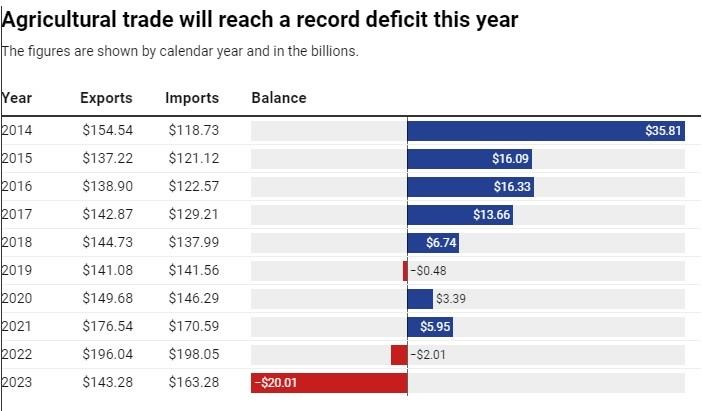

For the third time in five years, agricultural trade in the United States will be at a deficit — when a country imports more than it exports.

As of October, the U.S. imported $20 billion more in agricultural products than it exported in 2023, which would set a record for biggest deficit in a calendar year in nearly a century if the trend continues through the last month of the year.

For some farmers, this year’s big deficit is a sign that trade has taken a hit and other countries may be out trading the U.S. However, some economists argue there are logical explanations behind what has created such an eye-popping deficit — including rising imports, a strong American dollar and basic supply and demand.

“Trade deficits aren’t something we should be inherently worried about,” said Bill Ridley, a professor at the University of Illinois Urbana-Champaign, who studies international trade.

Over the last five years, agricultural exports have climbed from $141 billion in 2019 to nearly $196 billion in 2022, according to data from the U.S. Department of Agriculture. In both 2020 and 2021, agricultural trade was at a surplus, or the opposite of a deficit, where exports exceed imports.

To the farmers who grow some of the most profitable exports — soybeans, corn and wheat — the deficit is concerning and something many watch closely.

Chris Otten, a fourth generation grower who owns roughly 1,400 acres in southwest Illinois, said farmers would like to see the deficit turn into a surplus.

“That’d be ideal for us,” Otten said. “I don’t know if that’ll ever happen, but that is ideal for us to get back to where we’re exporting as much as we possibly can.”

During a year like this, when export totals have also dropped, farmers are naturally prepared to weather the current economic conditions, Otten said. However, the politics of trade are frustrating to him.

Examples include when China pulled out of buying U.S. agricultural products in 2019 or how Mexico announced this year it intends to ban genetically modified corn. The political nature of those disputes cost farmers, he said.

“I contend our food source shouldn't be a political game,” Otten said.

In his eyes, one remedy would be striking trade deals with other countries around the world to establish more avenues to sell American products.

For Otten and other farmers, checking a small box — called the commodity checkoff program — is a good place to start. Those provide small funds to certain commodity groups that could help advocate for expanded trade opportunities.

Click here to see more...