By Rob Ziegler

The October USDA Cattle on Feed Report estimated heifers make up nearly 40% of all cattle on feed inventories; a signal of producer’s intentions (or lack thereof) to retain heifers as replacements. Consensus is that the heifer mix needs to be somewhere in the 36-37% range to signal signs of herd rebuild, a level we haven’t seen since 2018. That said, the bred female market has received less attention recently, but moving forward will likely be a primary focus for when cattle producers consider increasing their cow herds.

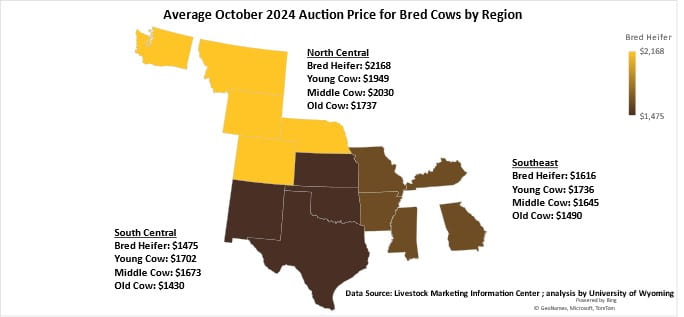

The University of Wyoming compiled replacement female prices available through the Livestock Marketing Information Center and aggregated them into the following categories: bred heifers, cows 2-4 years (Young), 5-8 years (Middle), and cows >8 years (Old). The entire data set includes prices from 2013 to current. Here we focus on prices in October of 2023 and 2024. A simple average was calculated as reference for bred female price in their respective age category regardless of pregnancy trimester. Prices from October 2023 and 2024 were then evaluated for change in price and volume. Furthermore, data from the available 14 states were grouped by region; North Central (CO, MT, NE, WA, WY), South Central (KS, NM, OK, TX), and Southeast (AR, GA, KY, MO, MS).

Replacement female prices in October 2024 were up for all categories and regions as compared with October 2023. The greatest increase in year over year prices was for old bred cows in the Southeast which was up 46%. Young cows in the North Central region showed the smallest increase in price at 5% year over year. The average October 2024 price for each bred female category and region is illustrated in Figure 1 above. The increase in bred cow prices this year as compared to last is likely due to the increase in overall beef cattle market prices, as opposed to increased demand for replacement females at this point.

The overall replacement cattle sale volume from January through October was down 6.61% for 2024 as compared to the same time period in 2023. The overall decrease in replacement cattle sale volumes is likely a reflection of an overall reduction in the national cow herd size. Volume of replacement cattle sales in the North Central region and Southeast were down 4% and 16% respectively year over year. In contrast, replacement cow sale volume in the South-Central region increased by 124% of last year’s volumes. This is most likely an indication of liquidation in drought affected areas.

At this point there is little indication that beef cattle producers are retaining heifers to increase cow herd numbers. Although bred cow prices have increased year over year, it is likely driven by overall supply factors, not necessarily demand for replacement females. When purchasing replacement females, several factors should be considered, including but not limited to expected feeder cattle prices, cow longevity and salvage value, and input costs. Due to market dynamics on both the input and output side of beef production, the value of a replacement female is highly variable and requires operation specific analysis. It will be interesting to see where replacement female prices head in the next few years as the current cow cycle unfolds.

Source : osu.edu