By Chad Fiechter and Jennifer Ifft

Charles H. Dyson School of Applied Economics and Management

Cornell University

Many recent discussions of “nontraditional finance” focus on alternative sources of credit for financially stressed farms. While this is an important issue facing the farm economy, broader changes to agricultural credit markets are also driving the growth of nontraditional finance. In this series, we discuss the major types of farm lending models, estimate the volume of nontraditional finance, and share a case study on vendor credit and farm financial stress from the Northeast. In this article, we present (1) an updated definition of nontraditional finance and (2) three types of nontraditional lending.

Defining Nontraditional Finance

Sherrick, Sonka and Monke (1994) defined a nontraditional lender as “Nontraditional credit suppliers or lenders… whose primary contacts with producers historically have been for goods and services other than credit.” This definition is largely consistent with vendor credit. Today, we believe the critical distinction between traditional and nontraditional credit is not only the type of institution and how it is regulated, but how credit is delivered. Over the past century, farm lending was primarily conducted at local lender branches (Farm Credit/PCA lenders or commercial banks) with a dedicated loan officer.[1] Thus, nontraditional lenders are lenders that operate outside a local lender branch and loan officer model. This definition goes beyond regulation and allows for an individual lender to fall into more than one category.

Ag Lending 101

Before we categorize nontraditional lenders, it is helpful to articulate the basics of agricultural lending, or the conditions necessary for a lending relationship for traditional and nontraditional lenders alike. First, agricultural lenders must overcome information problems or moral hazard (Barry and Robison, 2001). Lenders that are unfamiliar with agriculture and do not have a local presence have serious difficulty assessing borrower quality, especially compared with a local loan officer. In extreme cases, banks without a local presence have supported financially precarious farms that local lenders knew to stay away from. Second, given that nearly all farm loans are secured by collateral, farm lenders must be able to effectively collect collateral or otherwise convince borrowers that they can collect collateral. Third, lenders must be able to generate sufficient loan volume and/or charge high enough interest rates or fees to generate a profit, while managing information and collateral risks on top of the normal weather, market and other risks facing production agriculture. Nontraditional lenders must further compete with traditional lenders who have well-established business models and clients. For farm managers, it may be useful to apply these three principles to better understand the business model and products offered by a new lender.

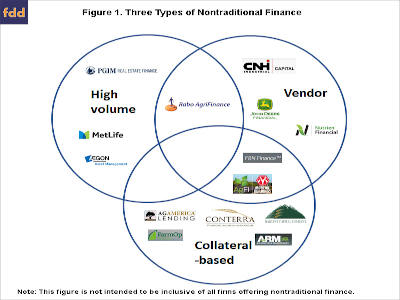

Types of Nontraditional Lenders

High-volume, branchless lenders: These lenders focus on large, progressively managed farm operations without operating out of a local branch. These are specialized ag lenders that are targeting the top end of the market in terms of volume, growth and management. Metlife and Rabo Agrifinance are the largest lenders in this category and are as big or nearly as big as the largest farm credit lenders (i.e., Farm Credit Mid-America), as well as some other life insurance companies. These lenders provide competitive rates and research services while developing a relationship with their borrowers. Wall Street banks appear to have lost interest in this type of lending in recent years.

Vendor finance: “Point of sale” financing has grown in recent years and is offered by nearly all farm input suppliers. Sometimes this is “effective credit” in the form of outstanding accounts receivable; in other cases firms have their own internal finance (Nutrien Financial, John Deere Financial, CNH Industrial Capital). Suppliers also partner with Deere or Rabo to provide vendor financing. Traditional lenders may directly or indirectly support vendor financing as well. Some of FBN’s new finance products fall into this category, as well as the next category. Vendor finance is usually offered at competitive rates, with a fee charged to the input supplier, who often also guarantees the loan. Fees may be absorbed by the supplier as a “cost of doing business” or passed on to the customer. Although repayment data is not publicly available, many vendors and lenders report that vendor credit is typically repaid quickly.

Collateral-based lenders: Collateral-based lenders, often referred to as alternative lenders, are nonbank institutions that make lending decisions primarily based on the value of collateral, although other factors are typically also taken into account. Collateral may be a crop (ARM, FarmOp), equipment (AgriFinancial) or land (AgAmerica, Conterra, Harvest Capital Company) or combinations of these. These lenders may provide conventional lending products at competitive rates, especially for farm real estate-backed loans, but they also have the capacity to take on riskier clients. In these cases, lenders would charge higher rates in return for taking on clients who have trouble accessing traditional finance, either due to financial distress or the desire for quick growth or taking on riskier financial positions. Taking on riskier clients is likely an important part of the business model for collateral-based lenders. While there is a perception that these lenders are “lenders of last resort,” a more accurate representation may be that these lenders are specialized farm lenders that fill the space between traditional farm lenders and nonfarm lenders that would charge interest rates in the range of 10% to 15% and higher. Many of these lenders report significant investment in getting to know their borrowers and monitoring farm operations and collateral. Some of these lenders have initiated financing partnerships with vendors, for example, AgFi/Morton or ARM/Nutrien.

Growth of Nontraditional Lenders

Nontraditional lending has been growing for several reasons. Some nontraditional lenders hire former bank or Farm Credit loan officers, which can help overcome information problems. Some nontraditional lenders are using technology, big data and other types of innovation to improve their ability to collect information on lenders and monitor collateral, including taking advantage of detailed farm management and production data. The success of vendor credit across industries is partially attributed to the close business relationship between suppliers and producers. Higher interest rates and/or a focus on collateral may also help compensate for higher risk. Many investors and pension funds both in the United States and globally have been seeking to invest in the farm sector, which may allow new firms to operate on thin or negative profit margins.

Demand for Nontraditional Lending

Lending standards imposed on traditional lenders have been speculated to be a cause for the growth of nontraditional finance, but research on this topic is limited. Financial stress in the agricultural sector may also be leading to increased demand for credit, although there is sometimes not a link between financial stress and nontraditional lending. The growing diversity of U.S. agriculture may also play a role. Some nontraditional lenders may target large, profitable farm businesses, while some may be more relevant for small and midsize operations. Complex or fast-growing or more risk-tolerant operations may also demand nontraditional finance. Nontraditional lenders may compete based on convenience, high-quality service, bundling with inputs, flexible lending standards, or source of collateral.

Implication for Farm Management

Overall, an increasingly diverse number of lenders serve U.S. agriculture. While financial stress is certainly relevant for some types of nontraditional finance, innovation and competition in modern agricultural credit markets is also driving the growth of nontraditional finance. This competition and innovation can create value for farm operators, but it can also increase risk and complicate management decisions. Taking the time to understand different lending strategies and types, as well as true cost of credit, can help farm managers navigate the wide variety of credit choices. In the next article in this series, we will discuss the potential size of nontraditional finance and related policy implications.

Source : illinois.edu