U.S. farmers holding on to near-record stockpiles of soybeans

By Devin Lashley

Soybean prices are currently at a four-year low, primarily due to favorable weather conditions in the U.S. Midwest and poor export demand among other factors that have resulted in an anticipated record crop in 2024. Despite various weather scares and threats, including droughts in China, a heat dome across the U.S. Midwest, hailstorms, floods and derechos, have not materialized, leading to a robust crop outlook.

The extended forecast predicts cooler and wetter conditions in key production areas, further supporting crop health. This has led traders to believe that the USDA's optimistic yield projections might hold true, keeping prices low. Without a drastic change in the weather, which is not being forecasted, it is unlikely that a significant price rally will occur. In fact, markets are getting ready with another USDA crop report for August with pre-report yields coming in at a record 52.50 bpa.

Adding to the price pressure, U.S. farmers are holding onto near-record stockpiles of soybeans, waiting for prices to improve. As of June 1, U.S. corn and soybean stocks were at a four-year high, with 48 percent of soybeans held on farms—the largest percentage since 2006. With very little 2024 bushels priced the supply cushion will remain an anchor on prices and basis. Any price rallies will be short-lived as farmers rush to sell their stockpiles, capping potential price increases.

Crop conditions as of July 29, 2024, were also better than the same time last year, with 67 percent of the U.S. soybean crop rated in good-to-excellent condition, compared to 51 percent in 2023. This robust condition further contributes to the expectation of a high yield, keeping pressure on commodity prices.

Moreover, the market dynamics have been influenced by fund selling pressure. With the extended forecast turning cooler and wetter, traders expect no significant disruptions to crop yields, leading to continued bearish sentiment. The USDA’s recent yield estimates, without a notable change in weather patterns, suggest an increase in carryout above the 400-million-bushel level, this may potentially push soybeans down to $8 or $9 per bushel.

Global market conditions are also adding to suppress U.S. soybean prices. Export demand remains weak, partly due to a stronger U.S. dollar and more competitive global markets. Brazil has enjoyed record exports, adding competitive pressure on U.S. soybeans. According to the USDA, the U.S. soybean supply for marketing year (MY) 2024/25 is forecasted at 4.8 billion bushels, 8 percent higher than MY 2023/24. Despite a slight decrease from last month’s forecast, the projection remains high, supporting the bearish price trend.

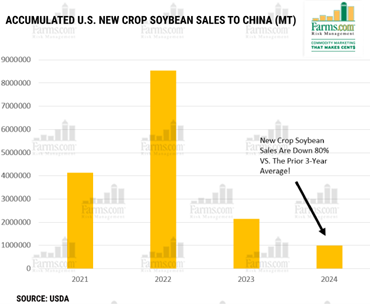

A record 24/25 Brazil soybean crop will only add to the pain unless a La Nina weather patterns impacts production. The record U.S. soybean crush rate is not enough to offset lower and weaker export demand. Markets need to trade lower to search for more demand. New crop commitments for 2024/25 at 1 million metric tons, is down 80 percent from the three-year average, though it is improving. Without Mexico, the second-largest U.S. soybean buyer, sales would be even worse!

In summary, the combination of ideal growing conditions, record crop forecasts, and significant stockpiles held by farmers has driven soybean prices to their lowest in four years. While the market hoped for weather-related disruptions to boost prices, the reality has been a series of favorable forecasts that ensure a bountiful harvest. This has kept prices suppressed and is likely to continue doing so unless a significant weather event around the world or a fundamental change occurs soon.

Photo Credit: USDA

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.