By Nate Kauffman and Ty Kreitman

Farm income and credit conditions in the Tenth Federal Reserve District tightened in the first quarter of 2024. According to the Survey of Agricultural Credit Conditions, farm incomes retracted at a sharp pace, farm loan repayment rates declined at a modest pace and loan demand rose notably. Conditions tightened comparatively more in states with greater reliance on crop revenues and less in more cattle heavy areas. As lenders entered the renewal period for annual operating lines, loan denials were very limited but many reported an uptick in carryover debt and loan restructuring to meet liquidity needs.

Conditions in the U.S. farm economy have tightened alongside lower prices for many key products and higher financing costs. Many lenders highlighted growing concerns about deterioration in working capital as a result of low prices, particularly for crop producers. Strength in cattle prices, however, has supported incomes for many cow/calf producers. A larger share of banks also reported higher loan demand following multiple years of subdued credit utilization, a sign that strength in farm finances built up in recent years has moderated. A continuation of subdued crop prices throughout 2024 would likely drive further tightening in agricultural credit conditions and elevated interest expenses could put additional pressure on farm borrowers.

Section 1: Farm Income and Credit Conditions

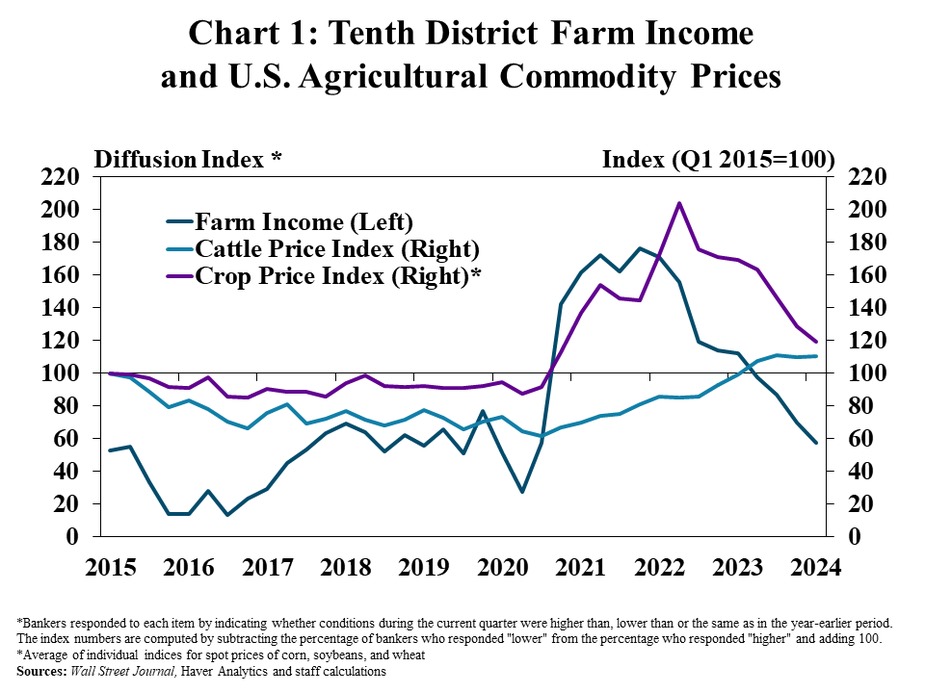

The pace of decline in farm income in the Tenth District continued to accelerate in the early months of 2024. The share of lenders reporting that farm income was less than a year ago reached 60%, the highest since early 2020 (Chart 1). Strong cattle prices supported profits for cow/calf producers in recent months, but a steep decline in prices of many key crops weighed on farm incomes over the past year.

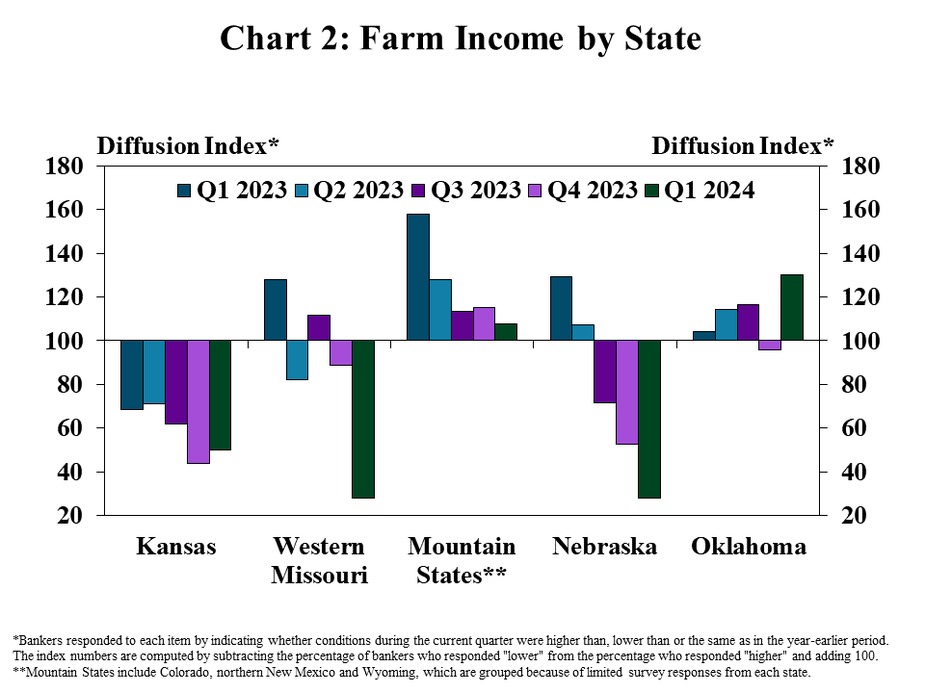

The pace of decline in farm income was notably faster in states with more reliance on crop revenues. More than 70% of lenders reported lower farm income than a year ago in Kansas, Missouri and Nebraska, states with higher share of revenue from crop production (Chart 2). In the other District states where cattle account for higher shares of revenue, less than a third of banks responded that incomes were down from a year ago.

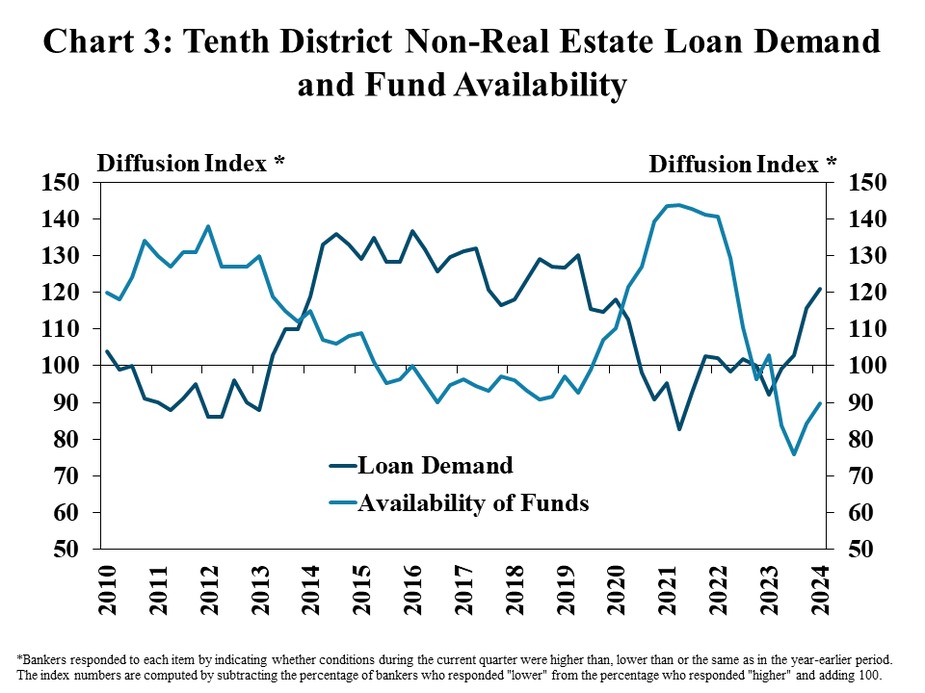

Non-real estate farm loan demand picked up considerably as profits thinned. Similar to farm income, the share of banks reporting that demand for non-real estate farm loans was higher than a year ago rose to the highest level since 2019 and neared 40% (Chart 3). As loan demand increased, availability of funds declined at a modest pace throughout the region.

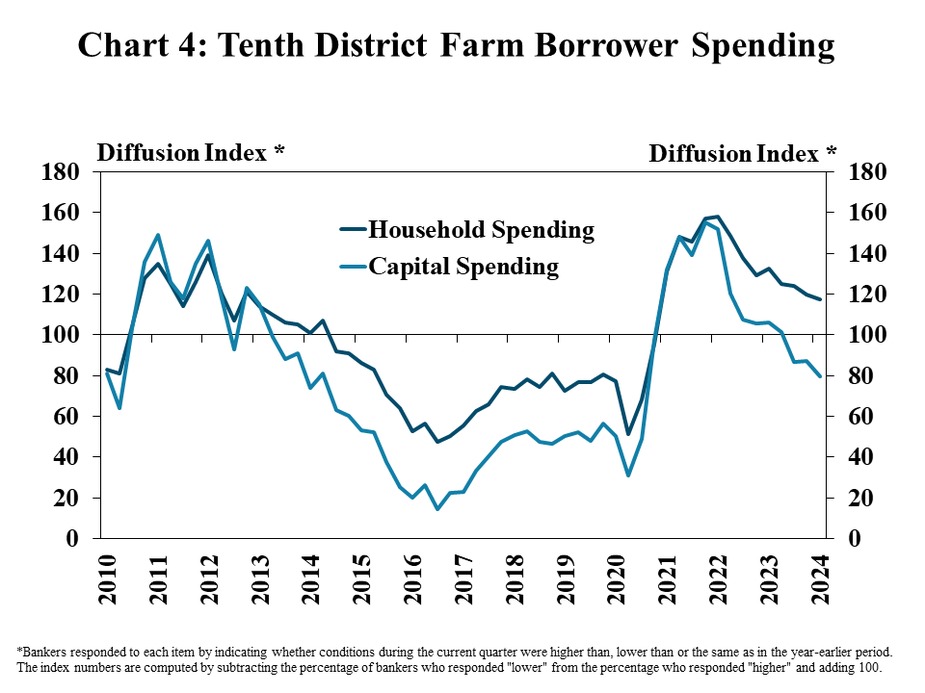

Capital spending slowed at a modest pace alongside lower incomes, but growth in household spending held firm. Capital spending by farm borrowers decreased at a gradually faster pace in the first quarter, typical during periods of lower farm income (Chart 4). Household spending however, continued to rise at a steady pace alongside broad inflationary pressure.

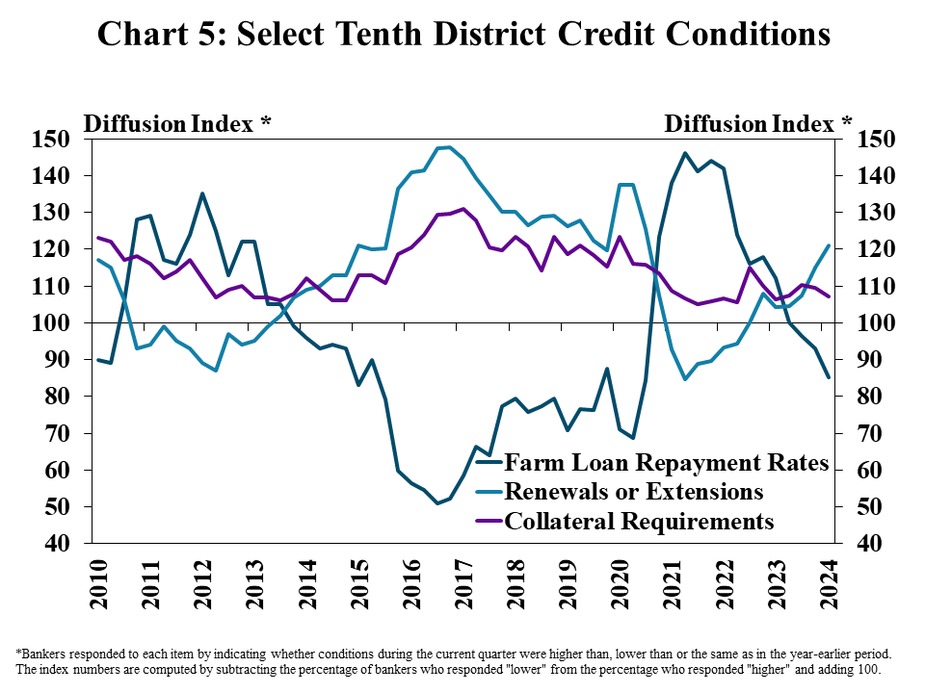

Other key measures of agricultural credit conditions showed signs of modest deterioration. Farm loan repayments rates declined in the District at the fastest pace since early 2020 (Chart 5). At the same time, renewals and extensions increased at the fastest pace since 2020 and collateral requirements tightened at a modest pace.

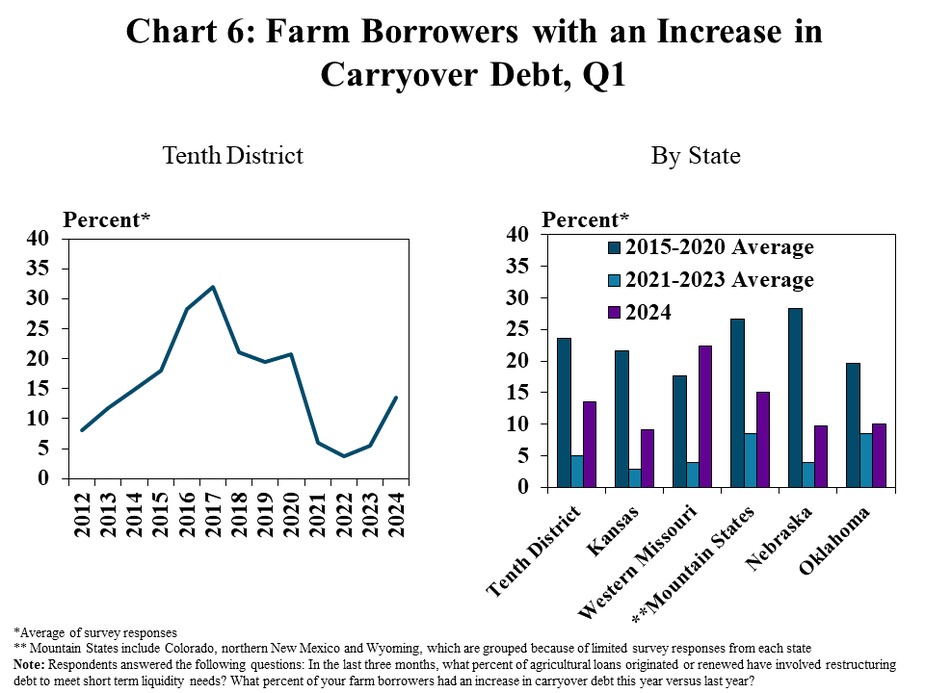

Instances of carryover debt rose slightly alongside thinner profit margins during the past year. About 15% of farm borrowers, on average, had an increase in the amount of debt not covered by profits compared with the same time a year ago (Charts 6). Instances of carryover debt grew in all states in the region, but were particularly pronounced in Missouri.

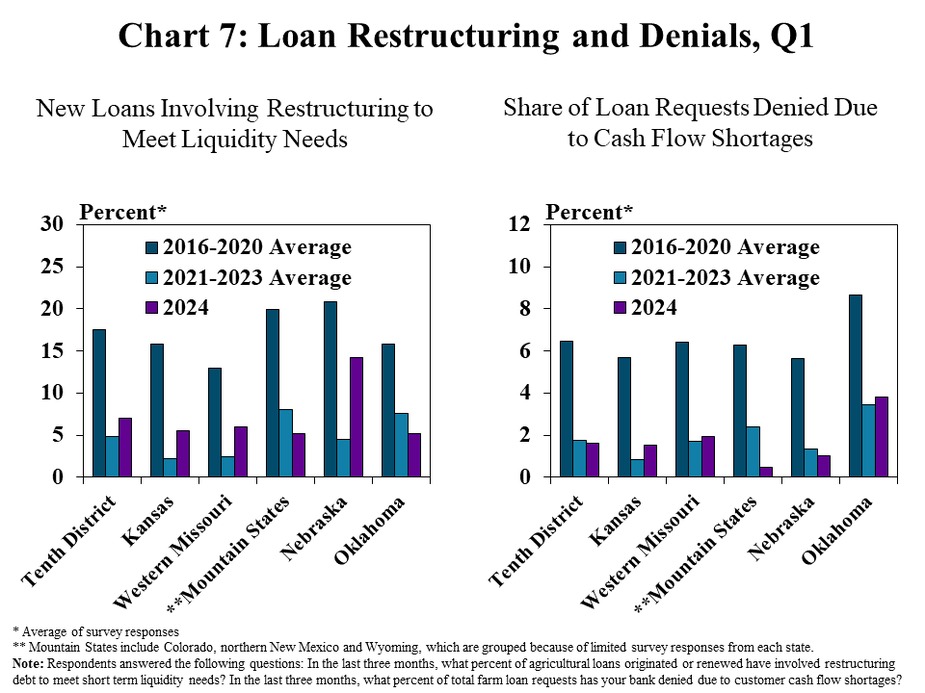

Cases of restructuring to meet liquidity needs were also higher, but loan denials remained limited for most lenders. About 5% of farm loans in the District, on average, involved restructuring to meet liquidity needs which was slightly higher than previous years but well below the levels of 2016-2020 (Chart 7, left panel). Loan denials remained minimal, staying below 2% on average throughout the region.

Section 2: Interest Rates and Farmland Values

While credit conditions softened and loan demand picked up, farm loan interest rates remained slightly above historical averages. Alongside relatively steady benchmark interest rates, average rates on all types of farm loans were largely unchanged from the previous quarter (Chart 8). Interest charges on agricultural loans remained slightly above the 30-year average, however, keeping financing costs elevated for agricultural producers reliant on financing.

Click here to see more...