By Ryan Hanrahan

The Associated Press’ Josh Boak, Paul Wiseman and Rob Gillies reported that “President Donald Trump’s long-threatened tariffs against Canada and Mexico went into effect Tuesday, putting global markets on edge and setting up costly retaliations by the United States’ North American allies.”

“Starting just past midnight, imports from Canada and Mexico are now to be taxed at 25%, with Canadian energy products subject to 10% import duties,” Boak, Wiseman and Gillies reported. “The 10% tariff that Trump placed on Chinese imports in February was doubled to 20%, and Beijing retaliated Tuesday with tariffs of up to 15% on a wide array of U.S. farm exports. It also expanded the number of U.S. companies subject to export controls and other restrictions by about two dozen.”

“Canadian Prime Minister Justin Trudeau said his country would slap tariffs on more than $100 billion of American goods over the course of 21 days. Mexico didn’t immediately detail any retaliatory measures,” Boak, Wiseman and Gillies reported. “The U.S. president’s moves raised fears of higher inflation and the prospect of a devastating trade war even as he promised the American public that taxes on imports are the easiest path to national prosperity. He has shown a willingness to buck the warnings of mainstream economists and put his own public approval on the line, believing that tariffs can fix what ails the country.”

China Announces Retaliatory Tariffs on US Ag Products

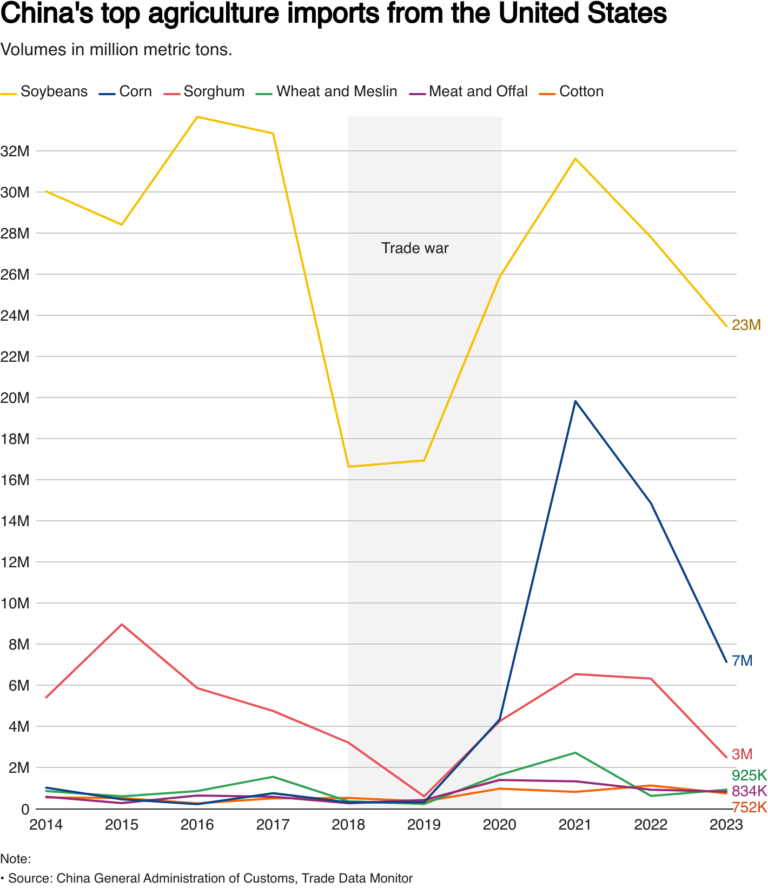

Reuters’ Joe Cash, Mei Mei Chu and Nicoco Chan reported that “China retaliated swiftly on Tuesday against fresh U.S. tariffs with hikes to import levies covering $21 billion worth of American agricultural and food products, moving the world’s top two economies a step closer towards an all-out trade war. China responded immediately after the deadline, with an additional tariff of 15% on U.S. chicken, wheat, corn and cotton and an extra levy of 10% on U.S. soybeans, sorghum, pork, beef, aquatic products, fruits and vegetables and dairy imports from March 10.”

In addition, Reuters reported that “China on Tuesday suspended the soybean import qualifications from three U.S exporters and halted the imports of U.S. lumber, increasing its retaliatory pressure against U.S. tariffs in the start of an all-out trade war. The three U.S. companies affected are CHS Inc, Louis Dreyfus Company Grains Merchandising LLC and EGT, the customs department said in a statement.”

The biggest concern for U.S. agricultural imports affected by these retaliatory measures may be soybeans, as Chu reported in a different article that “about half of U.S. soybeans, the country’s largest agricultural export to China, were shipped to the Asian nation in 2024, totalling $12.8 billion in trade, according to U.S. data. However, China has increasingly relied on cheaper and abundant Brazilian soybeans to reduce its dependence on U.S. supplies. This has resulted in the U.S. market share in China dropping to 21% in 2024 from 40% in 2016, according to Chinese customs data.”

Overall, Chu reported, “China imported $29.25 billion worth of U.S. agricultural products in 2024, a 14% decline from the previous year, extending a 20% drop in 2023. U.S. agricultural exports to China have declined since 2018 after Beijing slapped tariffs of up to 25% on soybeans, beef, pork, wheat, corn and sorghum in retaliation for duties on Chinese goods imposed by Trump.”

Canada Responds With Retaliatory Tariffs, Too

Reuters’ Promit Mukherjee reported that “Canada will impose 25% tariffs on C$30 billion in goods imported from the U.S. effective immediately. The duties will remain in place until the U.S. eliminates its tariffs against Canada. The counter measures do not apply to goods already in transit.”

“The C$30 billion is a part of an overall retaliatory measure targeting C$155 billion worth of goods imports from the U.S., with the remaining C$125 billion coming into force after a 21-day consultation period,” Mukherjee reported. “The first tranche of retaliation includes a list of 1,256 products such as orange juice, peanut butter, wine, spirits, beer, coffee, appliances, apparel, footwear, motorcycles, cosmetics, and pulp and paper. The cost of imports associated with some of the major products are cosmetics and body care worth C$3.5 billion, appliances and other household items worth C$3.4 billion, pulp and paper products of C$3 billion, plastic products worth C$1.8, billion among others.”

“Trudeau has also said Canada is considering non-tariff retaliatory measures potentially relating to critical minerals, energy procurement and other partnerships,” Mukherjee reported. “His energy minister has said an export tariff on critical minerals is one option.”

Source : illinois.edu