By Joe Janzen

Department of Agricultural and Consumer Economics

University of Illinois

As spring planting nears completion in much of the corn belt, attention turns to the weather and its impact on crop yields and prices. Market analysts often speak of a “weather premium” in the futures price for harvest-time delivery (i.e. the new-crop futures price). The basic idea for a weather premium is that concerns about production declines due to negative weather events create higher prices today higher than would be the case with “normal” weather and production. If the growing season progresses without a major weather event, new-crop prices are expected to fall. Since this price premium is related to weather risk, I call it a weather risk premium.

This article defines the weather risk premium and considers whether new-crop corn futures prices are consistent with such a premium. I do so by comparing observed prices during the pre-harvest marketing period to the price near contract expiration using data on new-crop December contract corn futures prices from 2000-2020. Implications for farmer pre-harvest corn marketing are also discussed.

I show that new-crop corn futures prices are indeed higher on average during the growing season than at harvest. December corn futures prices were on average 12% higher in the first week of June than in the week of December 1 during the period 2000-2020. This behavior is consistent with (but not definitive evidence for) a weather risk premium in new-crop corn futures prices.

What Is a Risk Premium?

In commodity pricing, a risk premium refers to the difference between the expected price of a futures contract at delivery and the current futures price. One interpretation of this price difference is a form of compensation, or premium, to one side of the market for taking on the risk that prices will differ from expectations between now and contract expiration. For example, suppose we expect the price of the December 2021 corn futures contract to be $5.50/bu at delivery in early December but this contract currently trades (in June 2021) at a price of $5.25/bu. In this example, futures traders who take long positions (commitments to buy the commodity in the future) are compensated (at a rate of $0.25/bu) for their commitment to buy now rather than waiting until December when prices may be even lower.

In theory, the difference between expected and observed prices may be positive as in the example above or negative. Suppose that the expected price in December remains $5.50/bu but the current futures price is instead $5.75/bu. This negative difference is compensation to short futures position holders for the risk that prices may be much higher in December. If the price near expiration is indeed $5.50/bu., selling futures at the current price of $5.75 would yield a profit of $0.25/bu.

Why might futures prices incorporate a risk premium? One classic explanation for a risk premium is a form of compensation from hedgers (typical selling futures) who shed price risk to speculators (typically buying futures) who take on price risk. Such a risk premium may occur at any time and in any market, though the evidence for such a risk premium is at best mixed.

Another form of risk premium comes from specific event-related risks. In the case of crop commodities, the market is often concerned about the risk that poor weather during the growing season may cause production shortfalls. Much higher prices may be necessary to ration scarce supply, especially when existing inventories are not available to buffer the price impact of lower production. The futures market may compensate those willing to sell ahead of harvest in the form of a risk premium like the one in the second example above. (For a full explanation of the economic theory behind the weather risk premium, see Li, Hayes, and Jacobs, 2018.) Since this premium is related to the risk of negative weather events, I call it a weather risk premium. Others may call it weather premium, or a weather fear premium (to indicate that it refers to the risk of negative weather events associated with higher prices.)

Proving the existence of a weather risk premium is difficult. All risk premia are defined relative to expected prices, in this case the price of a futures contract at or near expiration. This expected price represents the collective ‘best guess’ of market participants about expected supply and demand conditions at harvest time and it is inherently unobservable.

Since one cannot directly observe the weather risk premium, this article considers whether pre-harvest new-crop futures prices higher on average than the prevailing price at harvest. (In a previous farmdoc daily article, Zulauf, Rettig, and Roberts, 2014, make similar comparisons of pre-harvest and harvest-time futures prices at a one-year horizon only.) Such positive bias is consistent with the presence of a weather risk premium, particularly if the bias is larger during the June-August growing season and negligible once weather uncertainty is mostly resolved.

If a weather risk premium exists, it has direct implications for farmer marketing decisions. A weather risk premium implies that observed pre-harvest futures prices are biased upward, so that farmers will receive higher prices on average over the long run by pre-harvest hedging using futures sales relative to selling in the spot market at harvest. This does not mean farmers will always be better off. In some years, weather events will lead to higher prices at harvest time than in the pre-harvest period. The presence of a weather risk premium also does not imply that pre-harvest sales provide better returns to farmers on a risk-adjusted basis.

Analysis of Pre-harvest New-crop Futures Prices

To ascertain whether new-crop corn futures pricing is consistent with the presence of a weather risk premium, I calculate the deviation or difference between the weekly average price of the new-crop futures contract to the price at the general conclusion of harvest (in the 48th week of the calendar year which contains December 1). Deviations are calculated as a percentage of the price in week of December 1 to enable comparisons across years. For example in 2020, I compare weekly prices of the December 2020 futures contract between December 1, 2019 and November 24, 2020 (which ranged from $3.28 to $4.26/bu) to the average price of that contract in the week of November 25 to Dec 1 (which was $4.20/bu).

Positive deviations between new-crop futures prices earlier in the pre-harvest marketing period and the new-crop futures prices at harvest are consistent with the presence of a weather risk premium. For this deviation to equal the weather risk premium defined above, one must assume the observed price near expiration is an unbiased estimate of the expected price discussed above. (In a more advanced analysis of the weather risk premium, Li, Hayes, and Jacobs (2018) attempt to adjust the actual harvest time futures price for observable factors like production and inventory levels that might confound the harvest time futures price as an estimate of the true expected price. This simplified analysis avoids such adjustments which allows for comparisons of realized prices for pre-harvest and harvest-time crop sales.)

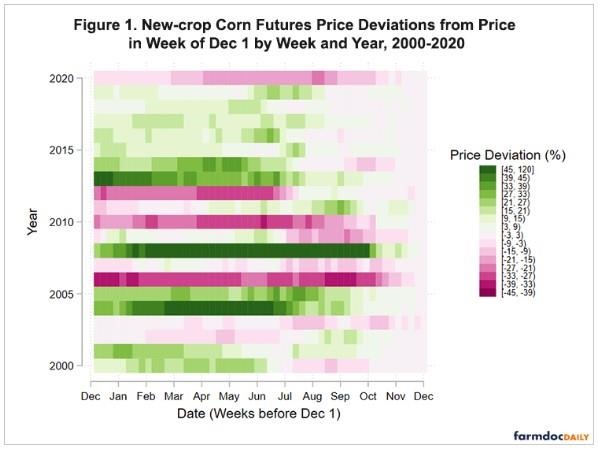

Figure 1 plots weekly price deviations from the harvest-time price for each year from 2000 to 2020 by shading each week prior to the week of December 1 by how much the new-crop futures price was above or below the prevailing price at harvest. Green bars indicate prices above the harvest time price, magenta bars indicate prices below the harvest time price.

Figure 1 shows that pre-harvest new-crop futures prices may be substantially above or below the price at harvest. However, major price moves in new-crop futures prices are unidirectional (within a given pre-harvest marketing period). Rarely do prices substantially fluctuate both above and below the harvest price in a given pre-harvest marketing period. Figure 1 also shows that large price moves in December corn futures are rare in the last few months trading. Price deviations tend to be relatively small after September.

Figure 1 also shows that price deviations tend to be positive rather than negative. There are more “green” years than “red” ones. Such positive deviations, consistent with a weather risk premium that is resolved by good growing conditions, appear largest in years following years of high prices and low crop inventories such as 2008 and 2013. In such years, the risk that a negative weather event leads to higher prices is substantial since inventories are unavailable to buffer production shortfalls. When such risks fail to materialize, prices fall between June and September. Smaller positive deviations are observed in other years, including every year in the relatively low-price period from 2014-2019.

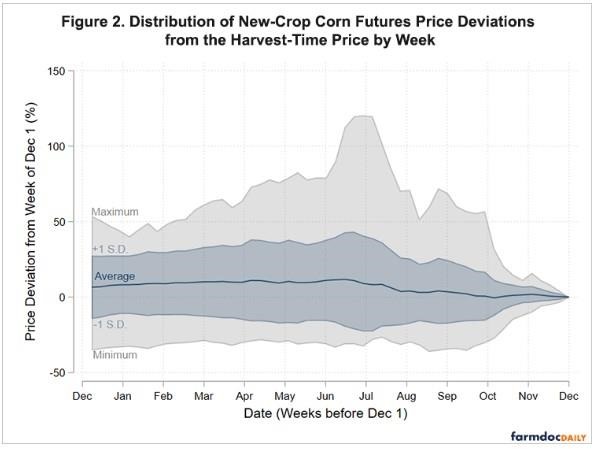

Figure 2 summarizes the information in Figure 1 by plotting the average deviation and the range of deviations across years by week. The average deviation from the harvest time new crop futures price (shown by the dark blue line in Figure 2) is positive for all weeks of the pre-harvest marketing period. New-crop futures prices were on average 7% above the harvest-time price in the December prior to harvest and rise to a seasonal maximum at 24 weeks to expiration (in the first week of June). Prices in early June were on average 12% higher than the price at harvest. That the average price deviation reaches a seasonal maximum in early June is consistent with a weather risk premium that resolves itself over the key growing months of June, July, and August. After peaking in early June, the average price deviation declines to less than 1% by mid-September.

While new-crop futures prices are consistently higher on average prior to harvest, the range of historical values is large. The shaded gray range shows the minimum and maximum deviation by week; prices may be anywhere from 120% higher to 35% lower than the harvest time futures price. The shaded blue range plots values one standard deviation above and below the mean value given by the solid line. It shows that two-thirds of the time prices range between 25-40 above and 10-20 below the harvest time futures price.

Implications for Farmer Grain Marketing

Figure 2 implies that selling December corn futures ahead of harvest, particularly in the May-July period, will be profitable in the long-run. However on a risk-adjusted basis, the returns from such a passive trading strategy are likely underwhelming. (See for example, Till 2018.) The possibility of catastrophic losses from such a strategy has led some like University of Houston finance professor Craig Pirrong to liken it to “picking up nickels in front of a steamroller.” (See Streetwise Professor, November 24, 2018).

However, farmers are long new-crop corn by virtue of the crop they have planted. They face price risk related to the price of December corn futures without taking any futures position. The results in Figure 2 suggest farmers receive a small premium in the long-run for selling forward with this premium being largest in early June. Selling December corn futures in early June is one way to capture this premium. Forward sales using hedge-to-arrive contracts are another. Forward contracts where the farmer agrees to deliver at harvest and sets both the futures and basis components of the price are a third alternative though this analysis does not consider the optimal time to price new-crop basis.

Source : illinois.edu