The disease showed a lot of variability throughout tested fields, Quantum Genetix says

By Diego Flammini

Staff Writer

Farms.com

Canola fields in Alberta have more sclerotinia pressure than those in the other Prairie provinces, a crop testing organization says.

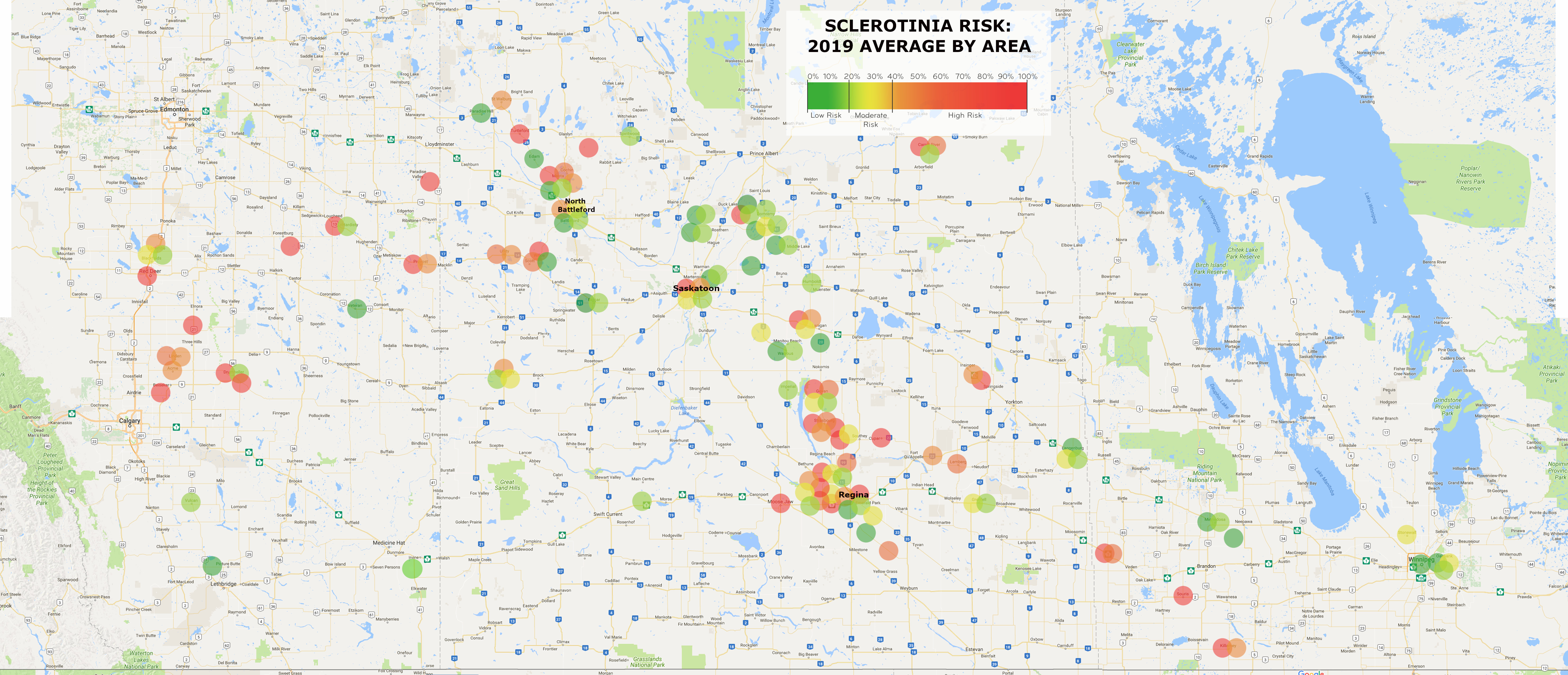

“There’s more disease in Alberta than there is in Manitoba and Saskatchewan,” Heather Deobald, general manager of Quantum Genetix, told Farms.com. “The average risk was about 56 per cent in Alberta, 35 per cent in Manitoba and 34 per cent in Saskatchewan.”

Producers can purchase a Q-protect test kit and send in canola samples any time between 20 and 60 per cent bloom. Quantum Genetix processes the samples to determine the risk of sclerotinia stem rot, and whether a fungicide application is necessary. Then, farmers can apply the necessary fungicide.

Quantum bases its recommendations on a risk barometer.

Quantum Genetix photo

A sample with a reading around 20 percent risk might not require a fungicide application, while a crop with a reading between 20 and 40 per cent could need an application. A sample with a risk factor of 40 per cent or higher would need a fungicide application, Deobald said.

Quantum started collecting canola samples from Western Canadian farmers in 2016 and the four-year test window has started to show some trends about the distribution of sclerotinia.

The percentage of growers in the low risk category (up 20 per cent) has dropped. The percentages of farmers in the medium risk (21 to 40 per cent) and high risk (anything over 40 per cent) categories have increased to the point where all three categories are almost even.

“We found that very interesting considering it has been a bit of a drier year here,” Rebecca Kolla, a sales rep with Quantum who processed the data, told Farms.com.

The tests also show the variability that comes with trying to track the disease’s movement, Deobald added.

“What we’ve seen is that the disease can be present in one field and not in the next,” she said.

Weather and crop rotation are the two main factors in sclerotinia development, she explained.

Farmers can use an app from Quantum to help calculate whether a fungicide application will provide a return on investment.

Producers can enter production information and crop input costs into the Quantum Genetix DNA Test App to produce detailed report, Kolla said.

“The app is linked to your test results,” she said. “Farmers can input what they think the crop’s yield will be, what they think they’ll receive as a market price and what the average spray cost is. There’s an economic calculator built into the app that gives a breakeven cost to determine if it’s worth it to spray the field or not.”

The app is available for Apple and Android devices.