By Bradley Zwilling

Illinois FBFM Association and Department of Agricultural and Consumer Economics

University of Illinois

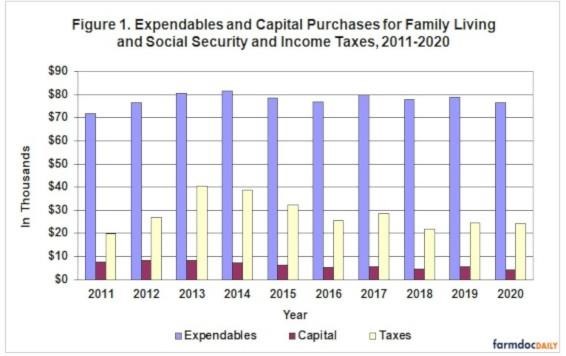

In 2020, the total noncapital living expenses of 1,088 farm families enrolled in the Illinois Farm Business Farm Management Association (FBFM) averaged $76,672–or about $6,400 a month for each family (Figure 1). This average was about 2.8 percent lower than in 2019. Another $4,354 was used to buy capital items such as the personal share of the family automobile, furniture, and household equipment. Thus, the grand total for living expenses averaged $81,026 for 2020 compared with $84,340 for 2019, or a $3,314 decrease per family.

Income and social security tax payments decreased 1.3 percent in 2020 compared to the year before. The amount of income taxes paid in 2020 averaged $24,214 compared to $24,525 in 2019. Net nonfarm income increased, averaging $47,892 in 2020. Net nonfarm income has increased $12,438, or 35.1 percent in the last ten years.

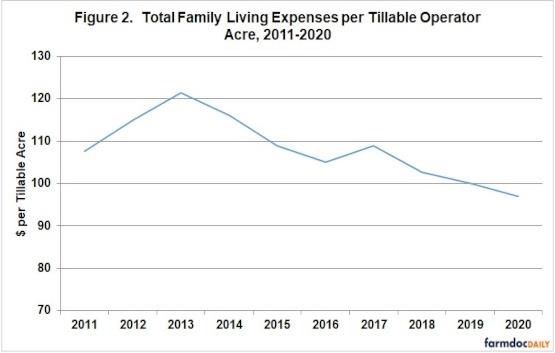

In Figure 2, total family living expenses (expendables plus capital) are divided by tillable operator acres for 2011 to 2020. In 2011, all of the family living costs per acre averaged about $108 per acre. This increased to $121 per acres in 2013, but has decreased to $97 per acre in 2020. $108 was the 10-year average of total family living expense per acre. If we compare this to the 10-year average of net farm income per acre of $158, then 68% of the net farm income per acre is family living expense. If we look at the average year over year change for the last ten years for family living per acre, the annual change was negative 0.3% per year. The five-year annual change per year would average negative 2.2%. Therefore, as you work on your crop budgets, keep in mind that a $97 per acre family living is equal to a 49 cent per bushel price change on 200 bushels per acre for corn.

When you take total family living expenses minus net nonfarm income this equals $40 per acre in 2020 and was $48 per acre for the five-year average. This would be the part of family living that is covered by the farm income. In addition, there is another $29 per acre in social security and income taxes to be covered by the farm in 2020. The five-year average for these taxes was $31 per acre. A 20 cent price change on 200 bushels of corn per acre is equal to the 2020 family living cost that would be covered by the farm. If you added the amount of social security and income taxes that would be a 35 cent price change on 200 bushel of corn per acre.

More information about Farm and Family Living Income and Expenditures can be found here: https://farmdoc.illinois.edu/handbook/farm-and-family-living-income-and-expenses

The author would like to acknowledge that data used in this study comes from farms across the State of Illinois enrolled in Illinois Farm Business Farm Management (FBFM) Association. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000 plus farmers and 68 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel with computerized recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State Headquarters located at the University of Illinois Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

Source : illinois.edu