A new report by the Agricultural and Food Policy Center at Texas A&M University, AFPC, in the Department of Agricultural Economics in the College of Agriculture and Life Sciences analyzes how some legislative proposals about how inheritance and estate taxes are treated may impact agricultural producers.

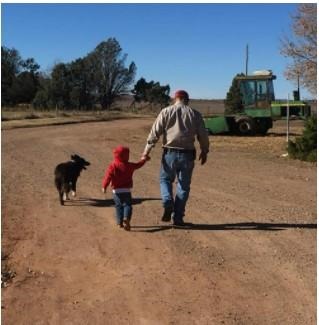

A report by the Agricultural and Food Policy Center at Texas A&M University shows how some inheritance legislation could impact family farms.

The report, “Economic Impacts of the Sensible Taxation and Equity Promotion Act and the for the 99.5 Percent Act on AFPC’s Representative Farms and Ranches,” includes an analysis of five scenarios of proposed legislative policy changes and how each might impact farms and ranches across the country.

Background on inheritance legislative proposals

Earlier this year, a number of proposals surfaced that would significantly change how inheritance is treated and, by extension, the disposition of estate taxes. The Sensible Taxation and Equity Promotion or STEP Act proposes eliminating a “stepped-up basis” that allows an heir to use fair market values as a basis of property valuation upon the owner’s death. And among other changes, the 99.5 Percent Act or 99.5% Act, would decrease overall estate tax exemption to $3.5 million per individual or $7 million per couple.

“Senator John Boozman, ranking member of the Senate Committee on Agriculture, Nutrition and Forestry, and Representative G.T. Thompson, ranking member of the House Committee on Agriculture, asked the Agricultural and Food Policy Center to examine what impact these proposals would have on farmers and ranchers,” said Bart Fischer, Ph.D., co-director of AFPC.

Fischer said the report is the result of the center’s analysis of different proposals.

“Results are presented relative to a status-quo baseline that maintains the current estate tax exemption and stepped-up basis provisions through 2026,” he said.

Under current law, when a farm or ranch owner dies, an estate is subjected to federal estate taxes. As of 2021, $11.7 million per individual and $23.4 million per couple in assets are exempted from the estate tax, effectively protecting most farms from the estate tax. Additionally, when a decedent passes farm assets to an heir, the heir is currently allowed to use the stepped-up basis of valuation, effectively avoiding capital gains taxes.

Using representative farms for analysis

AFPC maintains a database of 94 representative agricultural operations in 30 different states. AFPC’s representative farms and ranches are all assumed to be full-time, commercial-scale family operations. Data from those operations in conjunction with a farm-level policy simulation model allowed AFPC to analyze the impact of these policy changes on farms and ranches across the country.

A number of representative agricultural operations were used as the basis for the report analysis.

As part of this analysis, AFPC analyzed a total of five scenarios:

— Current tax law with no generational transfer. This baseline scenario assumes current tax law remains in place and that no event triggers a generational transfer.

— Generational transfer under current tax law. This scenario assumes current tax law remains in place and an event, such as the death of the principal operator, triggers a generational transfer in 2021.

— Generational transfer under the STEP Act. This scenario assumes the STEP Act is in effect and an event triggers a generational transfer in 2021. Under the STEP Act, the current estate tax exemption levels are maintained, and the stepped-up basis is eliminated.

— Generational transfer under 99.5% Act. This scenario assumes the 99.5% Act is in effect and an event triggers a generational transfer in 2021. Under the 99.5% Act, the estate tax exemption levels are lower, but the stepped-up basis is maintained.

— Generational transfer under STEP Act and 99.5% Act. This scenario assumes both the STEP Act and the 99.5% Act are in effect, and an event triggers a generational transfer in 2021. In this scenario, the estate tax exemption levels are lower and the stepped-up basis is eliminated.

“Agricultural producers are extraordinarily sensitive to changes in stepped-up basis and estate taxes because much of their net worth is traditionally comprised of land and equipment,” said Joe Outlaw, Ph.D., co-director of AFPC and primary report author. “Given recent trends in land values, the concern now is even more heightened as cropland values have more than tripled since 1997. So, even if a producer has not purchased any additional land, the land they were already holding is now considerably more valuable.”

Results of the analysis

The report showed under current tax law, only two of the 94 representative farms would be impacted by an event triggering a generational transfer.

By contrast, under the STEP Act, 92 of the 94 representative farms would be impacted, with additional tax liabilities incurred averaging $726,104 per farm.

“Eliminating stepped-up basis in the Sensible Taxation and Equity Promotion Act, even with the $1 million exclusion, would impact all of the ranches and dairies of the 94 representative farms, plus bring on a significant additional tax liability,” Outlaw said.

Under the 99.5% Act, 41 of the 92 representative farms would be impacted, with additional tax liabilities averaging $2.17 million incurred per farm.

“Imposing lower estate tax exemption levels from the 99.5% Act would impact 41 of these representative farms, including 26 of 64 crop farms, five of 10 ranches and 10 of 20 dairies, as well as present a substantial average additional tax liability per farm,” Outlaw said.

He noted that if both the STEP Act and the 99.5% Act were simultaneously implemented, 92 of the 94 representative farms would be impacted, with additional tax liabilities incurred averaging $1.43 million per farm across the 92 representative farms.

Source : tamu.edu