By Ryan Hanrahan

Bloomberg’s Clarice Couto and Gerson Freitas Jr. reported earlier this week that “China’s beef imports are dwindling amid slowing consumption and ample domestic supply, dealing a blow to its biggest supplier Brazil.”

“Official data show the value of China beef imports fell last year for the first time since at least 2016, with prices plunging to the lowest level in almost three years,” Couto and Freitas Jr. reported. “Import volumes are seen dropping 4% this year, ending 12 straight years of meteoric rise, according to the US Department of Agriculture.”

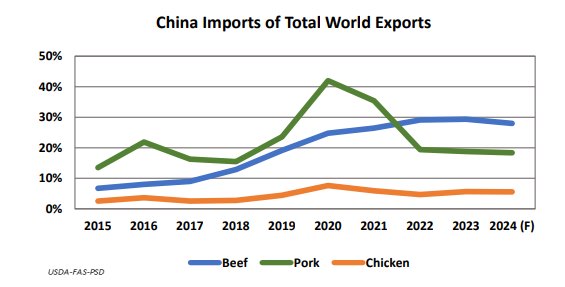

The USDA’s Foreign Agricultural Service wrote in its April “Livestock and Poultry: World Markets and Trade” report that in addition to lower imports, “China domestic beef supplies remain high following a buildup in stocks during 2023 following weaker than expected post-COVID recovery. Although China’s share of world beef exports increased rapidly from 2017 to 2022, China’s share in 2024 is forecast 5 percent below 2023.”

China Imports of Total World Exports. Courtesy of the USDA FAS.

“As China beef imports decline, U.S. imports will rise as domestic beef production is expected to be the lowest since 2018, given continued contraction in the U.S. cattle herd, and steady domestic demand,” the report said. “U.S. beef imports are expected to account for 15 percent of global beef trade, up from 14 percent in 2023 and more than offsetting reduced China beef imports.”

Couto and Freitas Jr. reported that China “is seen producing 7.7 million metric tons this year, up 1 million tons from 2020, according to the USDA. What’s more, an economic slowdown has prompted consumers to seek cheaper proteins.”

“Yet most analysts predict China’s pullback will be temporary, and that the Asian nation will continue to be a big growth engine for Brazil’s beef exporters as per capital consumption levels still trail the global average,” they wrote.

Pork Output Falls

In addition to beef imports dwindling, Reuters’ Mei Mei Chu reported Tuesday that “China’s pork output eased in January-March from a year earlier, the first quarterly decline in nearly four years, as farmers slaughtered fewer pigs to support a recovery in hog prices.”

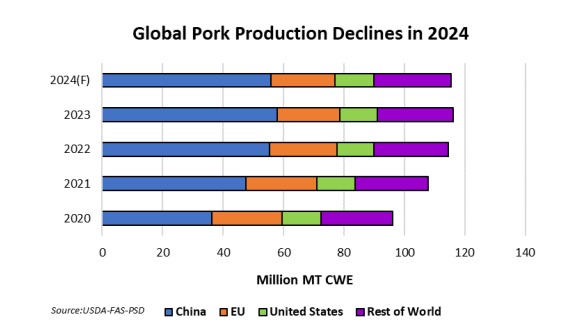

Global Pork Production Numbers. Courtesy of the USDA FAS.

“Meat sales during the quarter – the peak season due to Lunar New Year holidays – were also sluggish as China struggles to mount a strong and sustainable post-COVID economic bounce, undermining consumer confidence,” Chu reported. “Pork output fell 0.4% from a year ago to 15.83 million tonnes, the first quarterly drop since the second quarter of 2020, data from the National Bureau of Statistics (NBS) showed on Tuesday. Some 194.6 million hogs were slaughtered, a fall of 2.2%.”

In the April “Livestock and Poultry: World Markets and Trade” report, the USDAs Foreign Agricultural Service wrote that the decreased output comes “as persistently low

prices in 2023 triggered industry consolidation.”

China “has also lowered this year’s national target for normal retention of breeding sows to 39 million from 41 million,” Chu reported. “The supply of hogs in China is, however, still expected to exceed demand due to high numbers of productive sows and a reluctance by companies to destock after making large investments.”

Source : illinois.edu