By Robert Moore

Estate taxes have been a hot topic lately, especially with the looming expiration of the Tax Cuts and Jobs Act (TCJA). The TCJA significantly increased the federal estate tax exemption, which stands at $13.99 million per person for 2025. However, if Congress does not intervene, that exemption will drop to approximately $7.2 million in 2026, reverting to pre-TCJA levels.

Estate Taxes and Farms: The Current Reality

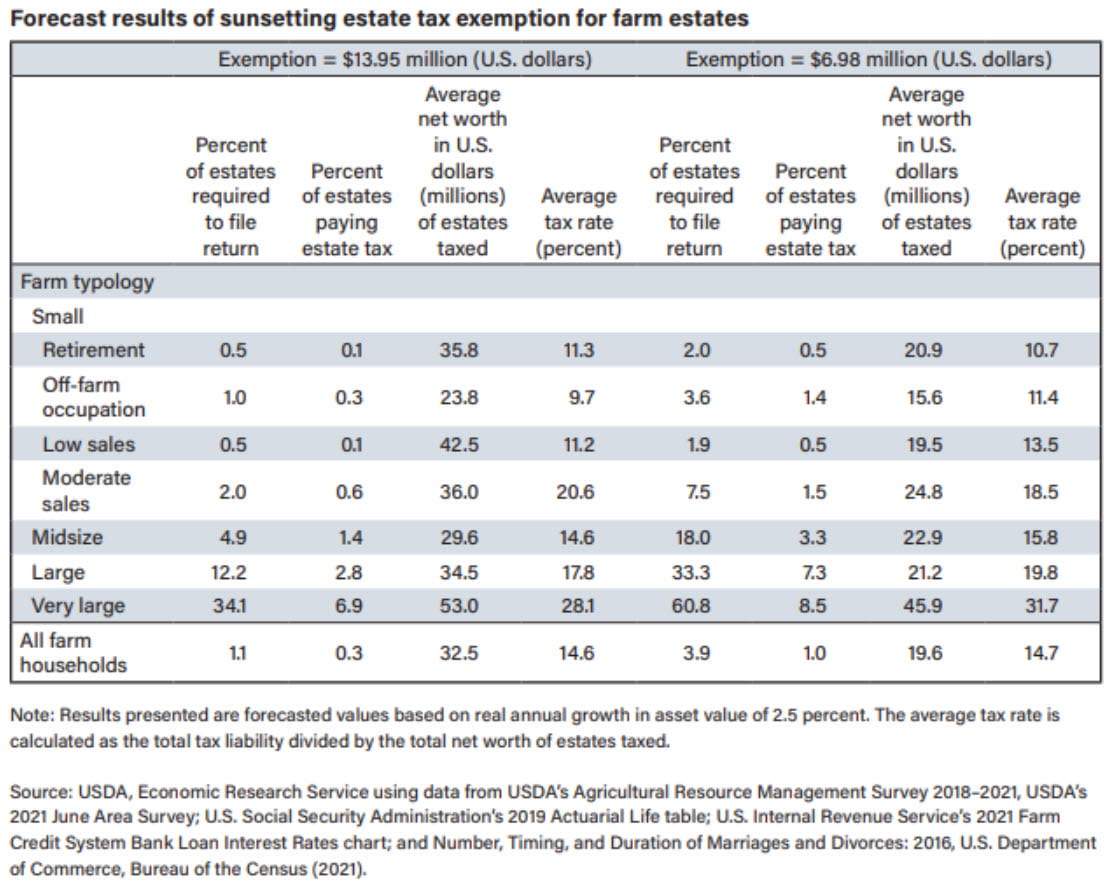

Despite the frequent debate about estate taxes, very few farm estates actually owe them. According to the USDA, only about 0.3% of farm estates are subject to federal estate tax under the current exemption. In fact, in 2022, the USDA estimates only 87 farm estates nationwide had to pay any federal estate tax at all.

If the exemption decreases in 2026, more farms will be affected, but the overall percentage will still be relatively small. Here’s what the numbers look like:

- The percentage of all farms owing estate taxes would rise from 0.3% to 1.0%.

- Large farms (those with $1 million to $5 million in gross income) would see the biggest jump, with taxable estates increasing from 2.8% to 7.3%.

See the chart below for a full breakdown.

Why Estate Taxes Matter for Farm Families

Even though only a small percentage of farms will be affected, for those that are, estate taxes can pose a significant challenge to passing the farm on to the next generation. Many farms are asset-rich but cash-poor, meaning they have substantial land and equipment value but limited liquid assets. This can create difficulties in paying estate taxes without selling off land or assets critical to farm operations.

How to Prepare for a Potentially Lower Exemption

With the possibility of a lower estate tax exemption in 2026, farm families should take proactive steps now to review and update their estate plans. Strategies to consider include:

- Gifting Strategies: Transferring assets now while the exemption is higher can help reduce the taxable value of an estate later.

- Trust Planning: Certain trusts, such as irrevocable life insurance trusts (ILITs) or grantor retained annuity trusts (GRATs), can help manage estate tax liabilities.

- Business Entity Structuring: Using a business entity, such as an LLC, can provide tax advantages and aid in succession planning.

- Appraisal and Valuation Planning: Keeping accurate and updated valuations of farmland and business assets helps clarify estate planning needs and may offer tax-efficient structuring opportunities.

The Bottom Line

Farm families need to evaluate their potential estate tax risk now both under current exemption levels and the possible lower exemption in 2026. If you have concerns, consult with your attorney and other key team members to determine whether updates to your estate plan are needed. Taking action now can help ensure that your farm remains in the family for generations to come.

Source : osu.edu