By Daniel Munch

Agricultural land values increased by $200 an acre over last year, according to USDA’s National Agricultural Statistics Service. The Land Values 2024 Summary report, released on August 2, shows a 5% increase to an average $4,170 per acre. This follows a 6.7%, or $250, increase between 2022 and 2023 and marks the fourth consecutive increase in agricultural land values. Cash rent values for cropland were up 3.2% to a record $160 per acre and up 3.3% to $15.50 per acre for pastureland.

This annual report provides one of many indicators of the overall health of the agricultural economy. While record rental rates are an increased production expense for renters, on the flip side, when land values stagnate or decrease, so do collateral values, limiting farmers’ ability to secure loans and access the increased capital needed to acquire higher-cost inputs.

Farm Real Estate Value

The U.S. average farm real estate value, a measurement that includes the value of all land and buildings on farms, clocked in at a record $4,170 per acre. This 5% increase over last year is less than the 6.7% bump between 2022 and 2023 and less than the 11.7% increase between 2021 and 2022, which was the largest change since 2006, when values increased 14% over 2005. The $200 per acre increase from 2023 matches the rise seen between 2020 and 2021, though it falls short of the $250 per acre increase recorded last year and the $390 per acre surge in 2022.

Despite the overall increase in agricultural land values, the rate of growth has decelerated compared to previous years. This deceleration can pose some challenges for farmers. Farmers rely on the equity in their land to finance their operations and investments. Slower growth in land values means slower growth in equity, which can reduce farmers' ability to leverage their assets for additional capital to purchase inputs like seed and fertilizer. Lenders might perceive a higher risk in lending to farmers, especially if they expect land values to plateau or decrease.

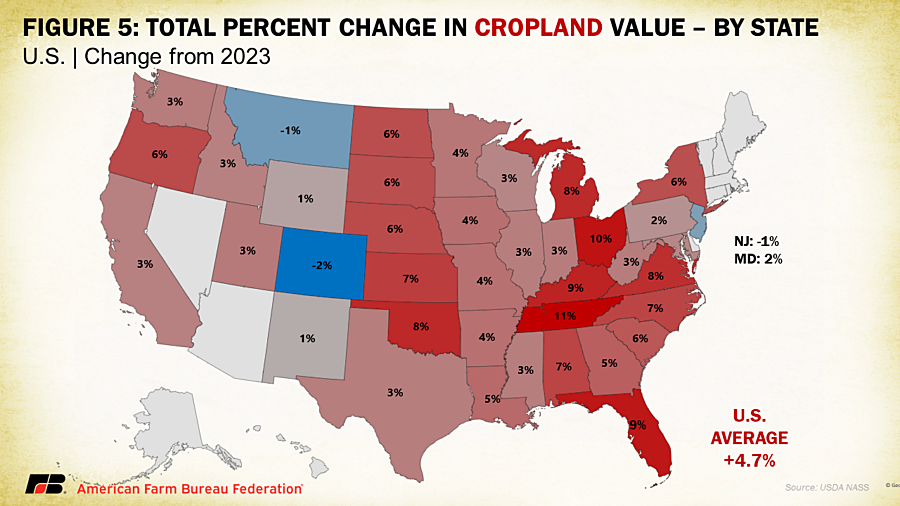

Agricultural land values vary significantly throughout the country, with the highest real estate values concentrated in areas producing high-value crops, such as wine grapes and tree nuts in California. Additionally, areas near urban centers with limited developable land, particularly in Northeast states, experience upward pressure on real estate values from competing uses. Much of the Midwest had higher total comparative agricultural land values, followed by the South and Pacific Northwest, with the Plains and Mountain states experiencing the lowest values.

Cropland values typically are based on how profitable farming the land is expected to be in the long-term, so part of this increase can be linked to the lingering effects of high commodity prices in 2021 and 2022, and expectations of the return from productive land in row crop-heavy heartland states. However, this effect has cooled significantly as commodity prices recede. High interest rates have raised the cost of borrowing for farmers, dampening the demand for agricultural land and helping slow the rate of increase in land values as compared to previous years. Government program incentives that provide financial compensation to landowners who voluntarily enroll and retire highly erodible and environmentally sensitive lands, such as those added in 2021 to the Conservation Reserve Program, also contribute to increased competition for active cropland, increasing land prices. Other factors contributing to rising land values are competing land-use interests, which can include urban and suburban sprawl or solar power installations, and increased investment demand for farmland as a safer return on investment during an extended period of inflation. On a state-by-state basis, Florida experienced the largest percent increase (+13%), followed by Tennessee (+11%) and Virginia (+10%). Between 2022 and 2023, five Midwest states experienced double-digit percentage increases in farm real estate values. In this report, only states in the Southeast experienced such increases.

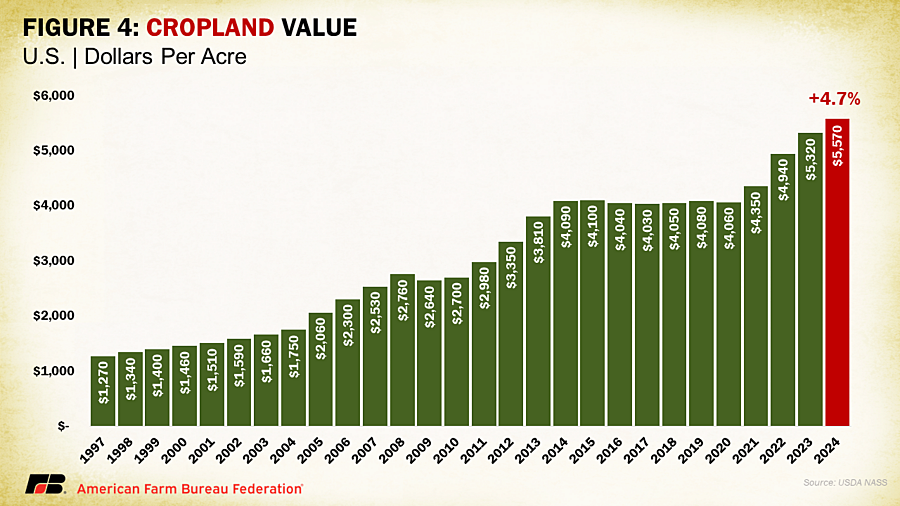

Cropland Value

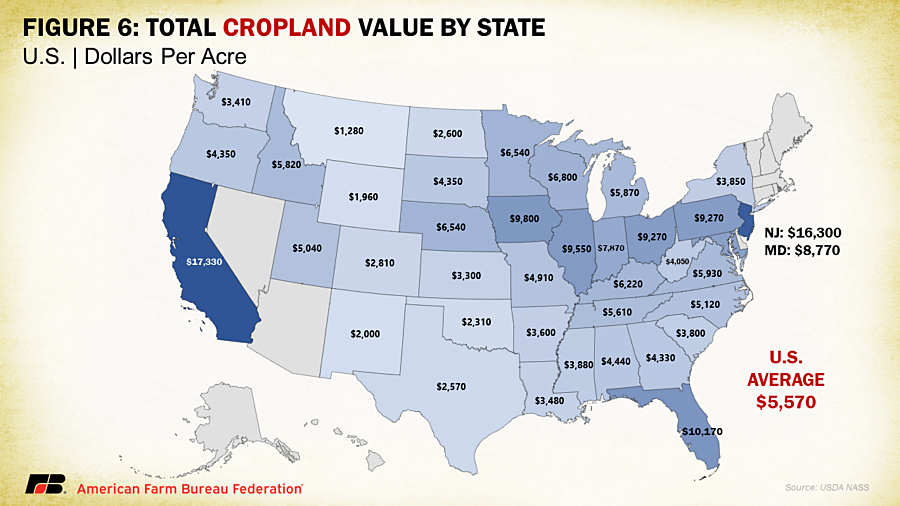

Like overall agricultural real estate values, average U.S. cropland values increased to record levels in 2024, rising to $5,570 per acre. This increase came in as a 4.7% increase over 2023, which is quite a bit less than the 8.1% jump over 2022 and earlier 7.8% increase in cropland values in 2021. In dollar values, this year-over-year increase was $250 per acre, the smallest increase since cropland declined in value between 2019 and 2020. The distribution across the country follows a similar pattern as overall farmland value, with California and the Northeastern states claiming the highest average cropland values. Following that top category is much of the Midwest and Florida, the latter of which has significant acreage of high specialty crop value and residential development pressures. The top four states in terms of percentage growth in cropland values are Tennessee, Ohio, Florida and Kentucky, posting gains of 11%, 10%, 9% and 9%, respectively. This report did show several states with declines in cropland value such as Wyoming (-2%), Montana (-1%) and New Jersey (-1%).

Click here to see more...