By Carl Zulauf and Gary Schnitkey

In response to higher inflation, the Federal Reserve has raised the effective Federal Funds interest rate from 0.08% in January 2022 to 5.3% currently. It is now higher relative to current inflation than its historical average over the last 60 plus years. In contrast, market interest rates relative to inflation are lower than history suggests. The latter is consistent with the market’s view that post-2020 inflation is temporary. If the market’s view is correct, the Federal Reserve will begin to cut interest rates but market rates will likely decline less than the Federal Funds rate. If the market’s view is incorrect, market interest rates will need to move higher if inflation remains at or increases above its current level. The data in this article come from the Federal Reserve Economic Data files (FRED) maintained by the Federal Reserve Bank of St. Louis.

Price Inflation:

Several measures of price inflation exist. The most commonly watched is the Consumer Price Index (CPI). However, economists consider the GDP (Gross Domestic Product) implicit price deflator index the most complete measure of prices in an economy. Since1962, annual consumer price inflation has usually exceeded the GDP deflator’s more complete measure of inflation (see Figure 1). Since 1962, annual CPI and GDP deflator inflation have averaged 3.8% and 3.4%, respectively. During the first quarter of 2024, annual CPI inflation was 3.3% and GDP deflator inflation was 3.1%. The two measures closely track one another. Their correlation is +0.96 (+1.0 is perfect positive correlation).

Inflation and Interest Rates:

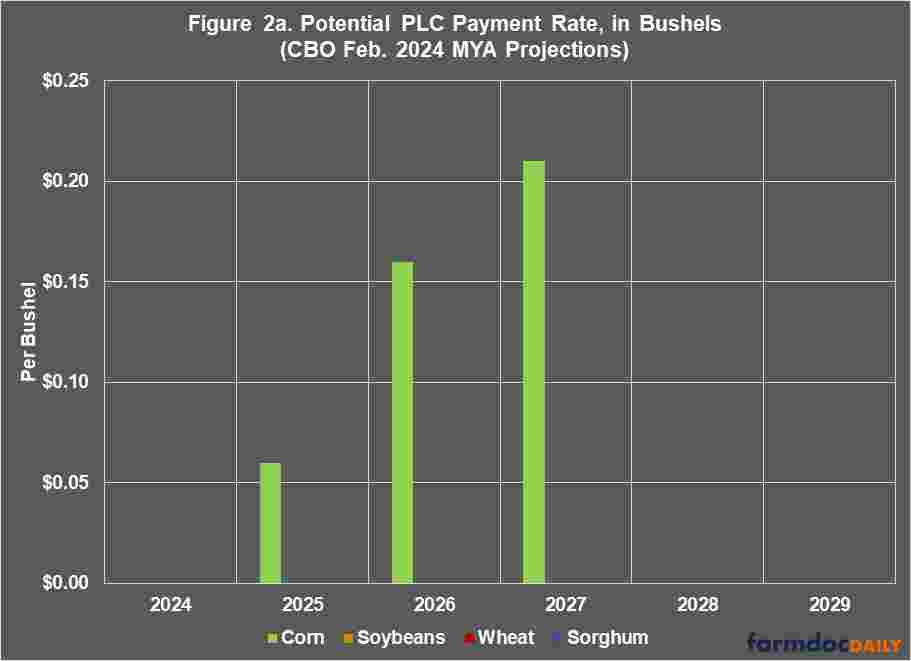

The Federal Reserve has the most control over the Federal Funds interest rate. A key relationship is its difference from the inflation rate. The Federal Funds rate has averaged 1.5 percentage points higher than GDP deflator inflation since 1962 (4.9% vs. 3.4%) (see Figure 2). During the first quarter of 2024, the difference was 2.2 percentage points (5.3% vs. 3.1%), or 0.7 percentage points above the historical average difference.

Differences between market interest rates and inflation are also of interest. Two widely watched market interest rates are the 10-year US Treasury Bond and Moody’s Aaa Corporate index rate. Since 1962, the first year for which FRED reports 10-year US Treasury bond rates; these two market interest rates have respectively averaged 2.5 and 3.5 percentage points higher than GDP deflator inflation (5.8% and 6.9% vs. 3.4%) (see Figure 2). During the first quarter of 2024, the differences were notably smaller at 1.1 and 1.9 percentage points, respectively.

Market’s Expected Inflation:

FRED publishes a market estimate of expected average inflation over the next 10 years. It is derived from the 10-year Treasury constant maturity bond and 10-year Treasury inflation-indexed constant maturity bond. It is first available for 2003. Over 2003-2023, this measure of expected 10-year inflation averaged 2.1% (see Figure 3). During the first quarter of 2024, it was slightly higher at 2.3%. The implication is that the market most likely views post 2020 inflation as temporary.

Source : illinois.edu