By Cory Walters

Over the past 25 years, producers have operated within the modern crop insurance regime, gaining valuable insights into understanding the essence of how insurance operates. The insurance market, including crops, property, and casualty, has experienced changes, especially in the past couple of years. Crop insurance per-acre premiums have risen and contract offerings have expanded, contributing to further complexity. Property and casualty have experienced increased claims costs, leading to higher premiums and/or higher deductibles and, sometimes, drops in coverage.

Increased knowledge of how insurance markets function, increases in contract complexity, increases in premium, increases in deductibles, and the threat of being denied coverage for risks makes the time ripe to discuss an insurance alternative: Section 831(b) of the U.S. tax law, commonly referred to as “micro-captives”.

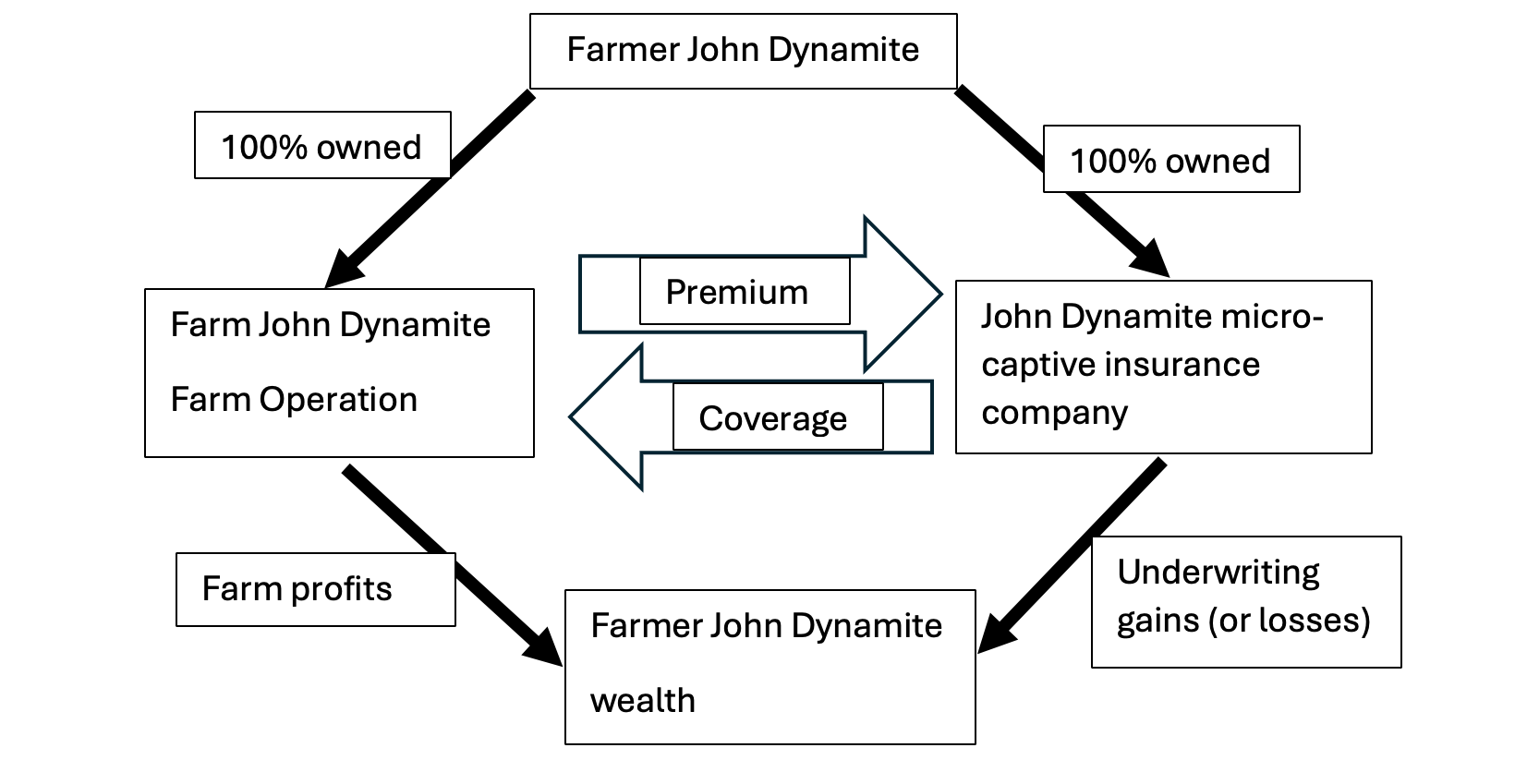

A micro-captive corresponds to an insurance company that is entirely owned and operated by the insured (Figure 1). Micro-captives pay taxes on investment income, meaning that underwriting gains (earned premiums less indemnities) are exempt from federal income tax. Micro-captives have been in existence for almost 40 years, since the 1986 Tax Reform Act. Since then, some reforms have been aimed at modernizing micro-captive tax code.

Figure 1. Micro-captive Ownership Structure and Outcome

Micro-captives are a farm insurance business that provides the following primary long-term benefits: 1) insuring risks for the farm business, 2) cost management for excessively priced and/or poorly designed commercial insurance, 3) financial gain via underwriting gains, 4) premiums are untaxed and underwriting gains accrue untaxed.

Micro-captives contain risks and expense that must be well understood and evaluated. Expenses include insurance company startup costs and yearly micro-captive administration costs. Administrative costs will become more efficient as the farms scale and micro-captive insurance usage increases. Owning a micro-captive has inherent risk to the owner’s capital, especially during the first couple of years, but good long-run risk managers will balance the risk/reward objective to generate a profit in the future.

What would a micro-captive strategy look like? The first point is that a micro-captive should not replace your underlying insurance policy. Many strategies exist and I am going to highlight a couple. The first strategy involves crop insurance. Suppose the producer is purchasing a Multi-Peril Crop Insurance (MPCI) Revenue Protection (RP) policy at 70% coverage level. They would like to purchase more insurance but feel higher coverage level premiums and county-based policies (such as SCO/ECO) are incorrectly priced and they want to insure farm yields, not county yields found in SCO/ECO. The producer elects to form a micro-captive to insure from 70% up to, say, 91%. The underlying MPCI-RP policy remains. Through your captive manager, premiums for this policy are discovered using MPCI methods, making the captive premium actuarially sound. The producer writes a premium check to their micro-captive in return for coverage from 70% to 91% of expected revenue.

Let’s fast forward to harvest. Two scenarios emerge you either have a claim, or you do not. Suppose yields and prices were reasonable leading to no claims. In this case, you keep the premiums in your captive (less micro-captive costs). Now your micro-captive has underwriting gains that you mange into the future. Suppose yields and/or prices were down, leading to an insurance claim. In this case let us suppose the loss exceeded your crop insurance deductible of 30%. You will receive an indemnity from your crop insurance contract up to your guarantee. You can submit a claim to your micro-captive insurance company, and they (you) will write the farm a check for your claim.

Getting started in a captive appears to be the biggest hurdle due to the possibility of there not being enough money in the captive to manage potential claims during the first year or two. While this is true, we must be reminded that in many years insurance does not pay out any claims, leaving you underwriting gains.

Another example could be for center pivot insurance. Perhaps forming a micro-captive could alleviate insurance availability and/or cost issues. Many more examples exist, revealing the beauty of a micro-captive tailored coverage to meet specific risks.

There are many ways to think about utilizing a micro-captive. In all cases, all rules of micro-captives must be precisely followed. Managing a micro-captive adds to farm financial management complexity. Before engaging in micro-captives, be sure to understand how to manage a micro-captive, all the micro-captive rules, stay up to date on changes to micro-captive tax code, your financial position, and your exit strategy out of the micro-captive, which would be way down the road.

A part of my position is working with Nebraska farmers about advancements in farm management and crop insurance. Given today’s agricultural environment and where we appear to be heading into the future, there appears to be farm financial management opportunities from strategically utilizing micro-captives.

Source : unl.edu