By Florencia Colella

Keeping a farm productive is both rewarding and difficult. Farm families strive to be good stewards of their land, but it is important to be a good financial steward as well.

The financial wellbeing of a farm is multidimensional, including household objective and subjective financial wellbeing, as well as farm objective and subjective financial wellbeing. This article will only focus on how to understand the farm’s financial wellbeing from an objective standpoint. Financial wellbeing is only one of the many aspects of wellbeing, among social, ecological, environmental, physical, mental, educational, relational and cultural.

Farm cash income and expense summaries that are typically used to file Schedule F, along with the balance sheets that are used to monitor net worth, are extremely useful as standalone documents. However, they can be turned into a powerhouse when combined with a few more pieces of information to create a farm financial analysis.

What can farm financial analysis do that those two reports cannot?

- Determine the true net farm income. This accounts for both cash income and expenses as well as inventory changes. This is a total dollar value for the year.

- Determine break-even prices for each one of the products you sell. This includes break-even prices that cover your costs and also break-even prices that account for the maintenance of equipment/net worth. These are dollar values per head, pound, cwt., etc.

- Determine financial ratios. Ratios provide a standard metric independent of business size and therefore enable comparisons across farms, with benchmarks or through time for your specific farm. Just like doctors look at a suite of tests to determine physical wellbeing, we use a suite of ratios that describe different aspects of the overall farm financial wellbeing, including liquidity, solvency, profitability, repayment and replacement capacity, and efficiency.

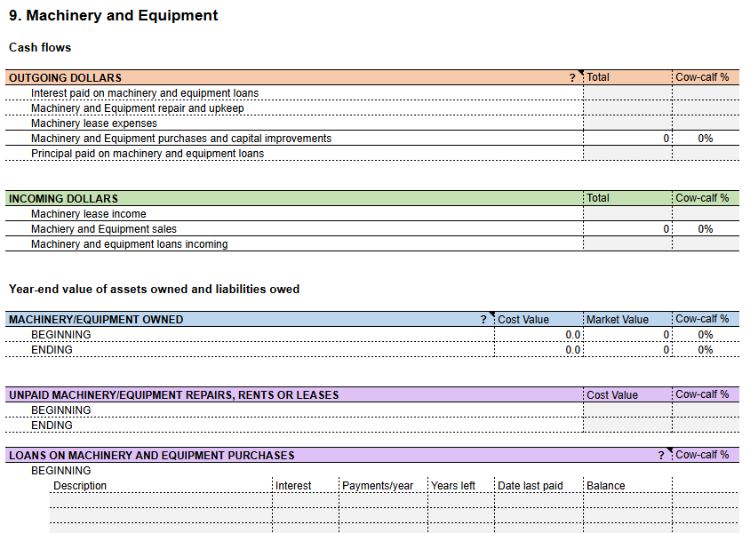

How much extra effort will this take? Most farms already have the information, it just needs to be recorded. The pieces of information typically not included in tax summaries nor balance sheets but necessary for a farm financial analysis are:

- Loan terms (interest %, number of payments per year, time since last paid and time left, and balance)

- Quantities of farm/ranch products purchased and sold (heads, pounds of beef, bushels of corn)

- Opportunity cost estimations (What would you be making if you were renting out your pasture rather than using it? How much could you sell your hay for?)

- Allocation of costs to your different profit centers (What do I use most of my gas/equipment on?)

- Depreciable asset details (purchase date and price and current market price for buildings, improvements, vehicles and equipment)

MSU Extension’s Financial Wellbeing Worksheet allows farms to input summary information into a spreadsheet that automatically analyzes the information. You may need to pull information from your accounting system, tax forms, balance sheet, bank statements, depreciation schedule, purchase and sales records, and some will have to be estimated by you. You will get a Scorecard that will show you a quick color-coded picture of your financial well-being. And you’ll also get accuracy checks, a summary comparative balance sheet report, an accrual adjusted profit and loss statement, break-even prices, and an enterprise analysis.

The worksheet is designed specifically for cow-calf operations but may be adapted for any type of farm. A video is available that provides a walkthrough of the main tabs in the worksheet input tabs “Farm & Ranch” and “Depreciable,” and output tab “Reports.” The Depreciable tab is for entering details on depreciable assets. The Farm & Ranch tab is for entering everything else, such as: cash received and spent, assets owned and debts owed, opportunity costs (marked in yellow to the left on the spreadsheet) and the percentage of each of these things that correspond to a specific portion of your operation.

If you would like help filling out, adapting or interpreting this worksheet, get in touch with Florencia Colella or with your local MSU Extension Farm Business Management educator.

Michigan State University Extension has many other resources available, including bookkeeping and financial analysis tools to help you with the important decisions you have to make as a farm manager. Many of these resources can be found at the MSU Extension Farm Management website: https://www.canr.msu.edu/farm_management. Contact your Farm Business Management Extension educator if you need help finding the right resources for your particular situation. Consider filling in this form to receive updated resources, answers to common questions, notices of future farm business management events, and other useful information.

This material is based upon work that is supported by the National Institute of Food and Agriculture, U.S. Department of Agriculture, under award number 2020-38640-31522 - H008917110 through the North Central Sustainable Agriculture Research and Education program under subaward number LNC20-437. USDA is an equal opportunity employer and service provider. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the view of the U.S. Department of Agriculture.

Source : msu.edu