By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

By Joana Colussi and Joe Janzen

Brazil is harvesting record corn and soybean crops (see farmdoc daily, June 7, 2023), but a broader view reveals no major increase in South American production of corn and soybeans in the 2022/23 crop year. In fact, South American soybean production is notably below trend, partly because Argentina is having its worst harvest in more than two decades due to La Niña influence (see farmdoc daily, March 31, 2023). Moreover, US domestic use and exports are struggling not just for corn and soybeans but for all large acreage US field crops. Lack of a large South American corn and soybean crop amid US crop sector demand struggles, suggests caution, maybe concern, is in order. Weather however has the final say, especially for an individual year.

Data and Methods

The data in this article are from the US Department of Agriculture, Foreign Agriculture Service (USDA, FAS) Production, Supply, and Distribution Online database for 1977/78 through 2022/23 crop years. The beginning year reflects the initial year of data for soybean production in Argentina and Brazil. Data for the 2022 crop year are projections as of mid-June 2023. South America has accounted for roughly 54% of global soybean production and 15% of global corn production over the last 5 years. Brazil is not the only corn and soybean producer in South America but it is the largest by far (see farmdoc daily, November 7, 2022). Over the last 5 years, shares of world soybean production are roughly 37% for Brazil, 13% for Argentina, and 4% for the rest of the region (Paraguay, Bolivia, Uruguay, etc.). Shares of world corn production are roughly 9% for Brazil, 5% for Argentina, and 1% for others.

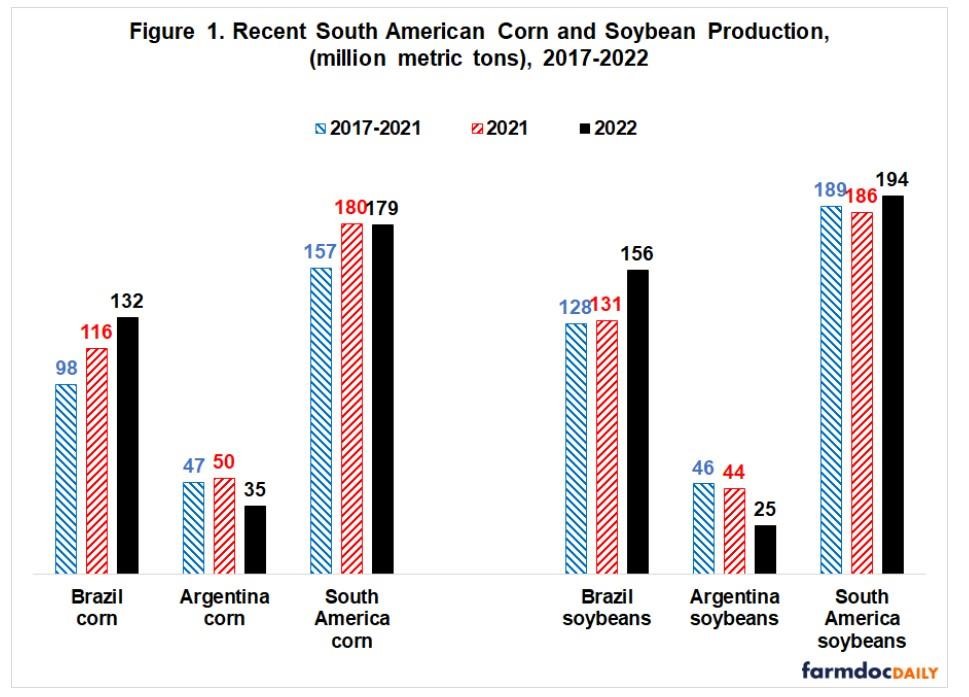

2022 South American Production

Brazilian 2022 corn production is up 13% vs. 2021 and 35% vs. 2017-2021 average production (see Figure 1). Brazilian 2022 soybean production is up 19% vs. 2021 and 22% vs. 2017-2021 production. Due to an intense, long-lasting drought caused by the La Niña presence, Argentine corn production is down – 30% vs. 2021 and -26% vs. 2017-2021. Argentine soybean production is down even more: -43% vs. 2021 and -46% vs. 2017-2021. In total, South American output vs. 2021 is little changed: down -0.5% for corn; up 4% for soybeans. Compared to 2017-2021, corn and soybean production is up 14% and 3%, respectively. Taken collectively, these comparisons do not imply a major increase in South American corn and soybean production in the 2022/23 crop year.

ime Trend Perspective on 2022 Production

Another important perspective on crop production is deviation from time trend. Deviation from trend is important because it is deviations from expectation, not just changes over time, that cause prices to change.

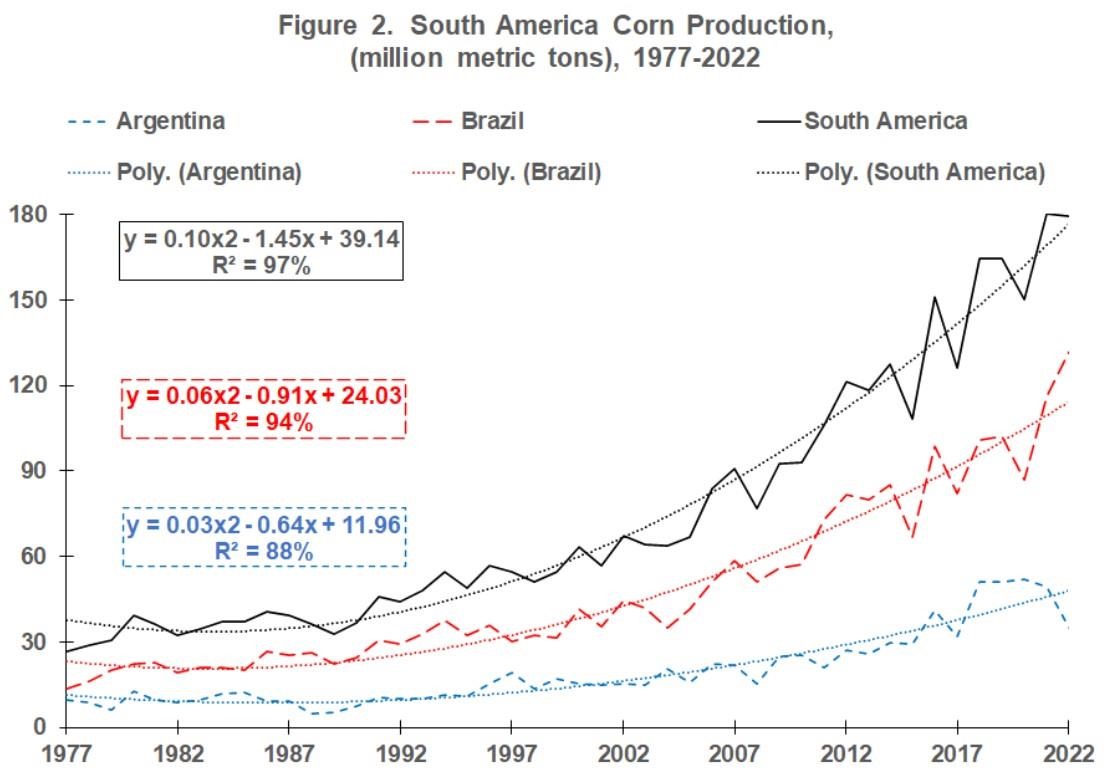

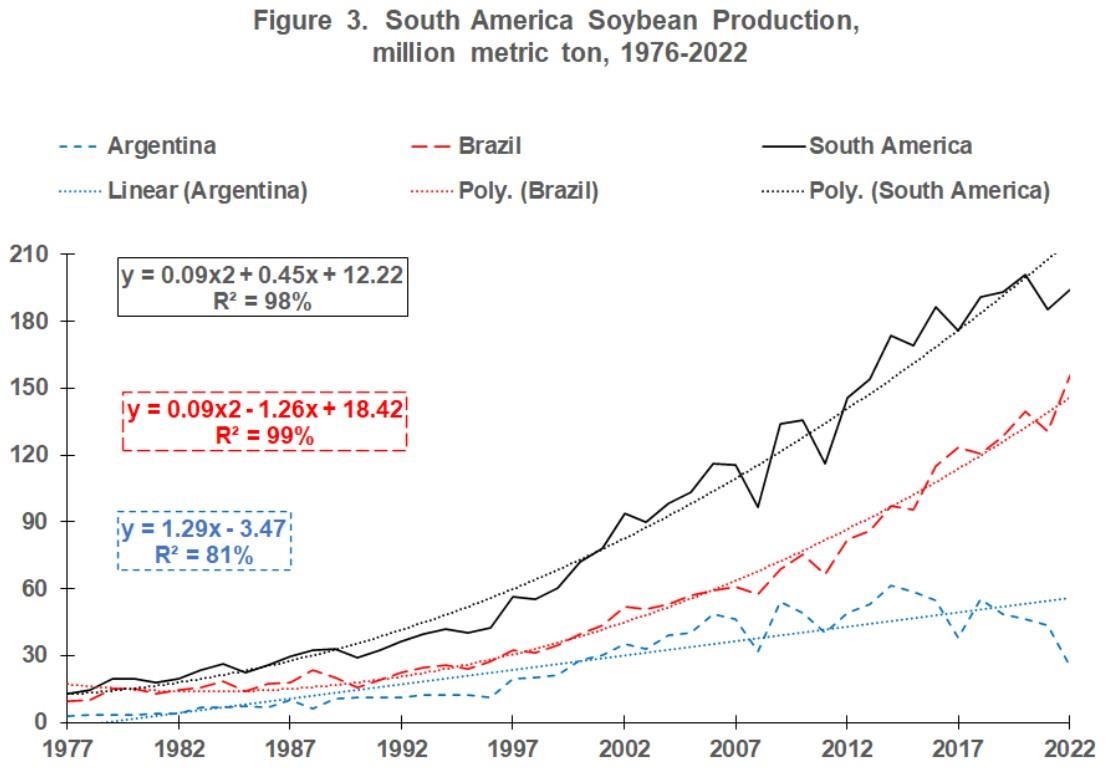

Figures 2 and 3 contain the post-1976 time trends for corn and soybeans, respectively. They are positive for South America, especially Brazil. Both South American acreage and yields of corn and soybeans are increasing. For corn, a key factor over the last 10 years is the substantial growth in Brazil’s 2nd (in some areas even 3rd) crop, known as “safrinha”. Safrinha corn accounts for over three-quarters of Brazil’s corn production in the 2022/23 crop season. Besides the potential to continue expanding safrinha corn area, Brazil also has a large potential to convert degraded pasture into cropland, further increasing grain production in the future.

022 production is above trend for Brazilian corn (+15%) and soybeans (+7%) but below trend for Argentine corn (-27%) and soybeans (-55%). South American 2022 production is slightly above trend for corn (+2%) but notably below trend for soybeans (-10%). These comparisons again imply no major increase in South American corn and soybean production in the 2022/23 crop year.

Argentine, Brazilian, and South American corn production has exceeded trend 4 of the last 5 years. Brazilian soybean production has been at or above trend 4 of the last 5 years. In contrast, Argentine soybean production has been below trend the last 4 years. These recent, multi-year trend deviations suggest (1) the increase in South American corn is due to more than Brazil’s safrinha corn crop, and (2) more than weather is likely impacting Argentine soybean production, with policy a potential factor. Compared to 2005-2009, Argentina has doubled corn acres while soybean acres are little changed.

Use of 2022 Crops

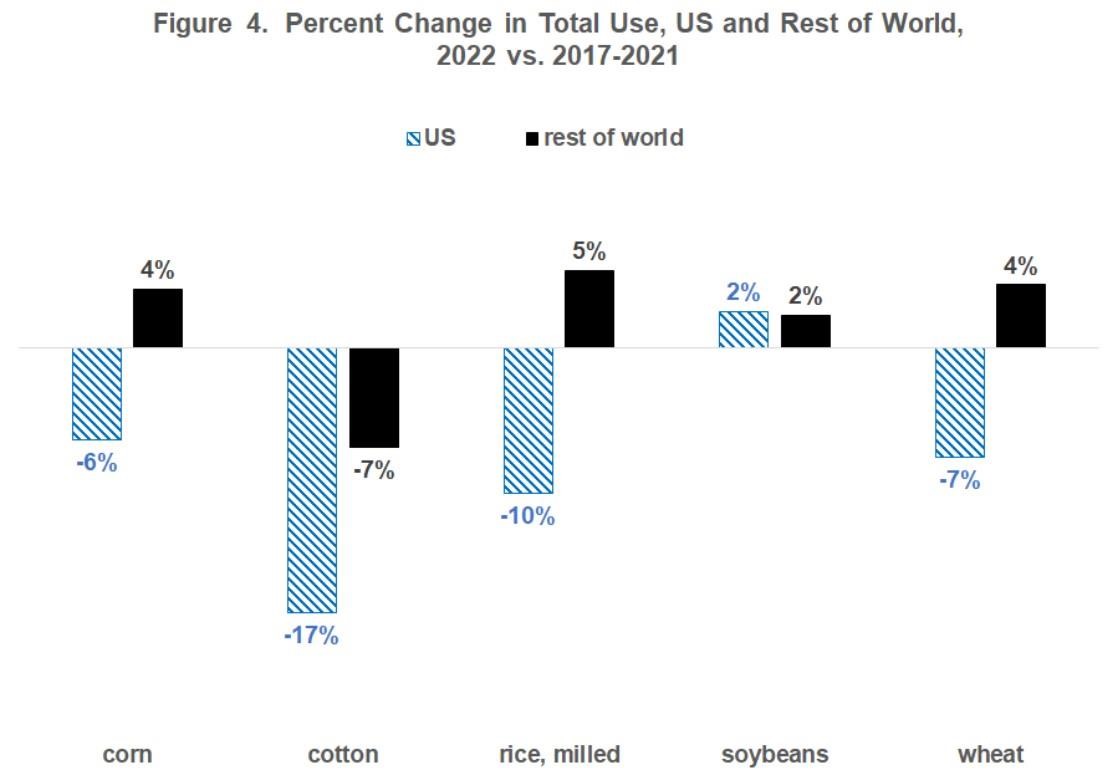

Figure 4 compares the change in total US use (domestic consumption plus exports) and rest of the world (ROW) use (world domestic consumption minus US domestic consumption) for the 4 largest acreage US field crops (corn, soybeans, wheat, and cotton) plus rice, a large acreage staple crop in the world. The specific comparison is percent change in 2022 use vs. 2017-2021 average use. Only for soybeans is 2022 US use higher than average 2017-2021 use. Moreover, except for soybeans, US use has either declined while ROW use has increased (corn, rice, and wheat) or US use has declined notably more than ROW use (cotton). Interestingly, ROW use has increased more for corn, rice, and wheat than for soybeans.

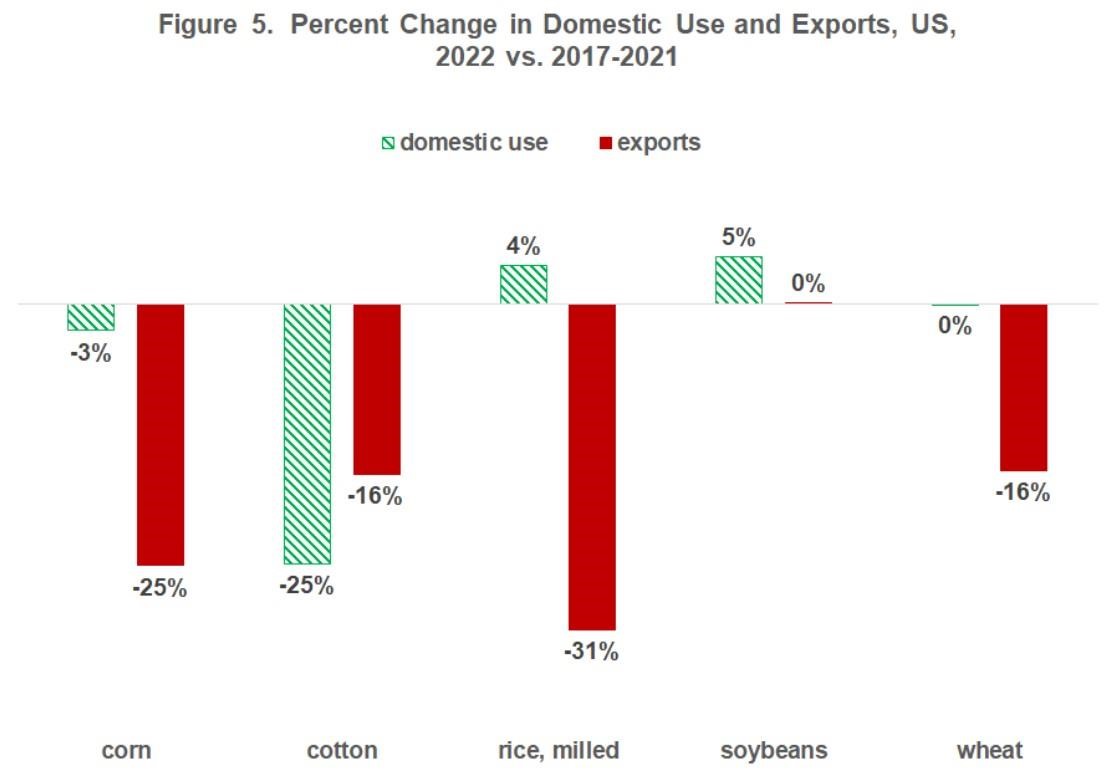

Changes in US 2022 Domestic Use and Exports

Further exploring the change in US use, exports are a clear issue. 2022 exports are lower than 2017-2021 average exports for every crop except soybeans, for which exports are the same (see Figure 5). For the other 4 crops, the decline in US exports ranges from -16% (cotton and wheat) to -31% (rice). Domestic use has declined notably for cotton over this period. For the other crops, domestic use has not increased robustly, especially given that the comparison is essentially over 3 years: 2022 vs. 2019 (average of 2017 and 2021).

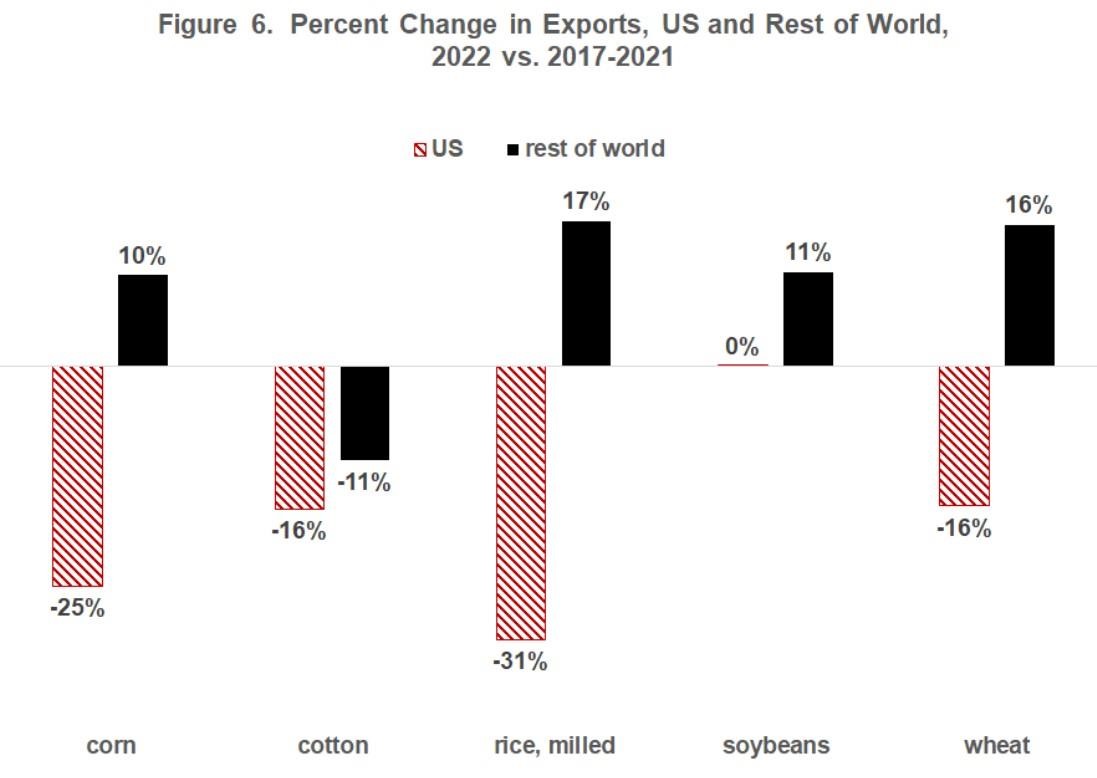

omparing US and ROW Exports

US exports of the 5 crops are also performing poorly relative to ROW exports. ROW 2022 exports are up double digits for rice, wheat, soybeans, and wheat vs. 2017-2021 exports (see Figure 6). US exports are down double digits except for soybean exports which are flat (see Figure 6). ROW 2022 cotton exports are down -11%, better than the -16% for US cotton exports but indicating demand for cotton has contracted worldwide.

Discussion

It is easy to understand US agriculture’s fascination with Brazil. It is in the process of dislodging the US as the world’s largest producer and exporter of numerous crops. However, fascination should not displace perspective.

For markets and US producers, it is South American, not Brazilian production that matters. The 2022/23 crop year clearly underscores this point.

Despite record Brazilian corn and soybean crops, South American corn and soybean crops are not large. In fact, South American soybean production is notably below trend.

South American countries experienced varying harvests in the 2022/23 crop season. While Brazil broke a record in soybean and corn production, Argentina had its worst harvest in over two decades. The contrasts resulted in part from the effects of La Niña on yields in the two countries.

Use of 2022 US field crops is struggling. This conclusion holds whether the comparison is with recent US use or rest of the world use. US exports are sobering and especially if compared with the rest of the world. Strength of the US dollar is a factor (see USDA, Economic Research Service), but the use of trade by the US as a foreign policy instrument is also a likely factor. No country likes to be dependent on a supplier that will use trade as a foreign policy instrument. This is a non-partisan observation: both recent Republican and Democratic Administrations have used trade as a foreign policy instrument. Regarding food, countries are more likely to understand restrictions on exports due to weather-reduced production than as a foreign policy instrument.

Hopefully, US exports will not repeat their performance after the 1980 Soviet Union embargo. Corn exports did not exceed 1979 crop year exports until the 2020 crop year. Wheat exports have never approached their 1981 peak. Soybeans did not consistently exceed late 1970/early 1980 levels until the late 1990s. For more discussion of the Soviet Union embargo and its impact on US exports, see farmdoc daily, July 13, 2018.

Lack of large South American corn and soybean crops amid struggling US demand, especially for exports, suggests caution, likely concern, is in order for the US field crop sector. Weather however always plays the final card when it comes to crop prices and returns, especially for an individual year. But, if US use continues to struggle, normal weather could bring economic stress, maybe quicker than expected. Contingency planning earlier than later seems in order.

Source : illinois.edu