By Chad Fiechter and Jennifer Ifft

Introduction

To manage input costs, many producers take advantage of early pay and other discounts offered by input suppliers. Seed and chemicals often have complex pricing, with a range of pre-pay discounts, volume discounts, rebates and other incentives. On top of that, financing options are almost always available, with their own schedule of discounts and fees. In our first article (farmdoc daily

October 10, 2019), we created a hypothetical discount schedule based on published information to show that seed discounts can easily result in costs over 20 percent less than the base price with early cash payment and volume discounts. In our second article (farmdoc daily

October 11, 2019), we show that under standard seed company financing options, early cash payment and volume discounts may reduce cost to about 15 percent less than the base price. In our third and final article, we use the information from our first two articles to compare the use of traditional operating lines with seed company financing.

We use the

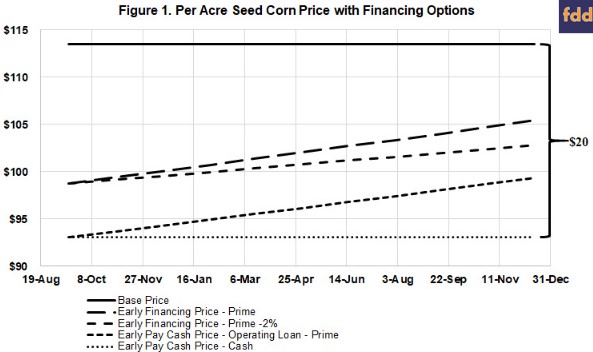

University of Illinois Farm Business Management 2019 Crop Budgets to establish a representative price for seed corn. A simple average across the four crop budget scenarios suggests a per acre cost of $113.50. Using a seeding rate of 34,000, we calculate the average per bag/unit cost to be approximately $267. This price likely reflects some existing degree of discounting or a combination of hybrid varieties selected with different base prices. The hybrid variety mix may be made up of one third in the highest pricing tier, one third in the middle pricing tier, and one third in the lowest pricing tier. Using this strategy, the farm’s corn enterprise may experience an average cost of $267 per bag/unit. Figure 1 shows the difference between the no discount price and the combined early pay cash and medium volume discounts. The difference would be greater in the case of the high volume discounts. We compare both early pay and early financing discounts with different financing options.

Figure 1 illustrates the cost advantage for a producer who can utilize the early pay cash discount through cash reserves or financing from a traditional lender. Our example base price of $113.50 is consistent with Schnitkey and Sellars’ (2016) evaluation of growth of crop inputs through time. The difference between the discounted price of the early pay cash discount and the early financing discount is over $5. “Early Pay Cash Price – Operating Loan – Prime” and “Early Financing Price – Prime” reflect a simple amortization using the current Wall Street Journal prime rate of 5.25 percent. We assume that for all financing options, the loaned funds will be carried the entire period and repaid in full on December 15. For comparison, some of companies provide promotional financing with preferable rates. This scenario is illustrated by “Early Financing Price – Prime – 2%”. With regard to promotional financing, only rates very close to zero percent would provide a better price than using an operating loan from another lender for the payment of the early pay cash discount.

Our strongest management takeaway from this series of articles is that procrastination may be costly. While many producers do take advantage of early pay discounts, the decision has multiple components. If financing is needed, the terms are typically similar to lenders’, and early discounts are still provided if the financing is locked in early. If a producer is aware of potential challenges with procuring financing, it would be advantageous to evaluate early while there is still time to take advantage of company-provided financing. If a producer is not concerned about financing, it still seems prudent to seek communication with their loan officer to illustrate the potential opportunity surrounding early pay discounts. We believe that “intentionality” is rewarded in the relationship lending norm of the agricultural credit market. A clear representation of the potential gain of the early pay cash discounts may influence a lender to extend or increase an operating loan to experience the benefits presented.

Company-provided promotional financing with more attractive interest rates than a producer’s traditional lender may be a good option for some producers. Some companies may internally “subsidize” their financing programs. Company-provided financing may further be helpful for producers who have concerns about additional financing from their traditional lender. As discussed earlier, producers who have access to lending from their traditional lender would generally need to receive a rate close to zero to be better off. Any promotional interest rates should be evaluated in combination with all possible discounts and the base price offered by the seed company.

This series has been motivated by the fact that discount schedules are a known value. In contrast, markets, weather and politics are often out of the control of individual producers, and products such as crop insurance must be purchased to mitigate risks. By utilizing seed corn discounts, a producer can reduce costs and help create some financial slack to minimize potential income shocks. In our case study, we show that early seed corn procurement can easily lead to a $20 per acre differential, even without accounting for base price and other discounts. What is $20 per acre worth or equivalent to?

- Late season fungicide

- Buying a better hybrid

- Paying crop insurance premiums

- Staying at the lake while the Co-op sprays your fields

Our point here is that seeking the potential savings from careful, early seed purchase is worthwhile. Early pay deadlines are pre-harvest (in a typical year), a time when producers have more bandwidth to make decisions than they would during the thick of harvest. Hence, evaluating financing options and preparing for early pay well before harvest may be advisable.

Source : illinois.edu