By Joana Colussi and Gary Schnitkey

While much of Brazil’s growing grain production has typically been destined for exports, the trajectory is shifting for corn. The country is using more of its corn for feed and fuel, pushing local prices to their highest levels since the start of the war in Ukraine and adding uncertainty to export volumes in the coming marketing years. Although corn exports have increased over the past decade, domestic consumption has also skyrocketed, driven by the growth of the animal protein and corn-based ethanol industries. As a result, processing plants in Brazil are consuming record amounts of corn, intensifying competition with exports. In this article, we look at how Brazil’s corn consumption dynamics have changed in recent years and what they could mean for the United States — the world’s top corn and ethanol producer — in the global trade market.

More Corn Going to Ethanol Production

Brazil, the world’s second-largest ethanol producer, has seen a significant expansion of corn-based ethanol processing plants across the Center-West states — a region where second-crop corn production has grown rapidly over the past decade (see farmdoc daily, June 30, 2023). As a result, the corn crush for ethanol production has grown from 16 million bushels in 2015/16 to 722 million bushels in the current crop season, accounting for 15% of the country’s total corn production. Total corn output for the 2024/25 crop season is projected at 4,833 million bushels, an increase of 6% over the previous harvest (see Figure 1).

In addition to the expansion of the corn ethanol industry, domestic corn consumption in Brazil has been driven by the animal protein sector — particularly poultry. Brazil is the second-largest poultry producer in the world, after the United States, and the largest poultry exporter globally. Over the past decade, domestic corn consumption in Brazil has increased by 53%, rising from 2,264 million bushels to 3,464 million bushels in the current marketing year. Of this total, the animal protein industry is expected to consume 2,539 million bushels, while the food, seed, and industrial sectors — which include ethanol production — are projected to use 925 million bushels (see Figure 2).

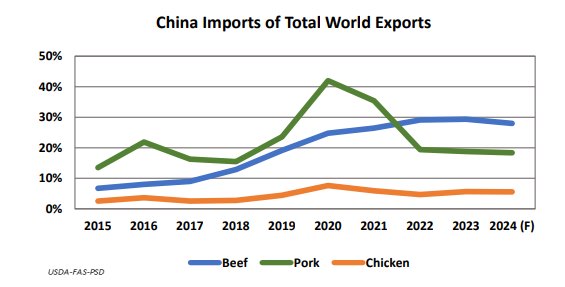

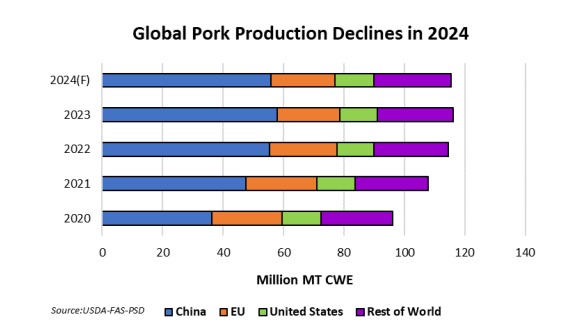

Meanwhile, exports are projected to total 1,732 million bushels, a volume nearly 20% lower than the record set two years ago (see Figure 2). The slowdown in Brazil’s corn exports is also attributed to the recovery of supply in other major producing countries and a decline in Chinese demand. Major producers such as the United States, Argentina, and Ukraine have expanded both their production and exports. After being Brazil’s top buyer in 2023, China has been reducing its imports. China has long-term goals of achieving self-sufficiency in corn production as part of its strategy to control domestic meat prices, and the country has made some progress toward this goal.

In contrast to the United States, where most ethanol is made from corn, the majority of Brazilian ethanol is produced from sugarcane. However, the number of ethanol plants using corn as a feedstock is increasing in Brazil. The country currently has 25 operational corn ethanol plants, with an additional 15 under construction, according to data from the Brazilian National Agency of Petroleum, Natural Gas and Biofuels. Most of these plants are concentrated in Brazil’s Center-West region, with Mato Grosso leading production, followed by Goiás and Mato Grosso do Sul.

Brazil has been producing corn-based ethanol since 2014, with the initial output coming from sugar mills that had been modified to process corn when sugarcane was not available during the summer wet season. Today, Brazil’s corn ethanol industry is built around three types of plants. Full plants process only corn to produce ethanol. Flex plants are traditional sugarcane ethanol mills that have been adapted to use corn during the sugarcane off-season. Flex-Full plants can process both sugarcane and corn simultaneously, allowing for year-round operations.

Since the country’s first corn ethanol plant opened in Mato Grosso in 2017 — a joint venture between Tapajós Participações S.A. and Summit Agricultural Group from Iowa, U.S. — Brazil’s corn ethanol industry has seen significant growth (see farmdoc daily, June 30, 2023). Corn ethanol production jumped from 140 million liters (37 million gallons) in the 2015/16 season to an estimated 8.2 billion liters (2.17 billion gallons) in the 2024/25 season, accounting for 22% of Brazil’s total ethanol production. Meanwhile, sugarcane ethanol has remained relatively stable at around 28 billion liters (7.4 billion gallons) annually, on average (see Figure 3).

Corn ethanol is expected to account for nearly one-third of Brazil’s total ethanol production by the 2025/26 season, reaching 10 billion liters (2.64 billion gallons), according to the National Corn Ethanol Union (UNEM), an organization created in 2017 to represent the interests of this growing industry. Much of the growth in Brazil’s corn ethanol production is being driven by the expansion of second-crop corn, known as safrinha, which is primarily grown in the Center-West region and now accounts for almost 80% of the country’s total corn output. The second crop production for the 2024-25 season is underway in Brazil, with planting being completed in March and harvesting beginning in July.

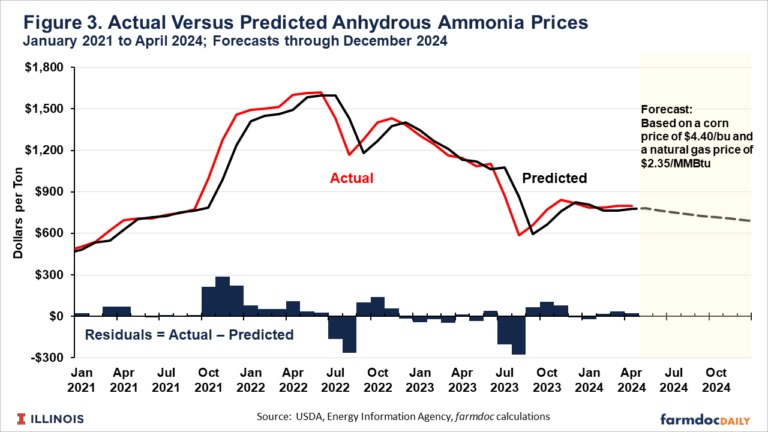

Domestic Demand Lifts Corn Prices in Brazil

As processing plants are set to process a record volume of grain this season, local corn prices have recently climbed to their highest levels since 2022, when the Russia–Ukraine conflict began. In Paranaguá, located in the state of Paraná, corn prices averaged above 37 reais ($6.57) per bushel in March — the highest nominal price in nearly three years — reflecting a month-over-month increase of more than 23%, according to data from the Center for Advanced Studies on Applied Economics (Cepea) at the University of São Paulo (see Figure 4).

Ethanol consumption in Brazil is expected to continue growing in the coming years, driven by new plants and increased demand supported by government programs. Currently, gasoline sold in Brazil contains 27% anhydrous ethanol, a policy that has encouraged the widespread adoption of flex-fuel vehicles — cars capable of running on any blend of gasoline and ethanol, from 100% gasoline to 100% ethanol. Following a recent technical review, regulators are recommending an increase in the ethanol blend to 30%, possibly as soon as this year. According to consultancy Datagro, the change could add an extra 1.3 billion liters (343 million gallons) to annual ethanol demand in Brazil.

Implications for the Global Market

Brazil’s growing corn ethanol industry is part of the country’s broader push for renewable energy and its ambition to become a global leader in sustainable biofuels with the hopes of additional growth from sustainable aviation fuel (SAF). Because corn is a second crop, the country’s corn ethanol system does not compete as directly with food production for land. This approach enables the integration of energy and food production on the same farmland (Arantes and Bachion, 2025). In addition, Brazil can further expand its currently cultivated area by intensifying land use for second-crop corn, with an additional 40 million acres (see farmdoc daily, April 9, 2024).

The growing demand for corn in Brazil is changing local market dynamics. Not long ago, corn was considered a bonus crop for Brazilian farmers, with some relying on government support to sell their harvest. Rising demand is changing the game: corn is now being sold ahead of harvest, much like soybeans, giving farmers even more incentive to increase production. A strong domestic market gives farmers confidence that both prices and demand will hold up, which can directly influence planting decisions in the coming years.

Keeping more corn in the domestic market, whether for ethanol production or to feed the animal protein industry, is shifting expectations for Brazil’s role in the international market, which has expanded over the past five years. With strong domestic demand, a natural consequence is likely to be a decline in Brazil’s corn exports in the coming years, reducing competition with U.S. corn exports in the global market and putting upward pressure on international prices.

Source : illinois.edu