By Ben Brown

College of Agriculture, Food and Natural Resources

University of Missouri

Introduction

Spring planting continues across the Midwest United States. The U.S. Department of Agriculture (USDA) reported corn plantings as a percentage of planting expectations of 17 percent for the week of April 25, 2021. Below average late-April temperatures slowed planting progress last week, but the National Weather Service’s 6 to 10 day forecast signals favorable early May planting condition, except for the upper Midwest where an elevated probability of above average precipitation exists. Annual U.S. production estimates, a function including acreage intentions, planting progress, and summer weather forecasts, undoubtably impact cash and futures markets at an increasing significance this time of year. Yet, recent price increases in futures and local basis can be attributed to decreasing available supply and export demand experienced to date. This article updates U.S. corn 2020/2021 exports and prospects for the remainder of the marketing year ending August 31, 2021.

Corn Export Summary

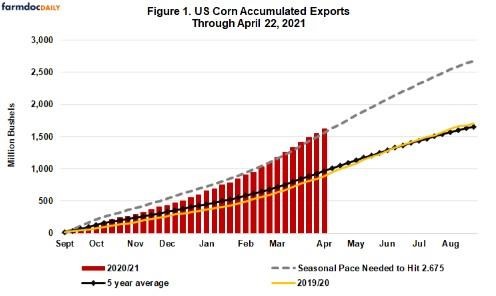

After a relatively slow start for corn exports compared with recent years, U.S. corn export inspections currently exceed the historical pace needed to hit USDA’s 2,675-million-bushel record projection in its April update by 62 million bushels. With 18 weeks left in the marketing year, inspections through the week ending April 22 total 1,623 million bushels, roughly 61% the expected annual total. Export inspections for the same week the previous three years expressed as a share of the corresponding April World Agriculture Supply and Demand Estimates (WASDE) forecast in 2018, 2019, and 2020 were 52%, 60%, and 51%, respectively. USDA increased their corn export estimate 75 million bushels in the April WASDE on strong export inspections. During the week ending April 22, 76.8 million bushels were inspected for export. Weekly export inspections in late February, March, and early April were historically very strong. Three weeks – February 25, March 11, and April 1 – had export inspections over 80 million bushels. As a result, March is expected to have set a monthly record for corn exports at roughly 361 million bushels, beating the previous record set May 2018 of 305 million bushels and the March record of 262 million bushels set in 2017. Weekly export inspections averaged 72 million bushels the previous five weeks with a high and low of 85.1 and 61.4 million bushels, respectively. To hit USDA’s export target, inspections need to average 58.4 million bushels over the remaining 18 weeks.

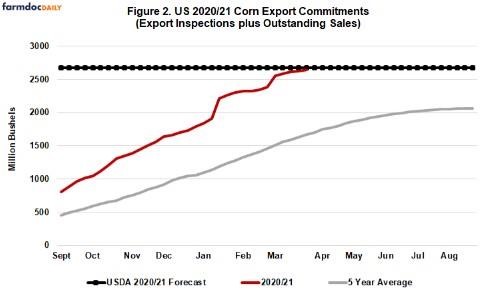

Total corn export commitments from the US are 2,645 million bushels (figure 2.) Unshipped corn sales to all destinations for the current marketing year total approximately 1,022 million bushels. The Peoples Republic of China represents roughly 55% of unshipped known sales or 487 million bushels. USDA estimates that China will import 24 million metric tons of corn in the current marketing year, up from 7.6 million metric tons in 2019/2020. In a report by the US Foreign Agricultural Service released April 16, 2021, analysts estimate Chinese corn imports for 2020/21 will reach 28 million metric tons to meet efforts to restock of reserves, continual feed demand, and attempts to bring down domestic prices. Although China’s has made record purchases of corn from the United States an increase in export inspections is needed to ship current commitments before the end of the marketing year. Twelve percent of anticipated outstanding U.S. corn sales are designated to unknown buyers. Inconsistent, weekly export sales averaged 52.7 million bushels the last 5 weeks with a high and low of 174.2 and 12.9 million bushels, respectively. Export sales exceed the historical seasonal pace needed to hit USDA’s export estimate by 485 million bushels. This is down from exceeding the seasonal pace 510 million bushels the previous week.

Corn Export Possibilities

U.S. corn exports could be aided by a smaller than expected corn production in Brazil and export controls on grains by Argentina’s government to control domestic food inflation. Weather related yield reductions of Brazil’s first crop corn and soybeans did not materialize earlier this marketing year, but the relatively late harvest of Brazilian soybeans delayed safrinha corn planting. Brazil’s safrinha crop, representing roughly three quarters of the county’s corn production, is at risk of below normal rainfall in the month of May. Planting progress suggests a quarter of the safrinha crop was planted outside the ideal window. The Mato Grosso Institute of Agricultural Economics estimates 45% of the corn in the largest Brazilian corn producing state had been planted outside the ideal window. USDA estimates Brazil’s 2020/2021 corn production at 109 million metric tons, up 7 million from the previous year. Brazil’s USDA counterpart, CONAB, increased its estimate by nearly 1 million tons to 108.97 million metric tons, largely on increased planted area. A perennial exporter of corn to the world, the Brazilian government recently lifted import duties on grain and oilseed products sourced outside the Mercosur trading until the end of the calendar year. The move, an effort to control domestic price increases and assist the domestic livestock market, opens the possibility of imports from partners like the United States. Brazilian imports of U.S. corn are not guaranteed as Brazilian ports are designed to export not import large quantities, several genetically modified corn varieties are not approved in Brazil, and freight costs to ship grain from the United States remain elevated. Regardless, Brazil’s government lowered a barrier for imports of grain outside South America.

Argentina’s government is also looking to shield domestic consumers of high grain prices and generate revenue by increasing the 12% export tax on corn and wheat. As the world’s third largest exporter of corn, increases in the export tax would lower available corn to the world. A similar proposal to increase export taxes was considered by the Argentine government in February, but then abandoned after strong opposition from producers and export companies. Push back is expected this time as well and follow through is uncertain, but the corn futures market rallied on the news.

Conclusion

USDA increased U.S. corn exports 75 million bushels in the April WASDE report after a record setting month of export inspections in March. Export inspections in April support the increase but future revisions will be needed if shipping pace continues. Export commitments exceed the season average pace by 485 million bushels, but the gap is decreasing. China is responsible for roughly half of remaining U.S. commitments. Recent sales to Mexico, South Korea, and Japan have also been supportive to corn demand amidst increasing prices. Available corn supply globally is also supportive to U.S. corn demand as concern grows for Brazil’s safrinha crop and a potential reduction in Argentina’s export volume. USDA may revise corn exports again in the May WASDE as market fundamentals continue to favor a higher value. Corn demand has picked up in 2020/21 from the previous marketing year with exports playing a leading role.

Source : illinois.edu