U.S. pork exports posted new volume and value records in 2019, reaching nearly $7 billion, according to data released by USDA and compiled by USMEF. Exports of U.S. beef were below the previous year’s record levels, while lamb export volume was the second largest on record.

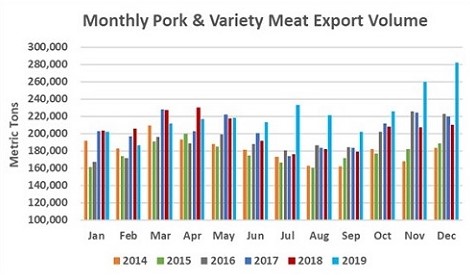

Pork exports soared to 282,145 metric tons (mt) in December, up 34% year-over-year and surpassing the previous high (set in November 2019) by 9%. Export value was $760 million, up a remarkable 44% from a year ago and breaking the previous record (also from November 2019) by 7%. These results pushed 2019 exports 10% above the previous year in volume (2.67 million mt) and 9% higher in value ($6.95 billion), breaking previous records for both volume (2.45 million mt in 2017) and value ($6.65 billion in 2014).

Pork export value per head slaughtered was $66.70 in December, nearly one-third higher than a year ago and the highest monthly average since 2014. For 2019, per-head value averaged $53.51, up 4% year-over-year. The percentage of pork production exported also set new records in December, as exports accounted for 32.1% of total pork production and 29.3% for muscle cuts only, up substantially from a year ago (26.1% and 23.6%, respectively). In 2019, exports accounted for 26.9% of total pork production, up from 25.7% and the highest since 2012. For muscle cuts only, the ratio was 23.6%, up from 22.5% in 2018.

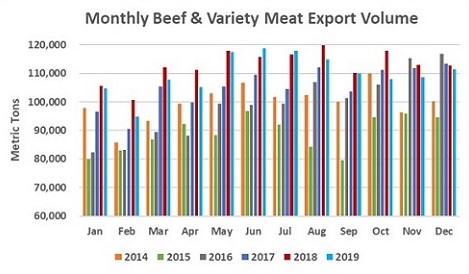

December beef exports totaled 111,315 mt, down 1% from a year ago, valued at $682 million (down 3%). 2019 exports totaled 1.32 million mt, 2.5% below the previous year’s record volume. After increasing by more than $1 billion in 2018, beef export value eased by 3% to $8.1 billion.

Beef export value per head of fed slaughter was $321.21 in December, down 9% from a year ago. The 2019 average was $309.75, down 4%. December exports accounted for 14.3% of total beef production and 11.6% for muscle cuts only, down from 15.5% and 12.6%, respectively, a year ago. 2019 exports accounted for 14.1% of total beef production and 11.4% for muscle cuts, down from the previous year’s record-high percentages (14.6% and 12.1%, respectively).

December pork demand surges in China/Hong Kong; exports to Mexico rebound

Following a record performance in November, China/Hong Kong’s demand for U.S. pork climbed even higher in December at 110,876 mt – more than quadruple the year-ago volume – while value was nearly six times higher at $274.9 million. For 2019, pork exports to China/Hong Kong were up 89% to 665,665 mt, valued at $1.45 billion (up 71%). China/Hong Kong’s pork imports from all suppliers in 2019 reached a record 3.45 million mt, up 40% year-over-year, and accelerated into December after China’s hog prices peaked in November.

“Despite retaliatory duties and the other barriers U.S. pork faces in China, exports to the China/Hong Kong region closed 2019 with tremendous momentum,” said Dan Halstrom, USMEF President and CEO. “We look forward to continued success in 2020, especially if U.S.-China trade relations continue to trend in a positive direction. The coronavirus situation is certainly concerning and disruptive, but it hasn’t dampened our enthusiasm for the potential this market holds for U.S. red meat.”

Pork exports to Mexico also closed 2019 on a high note as December volume reached 66,181 mt, up 10% from a year ago, and export value surged 46% to $137.6 million, the highest in two years. Saddled by Mexico’s retaliatory duties for the first five months of the year, 2019 exports to Mexico were down 9% from a year ago in volume at 708,133 mt, but recovered to finish just 2% lower in value at $1.28 billion.

December pork exports to leading value market Japan trailed the previous year by 3% in volume at 29,323 mt, but value increased 3% to $121.6 million. Full-year exports to Japan were down 6% from a year ago in both volume (369,891 mt) and value ($1.52 billion). Much of this decline was ground seasoned pork, which fell by $86 million due to a wide tariff rate disadvantage compared to European and Canadian product. Beginning Jan. 1, Japan’s tariff rates on U.S. pork and pork products were lowered to match those imposed on major competitors, with the rate for U.S. ground seasoned pork falling from 20 to 13.3%.

Other 2019 highlights for U.S. pork exports include:

- Led by substantial growth in Chile and Peru and an increase in shipments to mainstay market Colombia, exports to South America set new records in both volume (152,125 mt, up 12% year-over-year) and value ($382.3 million, up 16%).

- Strong growth in Panama, Guatemala, Honduras and Costa Rica drove pork exports to Central America to new record highs in volume (98,182 mt, up 14% from a year ago) and value ($239.5 million, up 19%).

- In Oceania, a key destination for U.S. hams and other muscle cuts used for further processing, strong demand in both Australia and New Zealand pushed exports 31% above the previous year in volume (116,113 mt) and 34% higher in value ($339.2 million), setting new records.

- Exports to Canada increased 4% from a year ago in volume (214,703 mt, the largest since 2013) and were 5% higher in value ($801.7 million, the highest since 2014).

- Exports to South Korea slowed from the 2018 records, with volume down 14% to 207,650 mt and value falling 12% to $593 million. But U.S. share of Korea’s imports increased modestly to 36%, as overall import volume also declined from 2018.

New beef export records for Korea and Taiwan; strong year for beef variety meat

The decline in U.S. beef exports from the record levels of 2018 was partially attributable to lower shipments to Japan, which were down 6% in both volume (311,146 mt) and value ($1.95 billion). Similar to pork, Japan’s tariff rates for U.S. beef were lowered on Jan. 1 to match those of major competitors, with rate for U.S. beef muscle cuts dropping from 38.5 to 26.6%. Another tariff rate cut will come April 1, when the Japanese fiscal year begins. December exports to Japan were slightly above year-ago levels in both volume (24,056 mt) and value ($144.6 million).

“It was gratifying to see beef exports to Japan perform so well in December, given that the first tariff rate cut was pending and set to take effect Jan. 1,” Halstrom observed. “Buyers in Japan have been waiting a very long time for tariff relief and have already responded enthusiastically. We look forward to solid growth in 2020 and beyond.”

South Korea made a strong push to become the leading value market for U.S. beef in 2019, finishing a close second to Japan at a record $1.84 billion (up 5% from a year ago). Korea was also the second largest volume market for U.S. beef at 255,758 mt (up 7%, also a new record). The United States captured a larger share of Korea’s chilled beef imports in 2019 at 62%, up from 58% the previous year. U.S. beef accounted for 51.5% of Korea’s total beef and beef variety meat imports and more than one-third of Korea’s total beef consumption.

“U.S. beef is achieving remarkable success in Korea’s traditional retail and foodservice sectors and is well-positioned to capitalize on growth in e-commerce, the institutional sector and other emerging sales channels,” Halstrom said. “As U.S. beef moves steadily toward duty-free status in Korea, it becomes accessible and affordable for a wider range of customers whose appetite for U.S. beef continues to grow. We are seeing many new menu concepts in this dynamic market and continued excitement about U.S. beef.”

Beef exports to Taiwan were record-large for the fourth consecutive year in 2019, climbing 6% from a year ago in volume (63,538 mt) and 3% in value ($567.1 million). This growth is also driven by success at foodservice and retail as Taiwan continues to embrace alternative cuts and U.S. beef is underpinning overall consumption growth. The United States dominates Taiwan’s chilled beef market, capturing approximately 75% of its chilled imports – the highest share of any Asian destination.

Click here to see more...