Russian weather scare has sent Chicago wheat futures surging

By Devin Lashley

Farms.com Risk Management Intern

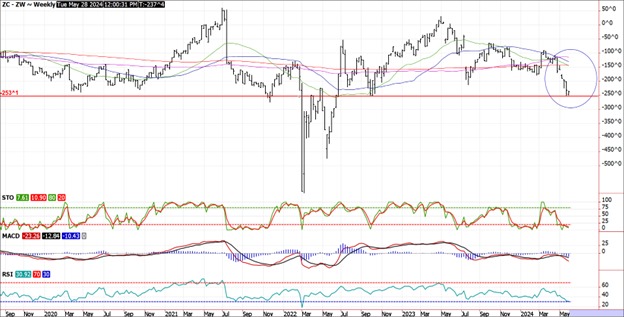

A good old fashioned Russian weather scare has sent Chicago wheat futures surging 30% from the lows at the end of February from dry/cold weather. That price increase vs. corn futures has widened and historically the spread of $2.50 is wide (with the exception of March of 2022 at $5.914/bu) means that more livestock rations will start to switch back to cheaper corn feed prices and result in a higher corn and residual feed demand on the USDA balance sheets.

Price Difference of 2024 July Corn Daily Futures vs. 2024 Chicago Wheat Daily Futures

image

In Mexico, extreme heat and drought are causing severe issues. Reports indicate that the drought is so severe that monkeys in the Mexican jungles are dying from heat, and neighborhoods around Mexico City are prohibited from drawing water from reservoirs that are drying up.

This dire situation has increased Mexico’s dependence on U.S. corn imports, which have surged by 42% this year making them the #1 buyer at 47% of the total sales with Japan a distant second at 14%. The state of Sinaloa, responsible for nearly a quarter of Mexico's corn production, is experiencing extreme drought conditions, categorized as D3 (extreme) or D4 (exceptional) by the North American drought monitor.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.

The U.S. Department of Agriculture (USDA) reports that Mexico's 2023-24 corn production is expected to be 17% lower than last year’s record, dropping from 28.1 mmt to 23.3 mmt. The drought has also led to notable declines in forecasts for Mexico's wheat and durum production.

A combination of surging wheat prices and surging corn imports from Mexico will provide tailwinds for higher U.S. corn demand for longer. Look for the premium in wheat over corn prices to narrow over time as it remains historically high over the past 15 years.