By USDEC Staff

Year-over-year (YOY) U.S. dairy exports jumped 8.5% in September in milk solids equivalent (MSE) terms, reflecting strengthening global demand in most regions outside of China. It was the third straight monthly YOY gain, yielding the United States’ best quarter for dairy exports since October-December 2022.

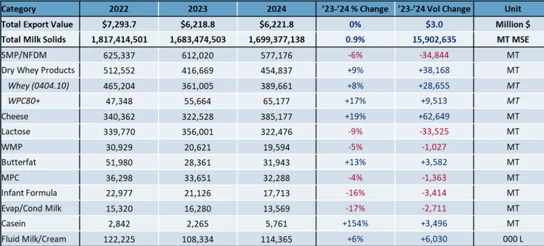

YOY U.S. export value jumped 18% to $715.2 million—the second highest monthly value this year. The increase lifted the year-to-date (YTD) change in export value to +0.4%. That’s the first time YTD value has crossed into positive territory in 2024. (All YTD numbers are adjusted for Leap Day.)

U.S. suppliers saw widespread YOY gains across most product categories, including nonfat dry milk/skim milk powder (NFDM/SMP), cheese and whey.

U.S. NFDM/SMP sales jumped 16% (+8,481 MT) driven by sizable increases to the two largest U.S. milk powder customers: Mexico and Southeast Asia.

After a slow first half, Mexican NFDM/SMP demand heated up in the third quarter. YOY volume July-September increased 17% to 105,841 MT. That is the most NFDM/SMP Mexico has ever purchased from the U.S. in the third quarter.

U.S. NFDM/SMP exports to Southeast Asia rebounded in September after a disappointing August. YOY volume jumped 34% (+4,309 MT), led by significant gains to the Philippines (+3,161 MT), Singapore (+1,033 MT) and Malaysia (+963 MT).

U.S. cheese exports extended their growth streak to nine straight months in September, as YOY shipments rose 7% (+2,503 MT). Healthy gains across Mexico, South and Central America, and the Caribbean offset declines to East Asian markets. (For a deeper dive on strong overall U.S. dairy sales to Latin America in September, see below.)

U.S. low-protein whey exports recorded their best month of the year in September, reaching 46,307 MT (+15% compared to the previous year). Sales to Indonesia more than tripled (+3,731 MT), while volume to the top U.S. low-protein whey customer, China, increased 12% (+2,086 MT).

High-protein WPC80+, on the other hand, had a rare off-month. YOY September shipments fell 1% (-104 MT). A 53% increase to China (+843 MT) and lesser gains to India (+308 MT) and Southeast Asia (+224 MT) failed to offset softer sales to Japan (-961 MT) and several smaller buyers, including the Netherlands (-203 MT) and South Korea (-155 MT).

Despite the overall gains, weakened Chinese demand continues to dampen not only U.S. exports but those of our main competitors. U.S. MSE shipments to China fell 13% in September (compared to the previous year). While U.S. suppliers posted gains in whey to China (and in some smaller product categories like butterfat and milk protein concentrate (MPC)) in September, U.S. NFDM/SMP shipments fell 50% (-1,087 MT), cheese sales plummeted 85% (-1,646 MT), and lactose dropped 39% (-6,229 MT).

Several factors are negatively affecting Chinese dairy import demand. One is slowing economic growth. Chinese lawmakers are gathering this week to flesh out details on recently announced stimulus measures aimed at lifting domestic consumption and fueling improved economic growth. It remains too early to tell whether the stimulus will achieve those goals and strengthen dairy import demand in the process.

U.S. Exports (YTD thru September)

U.S. Dairy Exports by Month

.webp)

Latin America underpins export growth

Strong demand in Latin America was a key driver of positive U.S. dairy export performance in September, with gains seen across nearly the entire region. MSE exports to Latin America surged to 78,430 MT during the month, up 17% (+11,574 MT) YOY and accounted for 41% of all U.S. exports in September, up from 38% in the same month last year.

Mexican importance to U.S. exports is irrefutable, and the seemingly insatiable appetite of buyers there has played a key role in supporting U.S. business in recent months. Exports to our southern neighbor were up a staggering 23% YOY in September, adding another 10,641 MT MSE to the U.S. export total. With these gains, Mexico’s share of U.S. exports stretched to 29%.

Notably, however, exports to Mexico shifted back toward milk powder in September, after being very cheese-heavy through the first half of the year. Exports of NFDM/SMP to Mexico jumped by 23% (+6,558 MT) in September, posting the largest YOY gain since May 2023. At the same time, cheese exports (+19%, +2,400 MT), while still above the previous year and undeniably strong by historical standards, have retreated from the record high levels witnessed earlier this year.

In addition to the gains in milk powder and cheese, several other products also witnessed hefty sales growth to Mexico in September. Butterfat exports were nearly four times greater than in the same month last year (+277%, +672 MT), while YOY shipments of lactose, MPC, dry whey, and high-protein whey also increased by 26%, 45%, 67% and 90%, respectively.

The strength of exports to Mexico during September is particularly notable given the macroeconomic challenges present during the month. Extrapolating the trend that has existed since June, the Mexican peso continued to lose value relative to the dollar across September, rendering imports more expensive. Meanwhile, economic activity in the country has begun to slow while consumer confidence is wavering. While these elements have not yet posed much of a barrier to U.S. exports, they could eventually weigh on export opportunities should they persist.

Though smaller than Mexico in absolute terms, U.S. dairy shipments to Central America and the Caribbean rose 5% (+454 MT MSE) YOY in September. Robust cheese volume drove the growth, soaring 29% YOY (+1,497 MT), as Guatemala (+24%, +306 MT) and the Dominican Republic (+26%, +244 MT) purchased more product. While cheese exports surged, however, shipments of NFDM/SMP fell by 3% (-89 MT) and exports of low-protein whey (HS Code 0404.10) faltered, falling by 28% (-445 MT) versus the same month last year.

Not to be outdone, exports to South America also lifted in September, rising by 4% (+479 MT MSE) YOY. Again, cheese exports bolstered the overall figure, soaring 60% (+1,084 MT) compared to September 2023. U.S. cheese exports rose substantially to several markets, including Chile (+49%, +487 MT), Colombia (+96%, +342 MT) and Peru (+89%, 276 MT).

While low-protein whey products fared well on balance in the region (+10%, +186 MT), high-protein whey exports slipped (-12%, -106 MT). Notably, exports of WPC80+ to Brazil slumped by 16% (-114 MT) in September. YTD U.S. WPC80+ shipments to Brazil were still up 11% (+686 MT), but September marked the second consecutive monthly decline, suggesting that buyers may be slowing purchases in response to rising prices.

Broad demand growth in Southeast Asia

U.S. milk solids exports to Southeast Asia (SEA) jumped in September—both a sign of rebounding demand in the region but also weaker YOY comparables. U.S. MSE volume to Southeast Asia in September 2023 was 29,934 MT, which was the lowest September volume since 2017. With the easier comparable, September exports rose a staggering 31% (+9,284 MT) with large increases in effectively every product:

- SMP: +34% (+4,309 MT)

- Low-protein whey: +48% (+4,052 MT)

- Cheese: +26% (+357 MT)

- Lactose: +18% (+1,222 MT)

- WPC80+: +78% (+224 MT)

- MPC: +306% (+301 MT)

But it’s not just one month. U.S. exports to SEA were up 5% YTD (+16,748 MT) with September marking the fourth month in a row of positive milk solids export growth.

Among the product highlights, Southeast Asian SMP demand has steadily grown this year, supported by improving economic fundamentals in the region (including reduced commodity prices, lower inflation, and economic growth that exceeds the global average). However, despite these more favorable buying conditions, tighter production has somewhat challenged exports out of the U.S. (although mostly on the NFDM side). Australia, as a result, has opportunistically increased SMP volumes into SEA.

Heading into the fourth quarter, we may see some additional volumes both out of Australia and New Zealand as both countries enter their flush, resulting in increased competition. But for now, the U.S. maintains dominance in the region and has held a steady market share of 35% over the last year.

Total low-protein whey demand in Southeast Asia is on a tear—up 18% (+43,316 MT) YTD through July. SEA low-protein imports averaged nearly 20% YOY growth every month this year. The U.S. is benefitting from the increasing demand. In September, U.S. exports surged 48% (+4,052 MT).

In contrast to SMP, low-protein whey prices have been increasing, although they remain well below the highs of 2022. The strong demand we’ve seen in Southeast Asia even as prices increase shows just how robust demand is in the region—driven by both economics and out of necessity, as any stocks on hand were likely worked through in 2022 and 2023.

Click here to see more...