By Doug Mayo

Credit: USDA National Agricultural Statistic Service

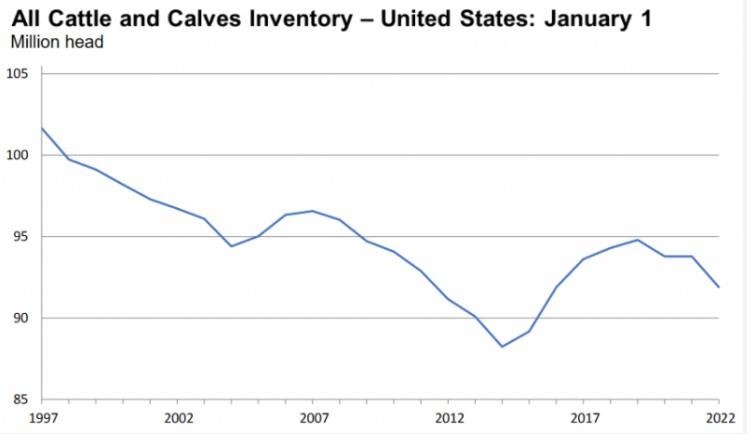

USDA’s National Agricultural Statistic Service (NASS) released the January 1 Cattle Inventory Report on January 31, 2022. These reports are a little confusing, as the year listed is the date of the report (Jan 1), but they are actually measuring the national inventory at the end of the previous year, so what is marked as 2022 on the chart above is really where we stood at the end of 2021. For the third straight year, the national cattle inventory declined in 2021, since the recent peak of 94.8 million at the end of 2018. According to NASS there were 91.9 million cattle in the U.S. at the end of 2021, which was a 2% drop from the previous year. NASS estimates the national cattle inventory twice per year on January 1 and July 1.

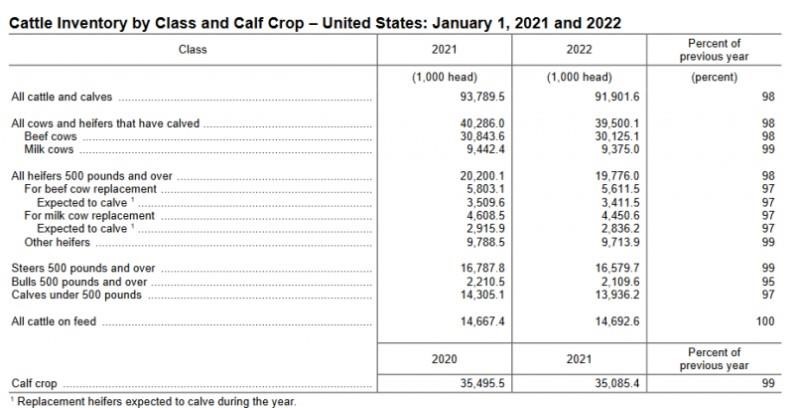

When you look at the national herd inventory by class you can see that cattle on feed was the only category up slightly from the previous year. This number suggests that flow of cattle out from feedyards to slaughter did not match the flow of cattle coming in 2021. The beef cow herd dropped from 30.8 M to 30.1 M or 2%. Yearling replacement heifers and coming two-year old heifers dropped 3%. Milk cows dropped only 1% from 9.8 M to 9.7 M. Yearling and bred dairy heifers dropped 3% as well.

Credit: USDA NASS Jan 2022 Cattle Report

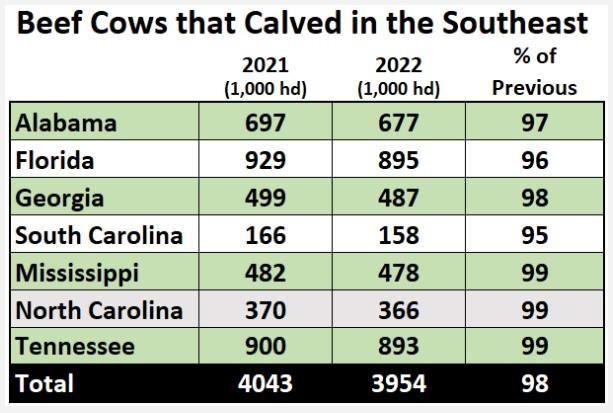

When you look through the beef herd numbers in the Southeast you can see that overall, there were 89 K fewer cows that calved last year than the previous year. In Florida there were 34,000 fewer cows that calved, or 4% fewer than the previous year.

So what does this mean for local cattle ranchers?

CattleFax, provided an Economic Outlook Seminar at the recent National Cattlemen’s Beef Association (NCBA) Cattle Industry Convention in Houston, Texas. The following were a few highlights from the NCBA News Release following the event.

Smaller supply and positive demand for beef retail products is good news for cattle producers. These cattle price quotes were very encouraging, but remember that calves sold in Florida, Alabama, and Georgia are discounted due to the cost of freight. So, understand there is a difference between the national average and the local average price.

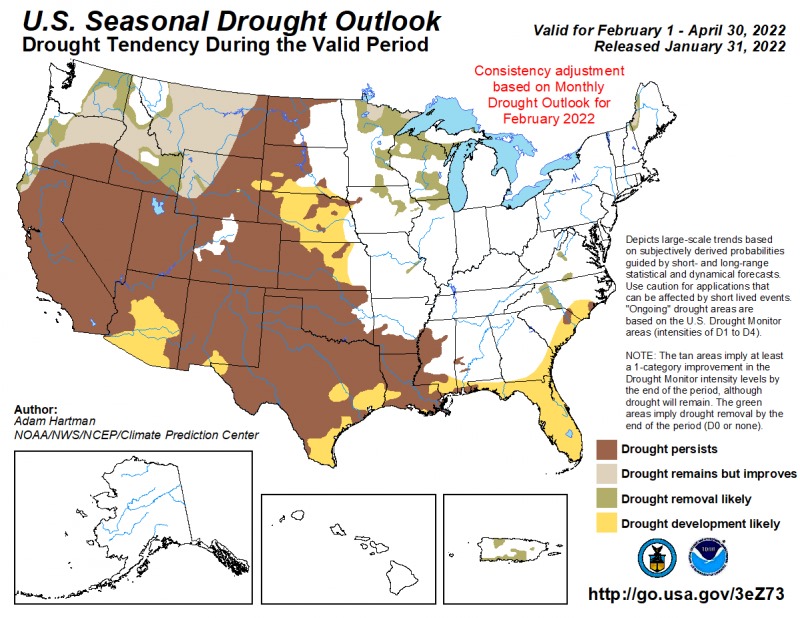

We do also have to remember why the national inventory of cattle is shrinking. The primary reason has been severe drought in the western half of the U.S. That is still a major concern, as the most recent Seasonal Drought Outlook shows through April.

Moisture in the western states is most influenced by winter and spring moisture. Based on the Climate Prediction Center’s current forecast, drought will continue to be a serious issue in 2022. Notice this forecast also includes much of the state of Florida. If this trend continues, the U.S. Beef herd will likely continue to shrink. So while inflation keeps raising production costs, the cattle markets should continue to improve as herds are reduced to compensate for drought.

Will cattle prices keep pace with the inflation of input costs? That is the big question on everyone’s mind in 2022. Based on CattleFax’s bullish forecast, it does appear that feeder calf prices will steadily improve in 2022. Cattle prices are expected to move up faster this year, as beef processing moves back to full speed again, keeping feedyards current shipping finished cattle on time. This is all positive news, if producers can find ways to keep production costs low enough to remain profitable. Markets are improving, so the input cost variables will be the primary factor that determines profitability in 2022 and beyond.

Source : ufl.edu