By Russ Quinn

Average retail price moves were evenly mixed for the eight major fertilizers in the second week of February 2024, according to sellers surveyed by DTN.

Breaking a streak of six straight weeks when most fertilizer prices declined, prices for half of the eight major fertilizers were slightly lower than last month while prices for the other half were slightly higher.

For the third week in a row, no fertilizer price was up or down substantially like we have seen in recent weeks. DTN designates a significant move as anything 5% or more.

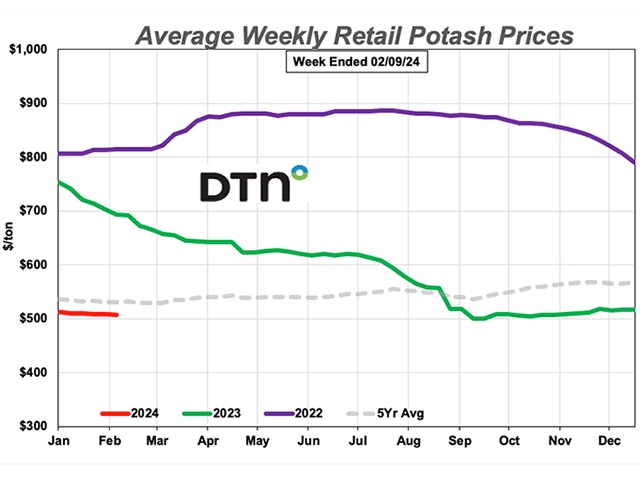

Prices for four fertilizers were down just slightly from the previous month. Potash had an average price of $508 per ton, anhydrous $773/ton, UAN28 $335/ton and UAN32 $390/ton.

Prices for the remaining four fertilizers, meanwhile, were just slightly higher than last month. DAP had an average price of $736/ton, MAP $809/ton, urea $528/ton and 10-34-0 $610/ton.

On a price per pound of nitrogen basis, the average urea price was at $0.57/lb.N, anhydrous $0.47/lb.N, UAN28 $0.60/lb.N and UAN32 $0.61/lb.N.

All fertilizers except one are now lower by double digits compared to one year ago. MAP is 6% lower, DAP is 12% less expensive, 10-34-0 is 19% lower, urea is 24% less expensive, potash is 27% lower, both UAN28 and UAN32 are 33% less expensive and anhydrous is 37% lower compared to a year prior.

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

Click here to see more...