By Chris Prevatt

The last several months have been exceptionally stressful for all participants in the U.S. cattle industry, due to the outbreak of COVID-19 (coronavirus) in China and its resulting spread throughout the world. The unknowns of this health crisis have resulted in extreme volatility in U.S. cattle markets. The entire U.S. cattle and beef supply chain has been impacted by COVID-19.

During late 2019 and early 2020, many forecasts were projecting higher U.S. cattle prices during 2020, relative to 2019. A combination of many factors (a plateauing U.S. cattle inventory, low corn prices, low U.S. unemployment, strong domestic and export beef demand, new trade agreements, etc.) supported the potential for higher U.S. cattle and beef prices. The improvement in cattle prices was well documented by Chicago Mercantile Exchange Live Cattle and Feeder Cattle Futures Contracts, USDA Agricultural Marketing Service, CattleFax, and Livestock Market Information Center’s (LMIC) price forecasts.

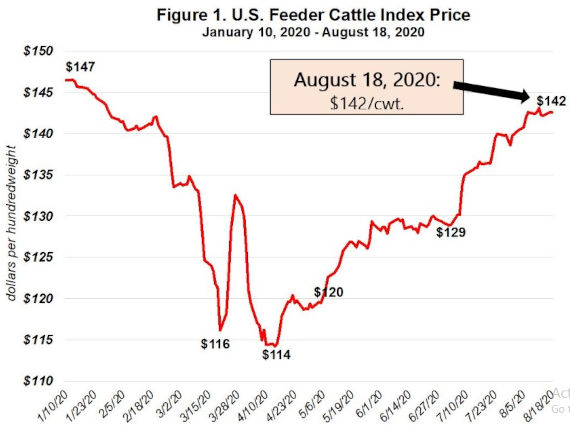

The U.S. Feeder Cattle Index Price, provided by the USDA’s Agricultural Marketing Service, is developed from actual sales of feeder cattle via auctions, direct trade, video sales, as well as internet sales within the 12-state region of Colorado, Iowa, Kansas, Missouri, Montana, Nebraska, New Mexico, North Dakota, Oklahoma, South Dakota, Texas, and Wyoming. These prices are a computed 7-day weighted average price, and provides a proxy for the current U.S. feeder cattle cash market, based on an 800-pound feeder steer. Figure 1 shows the substantial decline and recovery of the U.S. Feeder Cattle Index Price from January 10th to August 18th.

Thus far in 2020, the lowest U.S. Feeder Cattle Index Price occurred on April 14th. On that date, feeder cattle prices for an 800-pound feeder steer had declined by $33 per hundredweight, or $264 per head from January 10th, when the crisis began impacting U.S. Beef Exports. For a load of 60 head of 800-pound feeder steers, that amounts to a decline of $15,840 per truckload unit. Since April 14th, U.S. Feeder Cattle Index Prices have improved by $28 per hundredweight, or $224 per head. For a load of 60 head of 800-pound feeder steers, that amounts to an improvement of $13,440 per truckload unit. If evaluating the change from January 10th to present (August 18th), feeder cattle prices for an 800-pound feeder steer have declined $5 per hundredweight or $40 per head. For a load of 60 head of 800-pound feeder steers, that amounts to a decline of $2,400 per truckload.

What would help Feeder Cattle Prices stabilize or improve?

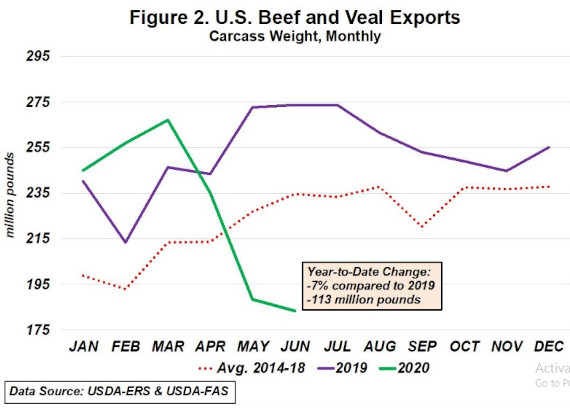

Domestic and global beef demand has been excellent the last several years. This was especially important given the huge supplies that were produced from the early expansion years. Today, we are presented with a different challenge as we still have huge supplies of cattle and beef in the U.S. supply chain for production in 2020 and 2021. However, our consumers (domestically and globally) have reduced discretionary spending habits, compared to previous years, due to the impacts from the pandemic. Figure 2. provides a comparison of U.S. Beef and Veal Exports from 2020, 2019, and the 5-year average of 2014 – 2018.

As you can see, U.S. Beef Exports have declined significantly since the pandemic started in March. When analyzing the data, there are year-over year declines in beef export volumes to Japan (-20.7), South Korea (-39%), Hong Kong (-11.2%), Taiwan (-37.2), Mexico (-61%), and Canada (-0.2%) for June 2020 compared to June 2019. It will be extremely important for export volumes to improve over the next several months, as U.S. beef production increases during the third and fourth quarters.

Obviously, there are a number of major concerns given the current number of business closings and the severity of unemployment so far in 2020. This will likely make the consumer the driver of prices moving forward. For U.S. cattle producers to see an improvement in feeder cattle prices in the short run, there must be significant improvements in U.S. economic conditions and consumer incomes. Additionally, where the product (beef) is sold is extremely important. Restaurant re-openings and improvements in seating capacity go a long way in helping to stabilize or improve prices. High-end restaurants are particularly key in order for premiums to exist for producers marketing beef cattle.

U.S. Economic Conditions

I’d like to briefly discuss five points in regard to the current U.S. economic conditions.

- I think it’s important for us to remember that when “flatten the curve” was implemented in March/April 2020 this was to slow the spread of COVID-19. It was not expected to stop or reduce the overall spread or number of people who will eventually get infected. The purpose was to avoid overwhelming medical resources until herd immunity, or a vaccine could be created. With that said, moving forward the same risks that were present this Spring still exist today.

- Anytime risk is high, we should expect consumer goods to increase in price and raw products to decline (assuming no significant changes in supply and demand). Why? Because everyone assumes more risk in the supply chain. Given, that 2020 has seen -$40/barrel crude oil, a health pandemic, extreme civil unrest in many cities, government mandates to shut down certain businesses, and a collapse in processing capacity in meat packing facilities, risk is at a level that has not been seen in our lifetimes. No one in the supply chain wants to assume more risk right now for the same returns they were receiving prior to the pandemic.

- On July 30, the U.S. Bureau of Economic Analysis officially confirmed that the U.S. Economy had entered into a recession. The official number for the second quarter growth rate for real gross domestic product (GDP) was – 32.9%. This comes after Real GDP decreased by 5% during the 1st quarter of 2020. Neither during Great Depression (1929–1933), nor the Great Recession (2008–2009) did such a decline in quarterly economic growth occur. The previous low-water market was a -10% slide during the 1st Quarter of 1958.

- Data from Opentable.com provides some insights on the declines in sales at food and drinking services. The site reports data on seated diners from online, phone, and walk-in reservations. While restaurant dining plummeted to a nearly 100% reduction in March and April, compared to 2019, a steady recovery from those spring lows has occurred. Data thru August 18, 2020 shows a 55% reduction in diners year-to-date, when compared to 2019. Additionally, new data from the U.S. Census Bureau indicates that food and drinking services saw year-to-date sales drop by 21.2% from 2019. This shows that while a recovery is occurring from the pandemic’s darkest days thus far, we are still nowhere near back to normal.

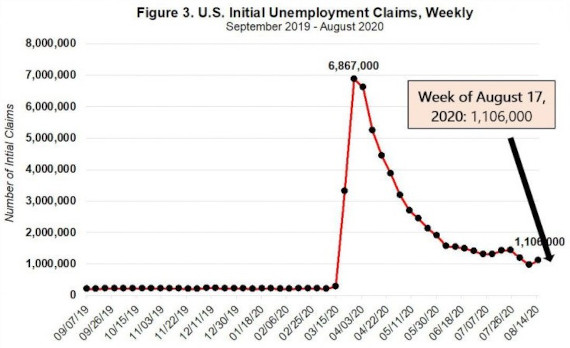

- Initial Unemployment Claims continue to increase each week at levels that can only be viewed by economists as disastrous. An initial claim is a claim filed by an unemployed individual after a separation from an employer. The claim requests a determination of basic eligibility for the Unemployment Insurance program. Figure 3 below looks at U.S. weekly initial unemployment claims from September 2019 – August 2020.

A look back. To have a better understanding of the magnitude of current initial unemployment claims, at no point in time since the beginning of the collection of this data set in January 1967 has initial unemployment claims ever begun to approach the level of claims seen over the past 22 weeks. Prior to 2020, the highest weekly unemployment claim was 695,000 from the week of October 2, 1982. During “The Great Financial Crisis” (08/09 recession), initial unemployment claims peaked at 665,000 for the week of March 28, 2009. Since the week of March 21, 2020 initial unemployment claims have exceeded 1,000,000 claims 21 times, while totaling 57,403,000 initial claims (in the last 22 weeks). While the stock market may have had a V-shaped recovery from their lows in March, the data for the U.S. economy sure hasn’t.

Bottom Line

COVID-19 has impacted every cattle operation in the United States. These cattle market impacts have resulted in substantial economic losses for many U.S. cattle producers. Many of these losses are ongoing and will likely continue through 2020. Regardless of when cattle producers market their livestock during 2020, they will likely receive significantly lower prices. Actual impacts will certainly vary widely across operations. Producers should expect markets to continue to be volatile, given our current set of circumstances and many unknowns. Abrupt changes and big price swings in a COVID-19 marketplace may become the norm. Cattle producers who continue to search for ways to lower their unit cost of production (what it costs to produce a pound of beef), and enhance the market prices they receive for their cattle will be in a better position when prices improve during the next decade

Source : ufl.edu