It means a lower U.S. $ Index which equals a continued strong U.S. export program

By Colin McNaughton

Farms.com Risk Management Intern

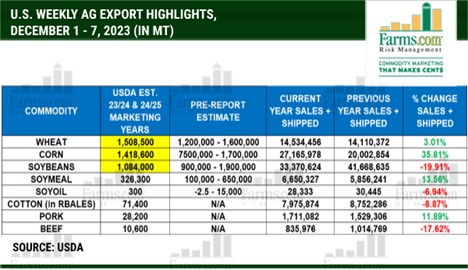

U.S. exports have been on a roll for the past few months, and that trend has continued this week. Demand from China has boosted the numbers and improved the overall demand picture significantly.

This week’s report showed U.S. wheat sales at 1.49 mmt. Beating out both corn and soybeans. That number is the highest single-marketing year sales total since September 2007! That came after China was actively buying soft red winter wheat last week with multiple large purchases, totalling 1.12 million metric tons.

U.S. corn sales came in at the higher end of expectations at 1.41 mmt. That is up 10% from last week but 12% lower than the previous 4-week average as demand has been strong recently with the pace increasing by the week +36% vs. last year vs. USDA at +25%. Not a surprise that Mexico was on top with the highest purchases at 669,000 metric tons representing 50% of all the total purchases for 23/24. However, it was nice to see China was also buying with a daily U.S. corn purchase of 143,300 metric tons. Look for more of this buying from China in the new year if the drought in South America takes a bite out of the 2nd Safroinha corn crop due to drought by as much as 20-30%.

U.S. soybean sales were at the lower end of expectations at 1.08 million metric tons. Not as strong of a report that we have been seeing recently, down 23% from last week and 46% from the prior 4-week average. Although lower, this is the tenth straight week of corn and soybean sales both being over 1 million metric tons and 8 straight days of daily USDA announcements of U.S. soybeans sales top unknown aka China. U.S. hard red winter wheat still having a tough time with exports so look for the USDA to reduce KC export demand in the Jan WASDE, but it could be offset with higher SRW exports.

The weather in North/Center Brazil has been too hot and dry and the rains continue to disappoint with below normal precipitation and the markets will be shocked when production falls below 145 mmt. The U.S. soybean export program will be the big winner in Q1 of 2024 as the U.S. $ Index continues is decline lower overtime.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.