By Joana Colussi and Gary Schnitkey et.al

Department of Agricultural and Consumer Economics

University of Illinois

Silvina Cabrini

National Institute of Agricultural Technology (INTA) – Argentina

South American countries, which account for about 55% of the world’s soybean supply, are experiencing varying harvest expectations this crop season. While Brazil is on the verge of breaking a record in soybean production, Argentina will have its worst harvest in more than two decades. The contrasts in yields result from the effects of La Niña. Overall, South American soybean production still is expected to exceed the previous year, but to a lesser extent than initially thought. The consequences of a larger soybean crop in South America, combined with the potential for a larger U.S. soybean crop in the fall, could tend to push prices down – a trend already evident in the commodity market in 2023, which could become more pronounced in the coming months.

Different Effects of La Niña

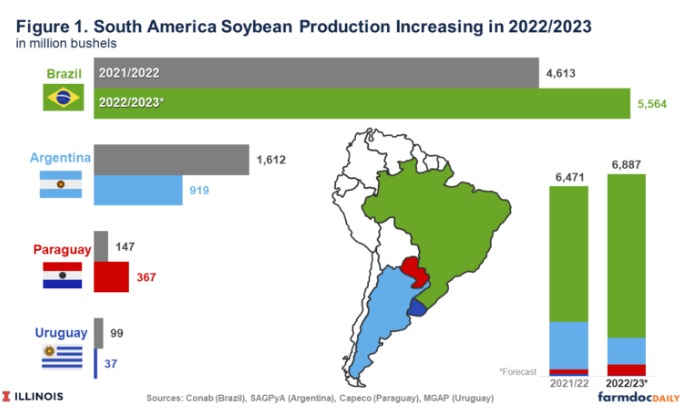

Projections put the combined 2022-2023 output in Brazil, Argentina, Paraguay, and Uruguay at 6,887 million bushels, up 416 million bushels (6%) from last crop season (see Figure 1). The South American soybean harvest would have been higher were it not for the strong influence of La Niña. La Niña events favor increased rain across northern Brazil and decreased rainfall in extreme southern Brazil, Argentina, and Uruguay. Lower rainfall this year caused extreme South Brazil, Argentina, and Uruguay to experience a drought.

The effects of La Niña this season were more concentrated in southern South America, affecting the extreme South of Brazil, Argentina, and Uruguay. Paraguay, the world’s fourth-largest soybean exporter, was spared this season. According to data from the Chamber of Exporters and Traders of Cereals and Oilseeds (Capeco), Paraguay is expected to produce 367 million bushels, more than double the output of the last crop season. This estimate represents a recovery from the previous cycle when Paraguay’s soybean harvest fell almost 60% to 147 million bushels, the lowest level in the last decade. Paraguay exports more than half of the soybeans it produces, and its economy depends heavily on those exports.

Conversely, soybean production in Uruguay is expected to be just a third of last year’s production because of the devastating effects of the extreme drought. According to data from the Uruguayan Ministry of Livestock, Agriculture, and Fisheries (MGAP), production is forecast to be 37 million bushels, down 63% from the 2021/22 crop season. Soybeans are the second most important product exported by Uruguay in terms of revenue.

The Pacific Ocean was in a La Niña phase from August 2020 to February 2023. Three consecutive crop years with La Niña conditions is relatively rare. This triple sequence has occurred only three times since 1950. Over the last 30 years, the data shows a strong relationship between La Niña and low soybean yields in Argentina but no correlation in Brazil (see farmdoc daily, May 23, 2022). The geographical variation of Brazilian soybean production limits the effects of La Niña compared to Argentina, as shown in the following sections.

Record Production in Brazil

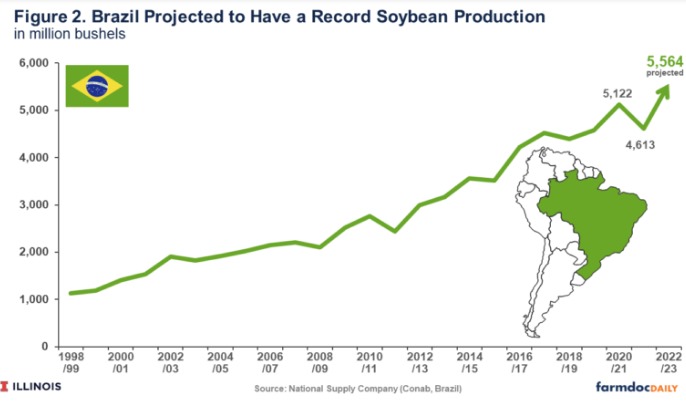

Brazil, the world’s largest producer and exporter of soybeans, is forecast to produce a record 5,564 million bushels this season, a 21% increase compared to the previous cycle, when a drought affected the crop in southern states. The projections for the current cycle remain optimistic mainly because of the recovery in yield to historical trend (52 bushels per acre on average) and to the 5% expansion of the cultivated area in relation to last season, according to data from the National Supply Company (Conab).

The Brazilian soybean harvest is underway and is expected to supply the global market over the next few months. About 70% of the soybean area was harvested by March 25, compared with 76% a year ago, according to data from the Conab. Constant rains in the Center-West and Northeast states, an expected weather behavior in a La Niña year, caused the delay in the harvest, especially in February.

While there is plenty of rain in most soybean-producing states, there has been a lack of rain in Brazil’s southernmost state, Rio Grande do Sul. The state suffered a severe drought for the second consecutive year. The soybean crop there is projected to be lower than the previous five years’ average. Rio Grande do Sul accounts for about 15% of the soybean production in Brazil. Despite the losses in the extreme South, yield gains in the Center-West and Northeast should offset them. In Mato Grosso, the country’s largest producing state, average yields have been about 55 acres per bushel.

Brazil’s soybean exports in 2023 should be higher than initially projected. The forecast is for a record 3,391 million bushels, 17% above the 2,892 million bushels in 2022, according to Brazilian Association of Vegetable Oil Industries data. The projection for domestic soybean processing is at the unprecedented level of 1,929 million bushels for 2023, a 3% increase from 2022. Soybean oil and soybean meal exports should also rise, because Argentina, the world’s biggest supplier of both commodities, faces an intense drought.

Global soybean stocks remain historically low (see farmdoc daily, March 13, 2023), although Brazil’s harvest is making large replenishments to global supplies. Soybean prices continue to fall in the Brazilian market because of the expectation of a record harvest. The pace of Brazilian farmer sales has improved recently in response to the strength of the U.S. dollar against the Brazilian real and producers’ need to make room in their silos for the coming months, when the second corn crop (safrinha) will be harvested.

Drought Cuts Production in Argentina

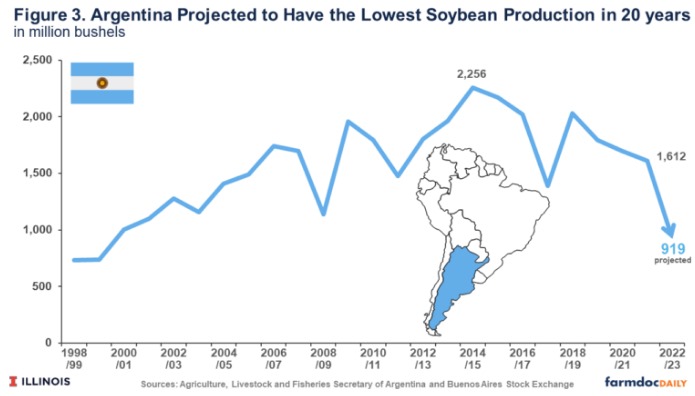

Argentina, the third-largest global producer of soybeans, is expected to harvest 919 million bushels in the current crop season. In the last two decades, soybean production in Argentina has averaged about 1,600 million bushels, with no significant trend, with a maximum of 2,256 million bushels in the 2015 harvest. The expected production in the upcoming harvest would be the lowest in more than two decades and 40% lower than the previous harvest (see Figure 3).

Since soybean crop planting, the soybean production projections reported by the local stock exchanges, Buenos Aires Grain Exchange and the Rosario Stock Exchange, have decreased monthly. With a third consecutive La Niña event, the Argentinian central Pampas are going through unprecedented unfavorable weather conditions: precipitation is at historical minimums, there was early frost in February, and heat waves at the end of February and March. Harvest is about to start, and production estimates are 45% below the initial projections for the growing season.

In the last 20 years, only in the extreme drought in 2008/2009 were soybean yields lower than the projected values for the current season. About 15% of soybean plantings are expected to be unharvested this year. Second-season soybeans planted after wheat are facing more severe conditions than first-season soybeans.

This situation will have a significant impact on Argentina’s exports. Argentina is a key player in the international soybean market: it is third in soybean grain exports and first in soybean oil and meal exports. Soybean products represent more than 30% of the value of the total exports in Argentina. China, India, and the European Union are the main buyers of Argentine soybean products. The importance of Argentina as an international supplier will drop abruptly, and demand will be meet by other exporting countries. Moreover, Argentina may have to import more than double the amount of soybeans compared with previous years, mainly from Paraguay and Brazil, to continue supplying regular external customers with soybean meal and oil.

Harvest prices for soybeans grown in Rosario, Santa Fe, are above the average for the last five years, but the price has decreased 20% in the last two months because of weak demand and the expectation of record production in Brazil. Currently, Argentine farmers are waiting for a government announcement to re-establish a preferential U.S. dollar-peso Argentine exchange rate (“soybean-dollar”) for soybean exports at harvest time. This measure could be implemented to encourage the sales of soybean products as soon as they become available.

Summary

Overall, South American soybean production is expected to exceed the previous year’s level, but to a lesser extent than previously anticipated. Unlike the last crop season, the effects of La Niña this season were more concentrated in the extreme South of South America – Argentina, Uruguay and Rio Grande do Sul state, in Brazil. These regions have been suffering a severe drought since the beginning of the crop season. Consequently, Argentina is expecting its lowest production in the last 20 years. This will have a significant impact on Argentina’s exports. In contrast, Brazil is projected to produce a record soybean crop this season as a result of favorable weather in most soybean producing regions. Therefore, Brazil’s soybean exports in 2023 should be higher than expected.

Source : illinois.edu