On Sept. 10, German officials confirmed the first case of African Swine Fever in a wild boar found near the Polish border. Given the proliferation of cases in western Poland, the announcement was not a significant surprise, but the confirmation of ASF in Germany could be devastating for the country’s pork industry, which is still dealing with disruptions caused by COVID-19.

Background on African Swine Fever

For most of the past two years, ASF has been in the spotlight following its discovery, and subsequent rapid spread, in China. AFBF’s Market Intel has covered the issue previously in several articles, but for the uninitiated a short background on ASF is helpful. ASF is a serious, highly contagious, viral disease affecting pigs. It spreads very rapidly in pig populations by direct or indirect contact. Pigs can contract the virus in a variety of ways, including transmission by ticks and direct contact between animals, as well as by contact with contaminated food, animal feed or vehicles. ASF can survive for long periods in uncooked swine products, which can facilitate its introduction into new areas. The virus is extremely hardy and can withstand extreme environmental conditions in fresh and frozen meat. The mortality rate of the virus is extremely high, and there is no vaccine commercially available or approved for use on the market.

It is very important to note that ASF does not affect humans and poses no food safety implications, particularly when it comes to the U.S. food supply. Humans cannot contract the virus by handling pork or by coming into contact with pigs, as only animals in the pig family can contract it. After being introduced into the world’s largest pork-producing and-consuming country, China, ASF spread like wildfire, decimating the country’s hog herd. It subsequently spread throughout many other southeastern Asian countries, reducing pork production and driving up animal protein prices across species.

In Germany, authorities have implemented ASF control measures, including erecting a fence around a 4 km radius of the site where the infected animal was found and combing the area for signs of other infected animals. However, samples taken from the infected animal indicate that ASF entered Germany several weeks ago, and already German officials have announced that five other infected wild boars were found in the endangered area.

Where does Germany Send its Pork?

Most of Germany’s domestic pig population is further west and south of where ASF was discovered, and with the discovery of a wild boar testing positive, there is no indication that the country’s commercial production has been impacted. However, as a result of the wild boar testing positive, many countries have begun to cut off imports from the country. Late last week, South Korea and Japan banned imports of pork from Germany, and over the weekend China announced a ban on German pork as well. China’s announcement went so far as to indicate the country would destroy any existing pork supplies that originated in Germany. These import bans and others that may follow deal a pivotal blow to the German pork industry, which has already been struggling from the impacts of COVID-19. Export markets are incredibly important to Germany, the largest pork producer in the European Union.

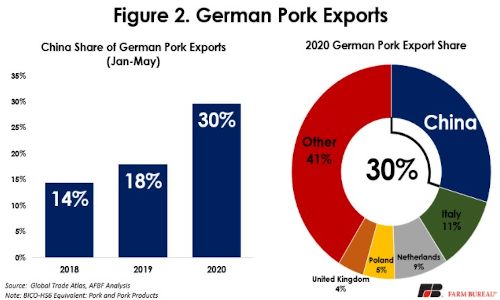

Last year, Germany exported nearly 40% of its pork production (excluding variety meat), a hefty amount, with the majority going to other EU countries. China, in particular, has developed into a crucial market for German pork, accounting for roughly 30% of exports from January to May 2020. Apart from its European Union neighbors, China is Germany’s largest customer. Germany’s reliance on China as a pork customer has significantly increased in recent years, with the first five months’ volume increasing from 14% in 2018 to 18% in 2019 and ultimately 30% in the first five months of 2020. Given the closure of external markets to German pork, it appears the EU could be awash in pork, especially considering Germany had been sending nearly one-third of its pork exports to China.

Where does China get its Pork?

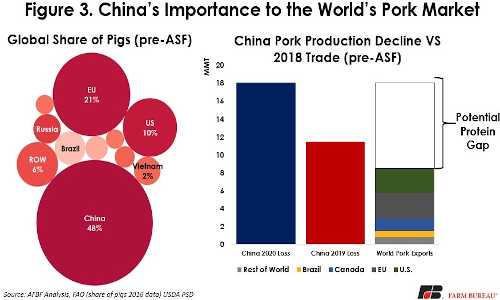

It cannot be understated exactly how important China is as a player in the global pork market. Before ASF decimated the country’s herds, China both produced and consumed nearly half of the world’s pork, making the country by far the world’s largest producer and consumer of pork. Another way of putting this in perspective is the estimated losses of China’s pork production dwarfs the entire world’s pork trade.

As China has seen its pork production plunge due to ASF, the role that imports play for the country’s supply of animal protein as changed. As a result of the shortage of domestically produced pork, wholesale and retail pork prices skyrocketed as China turned outside its borders to secure supplies. Figure 4 shows the increase in overall imports of pork into China, as well as country-by-country changes. From 2019 to 2020, China’s pork imports more than doubled, with gains occurring across all of their importers. The U.S. has seen a significant increase in pork moving to China, with volumes for the first seven months of the year more than tripling from 2019 to 2020. At the current rate of exports in 2020, the U.S. is now the highest supplier of pork and variety meats to China, at nearly 630 TMT from January-July, accounting for 19% of China’s imports so far this year. The U.S. is ahead of Spain, which had been the top supplier in 2019, followed by Germany and then the U.S. In 2018, Germany was the top supplier of pork and variety meat to China, followed by Spain, and then Canada before the U.S. If 2020 trends hold, the changes China has made in its top suppliers will be considerable, with the U.S. jumping from the fourth-largest supplier to the top.

As a side note, one might wonder why, as shown in Figure 4, Chinese imports didn’t jump in 2019, as they did in the first seven months of 2020, even though ASF was discovered in August of 2018. One driver of increased imports is the higher domestic prices that came with the declining domestic supply. China did not see increasing domestic pork and hog prices until later in the summer of 2019, after the cutoff in the dates included in Figure 4. This was due to a variety of factors, including an increase in Chinese pork production in the first half of 2019 as producers rushed animals to market to avoid having to cull herds if an outbreak popped up in their area.

Click here to see more...