The U.S. Department of Agriculture offers subsidized crop insurance to protect farmers from financial losses, such as from poor harvests and declines in market prices.

This snapshot identifies changes Congress could make to the program to reduce its costs.

We have previously suggested that Congress:

- Reduce subsidies to high-income participants by creating an income limit

- Adjust compensation to insurance companies to better align with market rates

As of February 2023, Congress hasn't acted on these matters. Savings from these changes could provide funding for other Farm Bill priorities.

The Big Picture

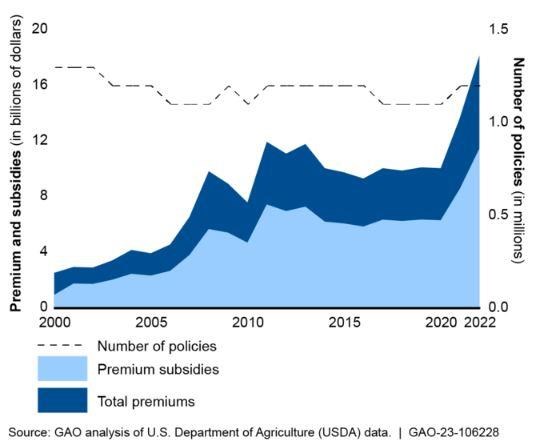

The federal crop insurance program offers subsidized crop insurance to protect farmers against financial losses from crop price declines and poor harvests due to natural causes. According to the U.S. Department of Agriculture (USDA), in 2022 the program supported about 1.2 million policies that covered 493 million acres. From 2011 through 2021, the total cost of the program was about $90 billion.

To implement the crop insurance program, USDA partners with private insurance companies, which sell and service insurance policies to farmers. The federal government's crop insurance costs include (1) subsidies to pay for part of a farmer's crop insurance premium (over 60 percent in recent years) and (2) compensation to the insurance companies for selling and servicing crop insurance policies.

Total Premium and Subsidy Dollars, and Number of Insurance Policies

What GAO’s Work Shows

In our work on the crop insurance program over the past decade, we have reviewed premium subsidies to farmers and compensation to insurance companies for selling and servicing policies. In each area, we have an open matter for congressional consideration to reduce costs, as follows.

Reduce Subsidies for High-Income Participants

By statute, the program provides the same level of premium subsidies to participants, regardless of income. In contrast, some other USDA farm programs have statutory limits on the income participants can earn and remain eligible for payments. For example, under the 2014 farm bill, some farm and conservation programs are not available to individuals or legal entities whose average annual gross income (AGI) exceeds $900,000. Not having an AGI limit for the crop insurance program sometimes results in relatively large subsidies for high-income participants. For example, in March 2015 , we found that one participant whose AGI exceeded the limit in effect for farm and conservation programs from 2009 through 2013 received an average of $1.2 million annually in premium subsidies during those years. Participants whose AGI was less than the limit received an average of about $7,480 annually in premium subsidies during the same period.

We also found that reducing crop insurance subsidies for participants whose AGI exceeded the limit would save millions of dollars in program costs while affecting less than 1 percent of program participants. If a provision establishing income limits is enacted, USDA has procedures from other farm programs that it could use to determine the appropriate income limit criteria for farmers participating in the crop insurance program.

- Open matter: Congress should consider reducing premium subsidies for the highest-income participants.

Adjust Compensation to Insurance Companies

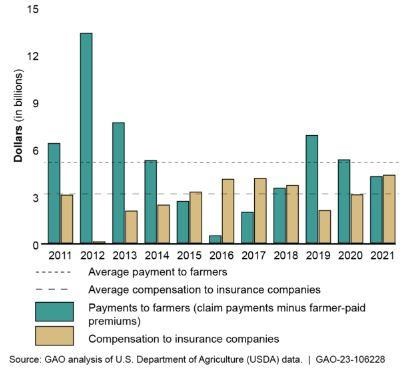

Payments to farmers and compensation to insurance companies can vary significantly from year to year. In some years, such as 2016, when insurance losses were low, USDA's compensation to insurance companies greatly exceeded payments to farmers. However, in other years, such as 2012, which saw historic droughts, payments to farmers far exceeded compensation to insurance companies.

Payments to Farmers and Compensation to Insurance Companies, 2011 through 2021

We found in July 2017 that the compensation that insurance companies were projected to earn annually under their agreement with USDA for participating in the program was higher, on average, than would be expected under overall market conditions. However, a provision in the 2014 farm bill requires that any changes that USDA negotiates with the companies for a new financial agreement be budget neutral—meaning that the changes cannot result in savings to the government. To allow USDA to adjust insurance companies' expected level of compensation to reflect market conditions so the federal government can realize savings, Congress would need to repeal this provision.

- Open matter: Congress should consider (1) repealing the 2014 farm bill requirement that any change to the standard reinsurance agreement be budget neutral and (2) directing USDA to adjust the participating insurance companies' target compensation to reflect market conditions during the next renegotiation of the agreement.

Challenges and Opportunities

- Congress must decide how to allocate resources amongst competing priorities in the farm bill.

- Savings from these changes could be available for other farm bill priorities, such as funding different agricultural programs.

Source : gao.gov