By Gary Schnitkey

Agricultural Risk Coverage at the Individual Level (ARC-IC) should be considered as a commodity title alternative for 2019 and 2020 in two special cases: 1) if a Farm Service Agency (FSA) farm has all its acres as prevent plant or 2) the FSA farm has low yields. Other cases may exist as well (see farmdoc daily, October 29, 2019 for more information). A newly released tool — the ARC-IC Payment Calculator — will calculate ARC-IC payments for one FSA farm enrolled in ARC-IC. It will not handle the case of multiple FSA farms enrolled in ARC-IC. This tool is part of the 2018 Farm Bill What-If Tool, a Microsoft Excel spreadsheet that can be downloaded from the farmdoc website (

https://farmdoc.illinois.edu/2018-farm-bill). We suggest farmers estimate 2019 ARC-IC payments by FSA farm, thereby allowing more informed decisions to be made between commodity title alternatives.

ARC-IC in Context with ARC-CO and PLC

By March 15, farmers will need to make their commodity title choices for the 2019 and 2020 program years. ARC-IC makes payments when farm revenue on all FSA farms enrolled in ARC-IC in a state is below an ARC-IC farm guarantee. ARC-IC can be selected for one or more FSA farms, with the election applying to all crops on an FSA farm. Alternatively, PLC or ARC-CO can be selected for each program crop on an FSA farm, and program choices can vary across crops and farms. Few farmers selected ARC-IC under the 2014 Farm Bill. Exceptional circumstances due to delayed and prevented planting in 2019, along with the ability to change commodity title choices in 2021, suggests that ARC-IC may be a more attractive alternative under two cases: 1) all of an FSA farm is prevent plant or 2) yields are very low on an FSA farm.

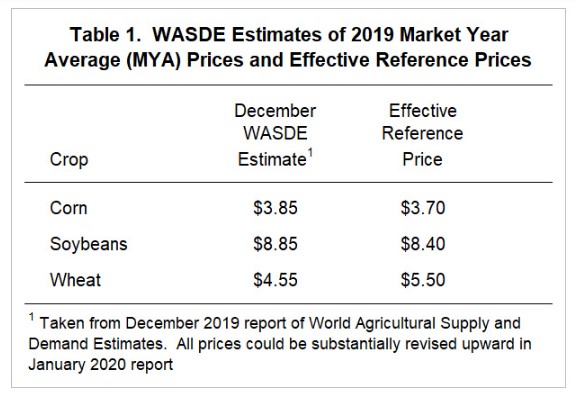

The advisability of choosing ARC-IC will be influenced by the expected payments from ARC-IC, PLC, and ARC-CO. PLC makes payments when the Market Year Average (MYA) price is below the effective reference price. Current projections of 2019 MYA prices suggest that PLC will not make payments for corn and soybeans. According to the WASDE report released in December 2019, the 2019 corn price is projected to be $3.85 per bushel, $.15 higher than the $3.70 reference price (see Table 1). The soybean price is projected at $8.85 per bushel, $.45 per bushel higher than the $8.40 reference price. These projected prices do not result in PLC payments. Given the recent announcement of a phase one agreement in the trade conflict between China and the US, there is a good possibility of higher prices than December estimates, further reducing the chance of PLC payments and lowering probabilities for ARC payments.

Current projections place the 2019 WASDE wheat price at $4.55 per bushel, $.95 per bushel lower than the $5.50 reference price. PLC has a very high chance of making payments for wheat. Note that if a farm has wheat base acres, this wheat payment will not occur for a farm enrolled in ARC-IC. Farm revenue compared to the ARC-IC guarantee determines if there is a payment.

Similar to PLC, ARC-CO likely will not make payments in many counties in 2019. ARC-CO is a county revenue program that makes payments when county revenue is below a county guarantee. Given the current outlook and known information, some counties in low yielding areas are expected to make payments. Chances for ARC-CO making payments are larger for soybeans than for corn.

- Estimates will be revised with new 2019 prices after the release of the January 2020 WASDE report, and

- Estimates will again be revised after National Agricultural Statistical Service (NASS) estimates of county yields on February 20th.

Both of these releases could significantly impact PLC and ARC-CO estimates. Those estimates can be compared to estimates of ARC-IC payments. ARC-IC payments can be estimated using the 2019 ARC-IC Payment Calculator.

2019 ARC-IC Payment Calculator

A 2019 ARC-IC Payment Calculator is part of the 2018 Farm Bill What-If Tool, a Microsoft Excel spreadsheet that can be downloaded from the farmdoc website. This spreadsheet will estimate a 2019 ARC-IC payment for a single FSA farm. Users enter:

- County where the FSA farm is located. This entry will bring in yields that may enter into benchmark revenue calculations.

- Yields for each program crop on the FSA farm for the years from 2013 to 2017. These are the same yields that will be used to determine if PLC yields will be updated (see farmdoc daily, December 3, 2019, for more information on yield updating).

- MYA prices and actual farm yields for 2019. Assuming harvest on the farm is complete, 2019 farm yields likely are known. MYA prices are not known, but reasonable estimates can be made.

Figure 1 shows an example of the benchmark revenue calculation for corn grown on an FSA farm in LaSalle County, Illinois. Farm yields are 215 bushels per acre in 2013, 225 in 2014, 204 in 2015, 265 in 2016, and 235 in 2017 (yellow boxes in Figure 1). These yields are combined with historic MYA prices to arrive at benchmark revenue. The benchmark revenue for corn in Figure 1 is $886.97 per acre. A similar screen to that shown in Figure 1 needs to be completed for each program crop grown on the FSA farm in 2019.

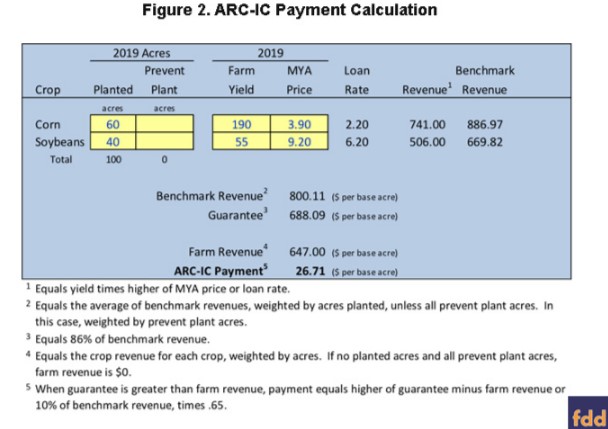

Users will have to enter farm yields and MYA prices for 2019. Figure 2 shows an example of an estimated ARC-IC payment. Corn yield is 190 bushels per acre of corn on 60 planted acres. Soybean yield is 55 bushels per acre on 40 planted acres. MYA prices are estimated at $3.90 per bushel for corn and $9.20 per bushel for soybeans. These yields and prices result in a $26.71 per base acre payment. Lower yields and lower prices will result in higher payments, and vice versa.

The special case in which it might make sense to consider ARC-IC is when all acres on an FSA farm are prevent plant (Note that FSA defines prevent plant differently than for crop insurance in certain cases). When all acres are prevent plant, the maximum ARC-IC payment would be received. For example, 60 acres of corn prevent plant and 40 acres of soybean prevent plant result in an ARC-IC payment of $52.01 per base acre. This maximum payment will only occur if planting of program crops does not occur on a FSA farm. If plantings occur, revenue from planted acres will determine payments.

Suggestions and Caveats

We suggest that farmers calculate ARC-IC payments using the 2019 ARC-IC Payment Calculator. Farmers likely have all of the yield information necessary to calculate 2019 payments, with the same historical information needed for updating 2019 PLC yields.

The calculator currently in the 2018 Farm Bill What-If Tool will only calculate payments for a single FSA farm at a time. If a farmer has an interest in more than one FSA farm enrolled in ARC-IC, resulting payments will not equal the sum of estimated ARC-IC payments for each FSA farm. All farms in a state enrolled in ARC-IC will be aggregated to arrive at the ARC-IC payment. The 2019 ARC-IC Payment Calculator within the 2018 Farm Bill What-If Tool is not designed to calculate payments in this situation.

The ARC-IC tool will only calculate payments for 2019. A farm enrolled in ARC-IC in 2019 also will be enrolled in ARC-IC for the 2020 program year. ARC-IC only will receive payments on 65% of base acres as compared to 85% for PLC and ARC-CO. This lower percentage suggests that ARC-IC may not pay as much as PLC or ARC-CO over time. On some farms, however, ARC-IC could make much larger payments than PLC and ARC-CO in 2019. Those large payments could warrant taking ARC-IC. Producers are reminded that the program decision covers both the 2019 and 2020 crop years, so ARC-IC payments would need to be the better option across both years.

ARC-IC may be the preferred alternative when all acres are prevent plant or yields are low. Other situations where ARC-IC should be considered are: 1) production is highly variable from year-to-year, ARC-IC’s benchmark is higher that the ARC-CO benchmark yields and the PLC farm payment yield, 3) fruits, vegetables, or wild rice is planted on the FSA farm (see farmdoc daily,

October 29, 2019).

Source : farmdocdaily