDA, soybean prices are expected to remain weak in early 2025. With a record crop expected from Brazil, the market is unlikely to see significant upward price movements in the coming months. While changes in weather conditions or harvest delays in South America could potentially drive prices higher, producers may have to wait until the market shifts its focus to the planting of the upcoming U.S. soybean crop before witnessing any substantial increases in prices. Given the uncertainty regarding future price direction, it is essential for producers to start preparing a marketing plan for the upcoming year and be ready to take advantage of profitable prices if they arise.

Figure 1. Global Soybean Stocks by Country; 2019-2024

Figure 2. Soybean Days-On-Hand; World and Select Countries; 2000-2024

Click here to see more...