By Nick Paulson and Gary Schnitkey et.al

Price declines for corn and soybeans continue to drive return expectations for the 2024 crop year lower and increase the likelihood of payments from crop insurance and commodity programs. Recent articles have examined prospects for individual crop revenue insurance and commodity program (ARC and PLC) payments (see farmdoc daily articles from August 6, 2024 and August 13, 2024).

Today’s article looks at payment scenarios for the Supplemental and Enhanced Coverage Option (SCO and ECO) policies which supplement a producer’s underlying individual coverage with additional area-based coverage. At current futures price levels, payments from ECO seem likely for 2024, particularly if county yields are not too far above trend yields. Area (usually county) yields at or above expected levels would negate payments from SCO at current price levels.

Background

- SCO provides county-based coverage with an 86% coverage level. The coverage range extends from 86% down to the coverage level of the farmer’s underlying individual plan. For example, SCO combined with an 80% Revenue Protection (RP) policy would provide protection against area (usually county) revenue declines from 86% to 80%, or a maximum band of coverage for 6% of expected area revenue. SCO can only be used on acres that are enrolled in the PLC commodity program; acres enrolled in ARC are ineligible for SCO coverage. More details on SCO are available in farmdoc daily articles from February 27, 2014 and April 24, 2014.

- ECO provides area (usually county) based coverage with either a 90% or 95% coverage level (ECO-90 or ECO-95). The coverage range extends down to 86%, providing a maximum coverage band of either 4% (ECO-90) or 9% (ECO-95). An underlying individual plan is required, but ECO can be used regardless of the farmer’s commodity program choice. More details on ECO are available in the farmdoc daily article from November 24, 2020.

Since introduction of SCO with the 2014 Farm Bill, and ECO for the 2021 crop year, use of the supplemental programs has been increasing (see farmdoc daily articles from August 9, 2022 and August 7, 2024). While losses are triggered at the area-level (usually county), the programs do provide producers with options to increase their overall coverage level. The higher coverage levels offered by SCO and ECO imply that payments can be triggered by smaller losses than those from individual insurance plans, albeit using area yields or revenue as the trigger.

SCO Payment Scenarios for 2024

In recent days, the December corn contract has continued to trade around $4.00 per bushel. Soybean prices have continued to fall over the past few weeks, with recent trading for the November contract around $9.75 per bushel. For corn, this represents a 14.2% price decline from the $4.66 projected price. For soybeans the price decline is 15.6% from the $11.55 projected price.

Both relative price declines would be large enough to trigger SCO payments with area yields at expected levels, given SCO’s 14% deductible (100% – 86%). Further price declines could result in SCO payments even with area yields at or above expected levels. Current or further price declines coupled with area yields below expected levels could result in larger SCO payments.

Tables 1 and 2 provide payment scenarios for an SCO policy that is combined with 80% individual revenue coverage. Indemnity payments are reported as percentage losses across a range of price and yield scenarios centered at current futures price levels and expected area yields just above expected yield levels.

The percentage losses reported in the tables would be multiplied by a farm’s expected crop revenue to determine the SCO payment for the farm. Consider an example farm with a trend-adjusted APH yield equal to the expected area yield of 215 bushels per acre. This implies an expected revenue of $1,002 per acre ($4.66 x 215 = $1,002). A 2% SCO loss would trigger a $20 SCO payment (2% x $1,002). The maximum SCO payment if the underlying policy has an 80% coverage level would be $60 per acre (6% x $1,002).

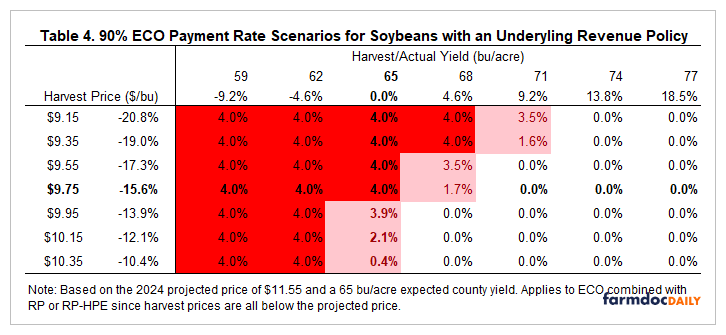

ECO Payment Scenarios for 2024

Farmers have the choice of 90% or 95% coverage levels for ECO, meaning smaller area losses are required to trigger payments. ECO-90 has a maximum loss of 4% (90% to 86%) while ECO-90 can cover up to a 9% county loss (95% to 86%).

Tables 3 and 4 provide payment scenarios for ECO-90. Again, indemnity scenarios are reported in percentage terms, with the loss percentage being multiplied by the farm’s expected revenue to determine their payment.

At current futures prices and area yields at expected levels, the maximum 4% ECO-90 payment would be triggered. ECO-90 payments could also be triggered at slightly higher prices and/or with area yields above expected levels. The maximum ECO-90 payment for the example farm would be $40 per acre (4% x $1,002).

Tables 5 and 6 show ECO-95 payment scenarios. Increasing coverage to 95% increases the maximum ECO payment to be 9% of expected revenue and also leads to ECO payments being triggered across a wider range of price and area yield scenarios. The maximum ECO-95 payment for the example farm would be $90 per acre (9% x $1,002).

Discussion

Current futures prices represent losses that would be sufficient to trigger payments from ECO, and small payments from SCO, with area yields at expected yield levels. Current expectations are for above average yields in most areas, leading to at least partial offset in price declines for revenue-based products like the supplemental plans. Further price declines, and/or county yields below expected levels, could result in maximum payment rates from the supplemental plans.

The higher coverage levels available through SCO and ECO, which can reach as high as 95%, result in smaller losses being needed to trigger payments compared with individual plans. While SCO and ECO trigger payments based on area losses rather than at the individual farm when considering yields, the price protection is based on the same futures prices as individual plans. Thus, price-driven losses will tend to trigger payments from SCO and ECO more easily than for lower coverage individual plans.

Timing of payments is another consideration in comparing individual coverage to the supplemental area plans, and to commodity program support. Payments from a policy like RP could be received in late November and early December, fairly soon after harvest. Payments from the supplemental plans, if triggered, would not be received until mid- to late-June after the Risk Management Agency has finalized the area yields used to determine payment rates. ARC and PLC payments for 2024 would not be received until October of 2025.

Source : illinois.edu