By VIRGINIA A. ISHLER

Production perspective:

The spring and summer months are challenging to dairy cows, especially to maintain strong milk fat and protein pounds. Components usually start going south when pasture enters the ration and then as heat and humidity take their toll. This can have significant ramifications to the milk check and the goal should be to maximize the milk price as much as possible. Many producers are playing catch-up on payables and paying down debt. What happens during the summer impacts the total year’s milk pounds and components, which ultimately impacts milk income. In today’s economy, milk volume and pounds of components along with feed costs are the key production metrics to a positive cash flow.

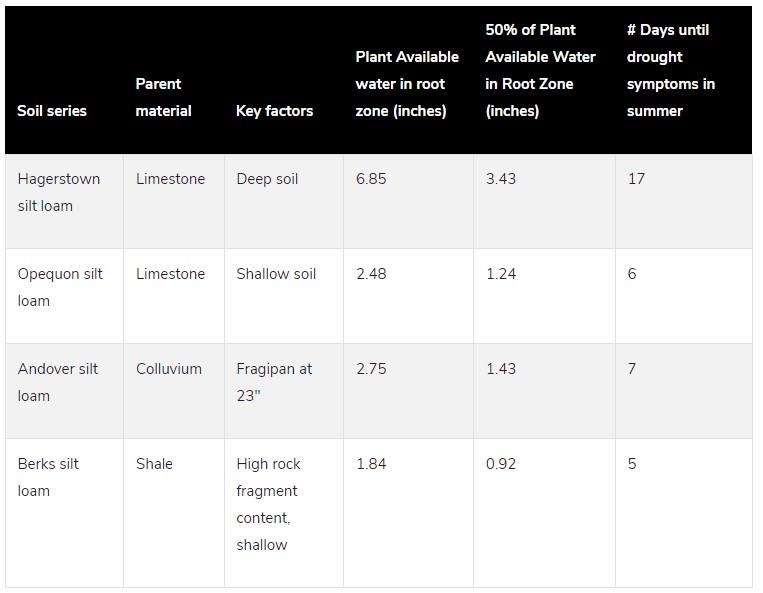

When examining an operation’s performance, the annual average milk production should be greater than 75 pounds on twice a day milking and greater than 85 pounds on three times a day milking. Based on hundreds of cash flow plans examined by the Extension Dairy Business Management Team, this metric typically reflects sustainable costs of production. The metric that is challenging for Pennsylvania producers is maintaining pounds of components greater than 5.50. Ideally, this should be greater than six pounds. Pasture, heat stress and even transition cow problems can negatively affect components. How much money is being lost by not focusing on pounds of components?

The federal milk marketing order 1 reports monthly the statistical uniform milk price based on 3.5% fat/2.99% protein and then based on the pooled components average. Figure 1 shows the comparison between the two milk prices for 2021 and 2022 to date. In 2021, the milk fat and protein averaged 3.99% and 3.15%, respectively. For a herd averaging 75 pounds of milk, pounds of components would be 5.36 and for a herd averaging 85 milk pounds it would be 6.07 pounds of components. The difference in milk price on average was $1.40/cwt with the higher components. Using the two production levels on a herd milking 80 cows, the added income with higher components would have ranged between $31,000 to $35,000 for the year. That is a significant amount of cash.

The pooled component average in the first four months of 2022 is very similar to the same months in 2021. Milk fat is averaging over 4.0% and milk protein at 3.2%. This year is showing a substantial benefit in milk price (pooled components) of a $2.43/cwt difference compared to the 3.5% fat price. Last year during the same time there was only a $1.51/cwt difference. If this trend continues, then this makes a stronger case to focus on improving components for 2022.

Old habits die hard, but maybe it is time to rethink certain feeding management practices. In the spring it was typical to get phone calls about milk fat depression when cows were turned out on pasture. Spring pasture is high in protein, and it is nearly impossible to match the carbohydrate needs with the excess protein. If milk fat depression is a common occurrence on pasture, then maybe limiting pasture or utilizing it for other livestock would be a better idea.

Combating heat stress is challenging depending on facilities. However, the farms that have focused on facilities and holding areas in the parlor, have made significant strides in minimizing reduced components in the summer. The biggest factor with heat abatement is to keep cows eating and maintaining the pounds of energy and fiber needed for a healthy rumen. That will have a greater impact than any nutritional adjustments.

There are many unknowns for 2022 related to inflation and higher overall costs on everything. Currently the milk price for 2022 is appearing optimistic. Improving milk components can offer a substantial addition to milk income, more so this year compared to 2021. Do not overlook the opportunity to make changes to reap that added benefit.

Figure 1. Comparing the statistical uniform milk price at 3.5% fat with the average pooled component tests.

Economic perspective:

Monitoring must include an economic component to determine if a management strategy is working or not. For the lactating cows, income over feed cost is a good way to check that feed costs are in line for the level of milk production. Starting with July 2014’s milk price, income over feed cost was calculated using average intake and production for the last six years from the Penn State dairy herd. The ration contained 63% forage consisting of corn silage, haylage and hay. The concentrate portion included corn grain, candy meal, sugar, canola meal, roasted soybeans, Optigen and a mineral vitamin mix. All market prices were used.

Also included are the feed costs for dry cows, springing heifers, pregnant heifers, and growing heifers. The rations reflect what has been fed to these animal groups at the Penn State dairy herd. All market prices were used.

Income over feed cost using standardized rations and production data from the Penn State dairy herd.

Feed cost/non-lactating animal/day.

Source : psu.edu