Letter stresses importance of international trade

By Diego Flammini

Assistant Editor, North American Content

Farms.com

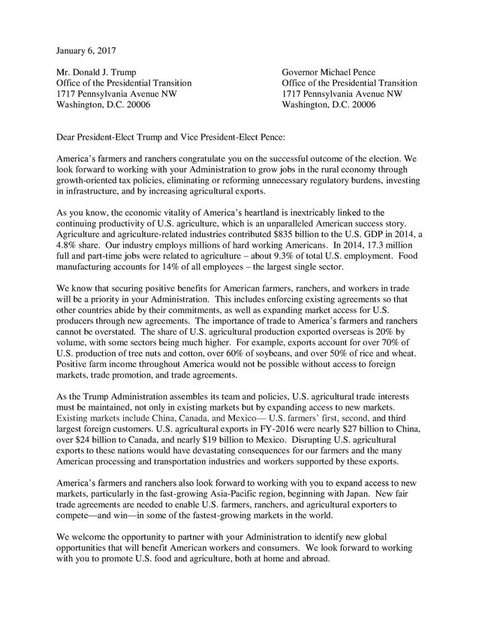

A group of 16 organizations representing American farmers, including the American Farm Bureau Federation, American Soybean Association, National Milk Producers Federation and U.S. Dry Bean Council, wrote a joint letter to the incoming government to stress the importance of trade to farmers.

“The importance of trade to America’s farmers and ranchers cannot be overstated,” the Jan. 6 letter says. “…U.S. agricultural trade interests must be maintained, not only with existing markets (including China, Canada and Mexico) but by expanding access to new markets.”

When it comes to new markets, the farm groups said they look forward to expansion into the Asia-Pacific region – specifically, Japan.

The letter also points out that agriculture is one of the country’s key economic drivers.

The farm groups outline agriculture’s $835 billion contribution to the country’s GDP in 2014 and the industry’s role in providing 17.3 million jobs in the same year.

They warn that any turmoil within pre-existing trade agreements could hurt American farmers.

“Disrupting U.S. agricultural exports to these nations would have devastating consequences for our farmers and the many American processing and transportation industries and workers supported by these exports,” the groups wrote.

“Throughout the (presidential) campaign, Mr. Trump and Gov. Pence committed to having farmer voices at the table when decisions are made that affect our industry. Nowhere is the potential effect more serious than in our trading relationships and as such we look forward to partnering with the Trump Administration on these issues,” Ron Moore, American Soybean Association (ASA) president and Illinois corn and soybean farmer, said on the ASA website.

The National Milk Producers Federation wrote a letter of its own on Jan. 6 to the incoming government outlining five reasons why keeping current overseas dairy sales would help protect jobs:

- U.S. dairy exports create tens of thousands of American jobs,

- Losing the equivalent of one day a week’s worth of milk production would have dire impacts on American farmers and manufacturing jobs at U.S. food companies,

- U.S. dairy farmers and processors need a level international playing field to compete and preserve the jobs that create their made-in-America products,

- Rampant foreign nontariff barriers require a ramp-up in trade enforcement, and

- Ensuring that U.S. regulatory agencies support exports will unleash greater U.S. dairy exports.