By Jonathan Coppess, Krista Swanson, Gary Schnitkey, Nick Paulson

Department of Agricultural and Consumer Economics

University of Illinois

And

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

As discussed previously, the 2018 Farm Bill’s inclusion of an escalator provision for PLC alters that program and would likely have increased PLC payments if it had been in operation during the 2008 to 2017 crop years (farmdoc daily,

February 28, 2019). The forecast for corn and soybean prices in the crop years (2019 through 2023) covered by the 2018 Farm Bill, however, are unlikely to impact the escalator provision as they are expected to remain relatively low. This article provides further analysis for the farm program decision between PLC and ARC-CO by reviewing those price forecasts and a simulated high price scenario to evaluate the impact on the reference price escalator in the PLC and ARC-CO calculations.

Background

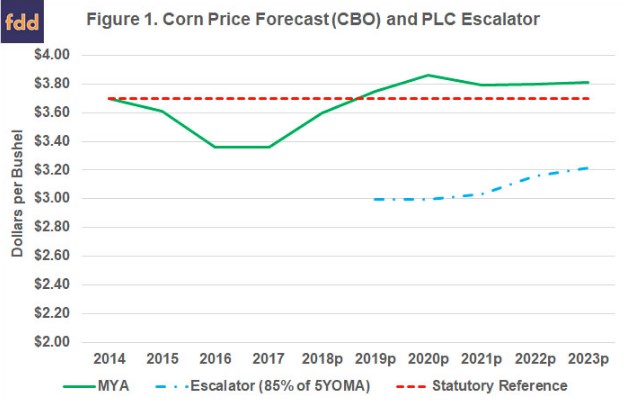

The Congressional Budget Office (CBO) published updated price forecasts for the major covered commodities in its January 2019 Baseline (CBO, January 2019). Figure 1 compares the CBO corn price forecast for the 2019 through 2023 crop years with the PLC price escalator provision, which is calculated as 85% of the 5-year Olympic moving average of prices. To provide further perspective on the escalator, actual marketing year average (MYA) prices for the 2014 through 2018 crop years are also included. The statutory reference price ($3.70 per bushel) is also illustrated. Given this price scenario, Figure 1 makes it clear that the PLC escalator provision will not impact the effective reference price under this price scenario for the 2019 to 2023 crop years, given current CBO projections. Thus, the effective reference will remain at the statutory reference price level. Moreover, prices at the forecasted level would not be expected to trigger PLC payments as the MYA would be above the effective (statutory) reference price in all years.

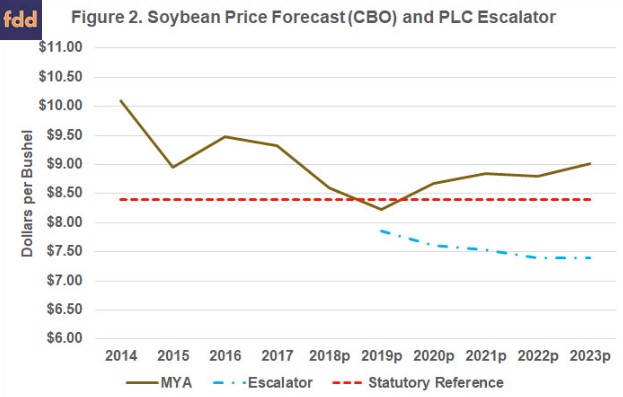

Figure 2 provides the same comparison for soybeans using the CBO January 2019 price forecasts and the 2018 Farm Bill PLC escalator provision, as well as the statutory reference price for soybeans ($8.40 per bushel). Similar to corn, under this price forecast the PLC escalator provision will not alter the effective reference price, which would remain at the statutory reference price level. The MYA forecasted for the 2019 crop year ($8.23 per bushel), however, is below the $8.40 effective (statutory) reference price and, if it proves accurate, would be expected to trigger payments under PLC based on an estimated deficiency of $0.17 per bushel. ARC-CO would not be expected to make a payment for the 2019 crop year at forecasted prices and trend yields for McLean County, Illinois soybeans (farmdoc daily,

February 26, 2019).

Given the current comfortable level of stocks, prices will most likely be driven by yield declines in the US and other major exporters. Moreover, any resulting price spike is likely to involve only one or two years. A price spike of one year will have no impact on the reference price since the price escalator is an Olympic average. The high price year will thus be removed. A two-year price spike could have some impact but it will be limited by the 85% factor in the escalator formula and because only one of the three years in the formula would be included.

As such, from a general perspective the reference price escalator in the program formulas requires a minimum of two years with MYA prices at least 15% above the reference price for the effective reference price to move above the statutory reference price. Two years are needed because of the Olympic average and a 15% higher price than the reference price is needed because of the 85% factor in the escalator. A more meaningful impact will require MYA prices higher than 15% of the reference price or for more than two years; it is most likely that it would require both.

The following discussion will review an unlikely price scenario in which prices are relatively higher than the current CBO price forecast (and more than 15% higher) for three crop years and without yield impacts. The purpose is to illustrate the price escalator mechanism and it is not intended to suggest that this is a likely scenario nor is it a forecast of prices.

Discussion

As indicated by CBO’s January price forecast and recent MYA prices, the new escalator provision is unlikely to have an impact on PLC or ARC-CO. Figure 3 illustrates a high price scenario for corn by creating a two-year, temporary price spike beginning with the 2019 crop year, followed by a partial retracement in 2021 and returning to pre-2108 prices in 2022. As discussed, this is an unlikely outcome and is simply used here as a what-if scenario; it is not in any way an attempt at making a forecast of future MYA prices for corn.

Figure 3 demonstrates key points about the reference price escalator and effective reference price provisions. The temporary price spike in the 2019 and 2020 crop years would increase the effective reference price above the statutory reference price beginning with the 2021 crop year and would be expected to trigger large deficiencies in the event of a price decline.

Figure 4 provides the same what-if, high price scenario for soybeans; a price spike in the 2019 and 2020 crop years with a decline beginning in the 2021 crop year. Similarly, this would increase the effective reference price above the statutory reference price ($8.40 per bushel) in the 2021 through 2023 crop years, triggering expected deficiencies in 2022 and 2023.

If corn and soybeans experience such an unlikely and temporary price spike it will impact both PLC and ARC-CO expected payments because the effective reference price is incorporated into both program calculations. Figure 4 illustrates a payment comparison for ARC-CO and PLC for McLean County, Illinois corn under the high price scenario in Figure 3. For PLC, a program payment yield of 174 bushels per acre was used. For ARC-CO, the RMA county yields as reported by FSA were used with a calculated trend yield as the estimated county yields.

As to be expected, if prices spike beginning in 2019, neither ARC-CO nor PLC would make payments until a subsequent price decline. The effective reference price would be above the statutory reference price, triggering large estimated PLC payments for the 2022 and 2023 crop years; payments calculated at 85% of the estimated deficiency (price or revenue) based on the factor for payment yields (85% of base acres). The higher prices and a trend yield would also increase the ARC-CO revenue guarantee (86% of the Benchmark) and the higher effective reference price would impact the prices used in the Benchmark calculation, replacing lower MYA in the five-year Olympic moving average.

A major caveat with these estimates, however, is that a trend yield was used for ARC-CO. It would be unusual for a price spike to take place under a trend yield scenario, thus the ARC-CO payments could be inflated but a lower yield in any of those years could also trigger ARC-CO payments. Figure 5 seeks to demonstrate program operation with the new reference price escalator in the unlikely event of a short-term price spike without changing yields.

Finally, Figure 6 provides the same analysis for soybeans in McLean County, Illinois. For this analysis a trend yield was used and for PLC the program yield used was 52 bushels per acre. Under the high price scenario from Figure 4, this estimate would indicate high payments under PLC for the 2022 and 2023 crop years, with a minimal estimated ARC-CO payment in the 2023 crop year.

Concluding Thoughts

Because of relatively low corn and soybean prices since the 2014 Farm Bill, the escalator provision in the 2018 Farm Bill version of PLC will not impact the effective reference price for the 2019 and 2020 crop years; the effective reference price will remain at the statutory levels for corn ($3.70 per bushel) and soybeans ($8.40 per bushel). Prices will need to spike for at least two years and probably more, as well as generate prices at least 15% above the statutory reference prices, for the escalator provision to have an impact on the ARC-CO and PLC programs. Any impact would increase the effective reference price above the statutory reference prices creating the potential for larger payments in the final years of the 2018 Farm Bill.

This article examined this unlikely scenario in order to illustrate program operation and potential impacts in order to provide further perspective on the program decision. It is intended solely for the purpose of illustrating the program mechanics and is not meant to be a forecast of prices in the future; give that trend yields were used, there is also a strong argument that such a scenario (high prices and trend yields) is highly unlikely. Future articles will examine additional scenarios for prices and yields to estimate the impacts on potential payments.