By Josh Maples

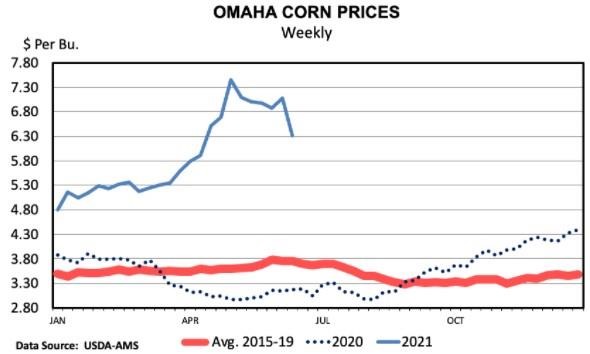

USDA will release their annual Acreage report on June 30th. This report will include an update of how many crop acres are planted this year. These reports can have a big impact on futures markets. We have already seen an example of that from the Prospective Plantings report released in March which showed lower prospective planting corn acreage than expected and led to sharp increases in corn future prices.

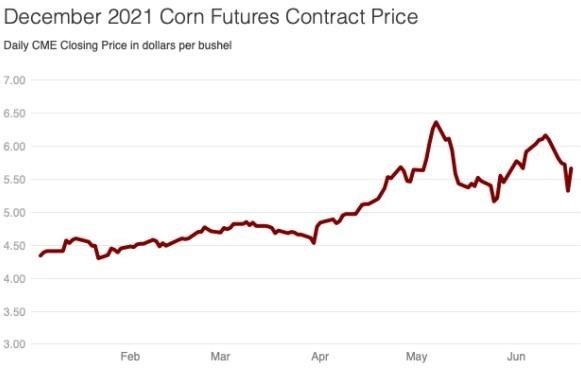

The chart above is for CME December 2021 Corn futures prices. Kenny discussed last week how the higher corn prices are a longer-term impact because of the expectation that corn prices will be higher in future months. This chart is an indication of that. Current market expectations are for corn prices in December to be in the mid-$5 range which is more than $1 higher than last December. Just a few weeks ago, futures prices were even higher with this same contract was trading in the mid-$6 range.

Futures markets provide an arena where market participants take positions on what they expect prices to be in the future. For example, the December 2022 corn contract is already trading (currently at $4.95). The December 2023 corn contract is too (currently at $4.50) although there is relatively little volume of trade on these contracts expiring that far in the future. New information can impact participants’ expectations and, therefore, prices.

Looking ahead to the acreage report next week, any surprises can have a result on futures prices. If acreage is lower than expected, that could suggest a smaller corn crop and higher prices. If acreage is higher than expected, that could suggest a larger corn crop and lower corn prices. Weather information can have a similar impact such as timely rains in the Midwest.

Corn prices have been a little lower over the last few weeks. A lot can happen during a growing season and new information in corn markets will impact expectations for cattle prices. Acreage estimates and crop progress will be key to watch as the summer progresses.

Source : osu.edu