By Kenny Burdine

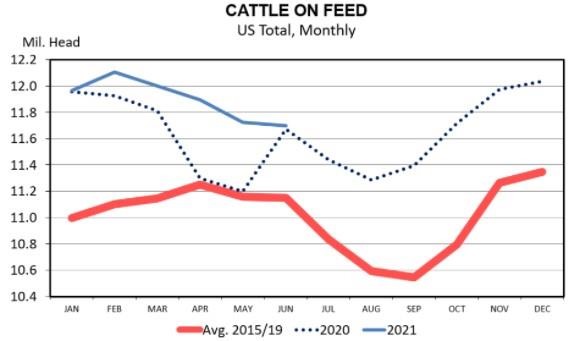

USDA released the June Cattle on Feed report on Friday June 25th. This monthly report estimates feedlot inventory in feedlots with one-time capacity over 1,000 head as of June 1st. Total feedlot inventory on June 1st was estimated at 11.7 million head, which was just fractionally higher than June 1st of 2020. On feed numbers had been running well-above year-ago levels for the last several months.

But, as can be seen in the chart above, 2020 on feed inventory rose sharply from May to June. So, this is the first time in a while that on-feed inventories have been similar to last year. It is common practice to compare any of these numbers to the previous year, but comparisons to 2020 should be made in context of the impacts COVID-19 was having on our supply chain last year. A link to the report can be found here.

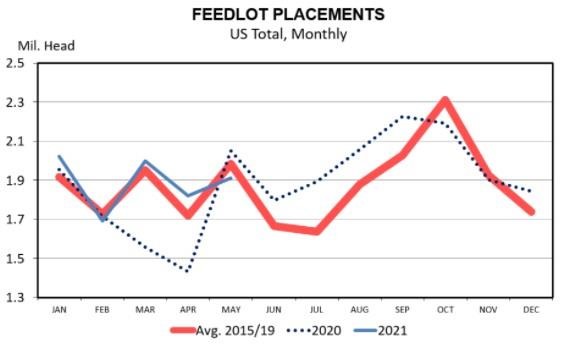

In addition to estimating total on-feed inventory as of June 1, this report also estimates placements and marketings for the month of May. The marketings estimate is likely to get the most attention as May 2021 marketings came in 23% higher than year-ago. Again, context is important as slaughter was greatly impacted in May of 2020 and feedlots simply weren’t moving as many cattle out. While considerably higher than 2020, the May 2021 marketing estimate was actually 10% below 2019.

The most bullish number on the report was the May placement number (see below), which came in very much on the low-end of pre-report estimates. Placements for May 2021 were down 7% from 2020 and were actually down by about that same percent from 2019. While cattle numbers, weather, and many other factors will impact this number going forward, it is possible that this may be the start of seeing on feed inventories trend downward. High feed prices can also impact this as it tends to encourage placement of heavier cattle and encourage more pounds to be added outside of feedlots. This was one of the topics that Josh, James, and I discussed in our quarterly market outlook video below. USDA’s acreage report will be released on Wednesday, which should provide some additional perspective on grain prices for the rest of the year.

Source : osu.edu