After reaching a $7.48 high in mid-August, the July wheat futures market fell to below $7 this week, and the outlook for the commodity’s profit margin is mixed at best.

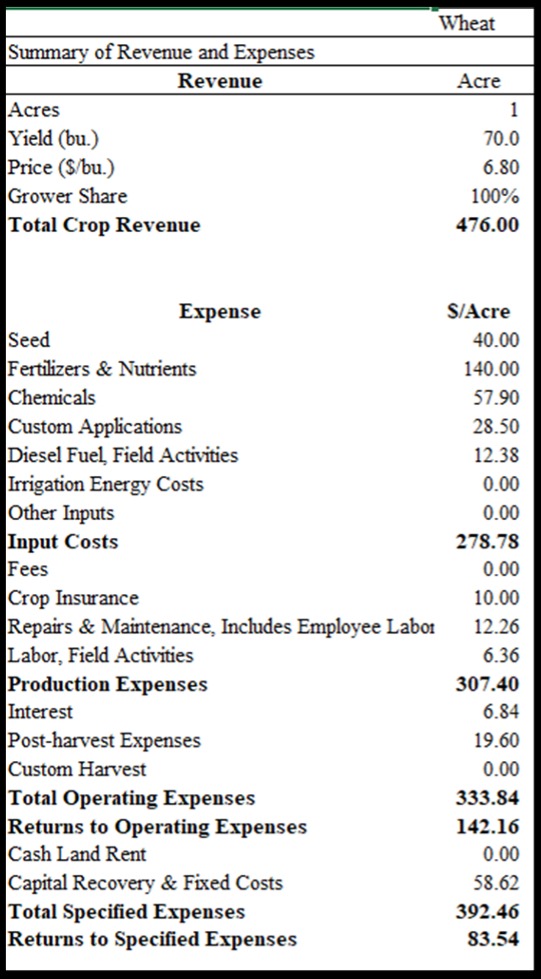

DECISION MATRIX — After reaching a $7.48 high in mid-August, the July wheat futures market fell to below $7 this week, and the outlook for the commodity’s profit margin is mixed at best. Stark increases in input costs, including fuel, seed and fertilizer, will have a profound effect on the crop's profitability. (Division of Agriculture graphic.)

Scott Stiles, extension economist for the University of Arkansas System Division of Agriculture, said increases in input costs, such as fuel, seed and fertilizer, are offsetting much of the increased revenue from higher wheat prices. Variable costs for the 2022 crop are projected to be near $334 per acre—up almost $85 per acre from last year.

“I hope growers were watching closely and locked in prices above $7,” Stiles said. “There was a stretch from the end of July until about Sept. 7 they could do that. Unfortunately, as we get closer to planting, the July 2022 futures prices have dropped about 65 cents from the mid-August peak.”

As of Friday morning, futures prices were trading at $6.83. Stiles said the basis for June/July delivery in 2022 currently ranges from zero to 30 cents under the futures price, depending on where growers will deliver their harvested wheat for sale.

“At this point, some growers may be looking at booking prices in the range of $6.80 to $6.50,” he said.

Stiles said increases in fertilizer prices have had the greatest impact on wheat profitability, with per-ton prices for urea having increased 60 percent over the past year, and potash prices having increased more than 90 percent during the same period.

“Prices for all the major fertilizers increased again last week, as Hurricane Ida impacted some nitrogen fertilizer production and caused logistical challenges such as river navigation,” he said.

Stiles said agriculture experts are anticipating higher seed costs and higher fuel costs, relative to last year. New York Mercantile Exchange diesel futures have nearly doubled over the past year, with nearby futures currently trading at $2.14/gallon, compared to $1.08 a year ago.

“Returns — excluding government payments — will vary for producers, depending on a number of factors,” he said. The price currently used for assumptions in the 2022 wheat budget is $6.80/bushel. Projected returns above variable costs are $142 per acre, assuming a 70 bushel per acre yield.

“Our projected returns in the budget do not include any land rent,” Stiles said. “The $142 return over variable costs is assuming the operator either owns the land or will have to cover land cost from those returns. Typically, producers are paying a 20-25 percent share rent, or even 30 percent in some areas.

“On a 20 percent share, the returns over variable costs drop to $47 per acre,” he said. “On a 25 percent share rent, the returns drop further to $23 per acre. For the growers looking at a $6.50 net price, these returns are even tighter.

“Each grower has to evaluate wheat through his own lens,” he said.

“At the current price for wheat, which is historically high, I wish I could be more optimistic,” Stiles said. “But the sharp increase in key inputs over the past year has really taken a bite out of potential profits.”

An updated PDF and Excel wheat budget for 2022 has been posted to the Cooperative Extension Service (CES) field crop enterprise budgets website and can be found at Arkansas Field Crop Enterprise Budgets.

Source : uada.edu