Global Conflicts and Drought: Unraveling Their Impact on Commodity Markets

Photo Credit: Pexels Anna Nekrashevich

By Colin McNaughton

Farms.com Risk Management Intern

This summer, commodity markets faced an array of challenges that have left investors and analysts grappling with uncertainty about the path ahead. A drought, reminiscent of the infamous 2012 drought was paired with USDA yield estimates hovering around record highs.

Simultaneously, the key Black Sea grain deal conflict between Ukraine and Russia added another layer of complexity, leaving many unsure about what would happen next.

In a dramatic turn of events, the recent conflict between Israel and Hamas, which saw the Iron Dome defense system breached, has plunged Israel into a state of emergency.

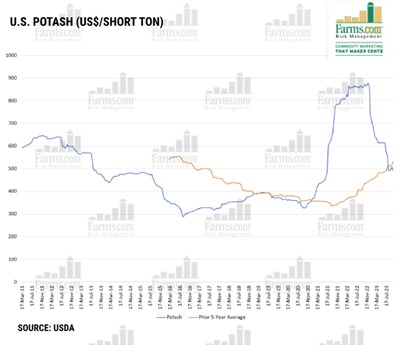

Fertilizer prices are at risk of surging due to the potential impact of the Israel conflict on global supplies. The conflict has disrupted operations at Israel's key potash fertilizer export. Critical global potash supply is in jeopardy, and global fertilizer prices could climb due to supply limitations. The fertilizer price pain could be aggravated by higher U.S. & European natural gas prices.

The Black Sea conflict continues to create tensions with varied effects on commodity markets. Chicago wheat futures rallied as reports of new tensions in the Black Sea region emerged. The conflict in the Black Sea region took an unusual turn when a Turkish-flagged general cargo ship hit a mine off the coast of Romania. Fortunately, the crew remained safe, but this incident underscores the volatility and potential disruptions in the region.

Corn futures reached a one-month peak in the first week of October, breaking free from their prior trading range, while soybeans also reversed higher despite lackluster export demand. December corn futures settled at $4.97-1/2 on the 5th of October, marking the highest closing price since August 8. The contract also crossed back above its 50-day moving average for the first time since July 27, signaling a potentially significant shift in market dynamics.

December Chicago Board of Trade (CBOT) wheat futures, which hit a three-year low by the end of September, rose by over seven per cent to settle at $5.79-3/4 a bushel on the 13th of October. This upward movement is pushing December wheat higher towards crucial technical levels it had been struggling to breach.

Managing your risk in a market like this is crucial, which includes being patient and avoiding selling at the market lows.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.