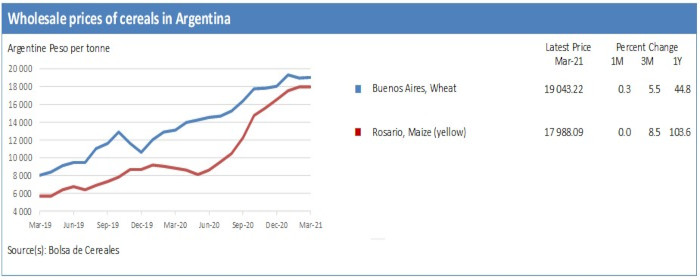

Prices of wheat followed mixed trends in March. In Argentina, the major wheat producer of the subregion, prices were stable in March reflecting adequate market supplies from the 2020 harvest, completed in January. However, prices remained nearly 45 percent higher than one year earlier due to the year-on-year reduced output estimated in 2020 because of dry weather conditions in centrenorth producing regions. Similarly, in Brazil, following increases in the last two months, prices stabilized in March as sluggish demand offset lower market supplies. However, prices remained higher year on year on account of the weaker local currency and the low level of imports between September 2020 and February 2021 compared to the same period one year earlier. In Uruguay, prices continued to increase and reached all-time highs, supported by strong export demand of the 2020 crops recently harvested. Export sales of wheat grain between October 2020 and January 2021 were nearly double the previous five-year average. In Chile and Peru, prices strengthened in March, mainly reflecting higher import costs due to the increase in international prices of the grain. In other importing countries, Colombia and Ecuador, prices held steady and were generally around their year-earlier levels.

Regarding maize, prices remained higher year on year in most countries of the subregion. In Brazil, prices continued to increase in March and were underpinned by concerns over the impact of the late sowings and the dry conditions forecast in the second quarter of 2021 on the main crop yields. Prices were well above their year‑earlier levels and are expected to remain high until the start of the main season harvest in July. Prices also strengthened in Colombia despite the ongoing 2021 first season harvest, forecast to be down from the previous year’s output due to a contraction in plantings. By contrast, in Argentina, after the sustained increases since June 2020, prices were stable in March, as downward pressure from the start of the 2021 harvest offset the strong export demand. While the 2021 production is expected at a well above-average level due to the near-record planted area, prices were nearly twice their values one year earlier in nominal terms, mainly reflecting trends in the international market and sustained demand. In Uruguay, prices weakened in March with the start of the 2021 harvest but remained about 25 percent higher than one year earlier. The high price level reflects the reduced imports in the second half of 2020 and concerns over the impact of dry weather conditions in the last quarter of 2020 on crop yields. Similarly, in Peru, prices declined for the first time in seven months, as the ongoing 2021 minor season harvest and the weak demand from the domestic feed industry exerted downward pressure. In Ecuador, prices of yellow maize kept stable in March and were on average about 15 percent above their levels one year earlier. In Chile, prices were more than 30 percent higher year on year reflecting the reduced output of the ongoing harvest as well as the high prices of imported maize.

Regarding rice, in Brazil, prices strengthened in March despite the ongoing harvest, as the downward pressure from the harvest was more than offset by the strong demand from the milling industry and the slow sales by farmers. Prices were well above their values one year earlier following sustained increases in the previous months, which resulted from the strong domestic and foreign demand. In Uruguay, prices also increased unseasonally due to the strong export demand and were about 15 percent higher year on year. Prices strengthened or were stable in Ecuador ahead of the start of the 2021 main season harvest in April. By contrast, prices continued to decrease in Colombia and were on average 20 percent below their levels in March last year reflecting ample carryover stocks from the good 2020 harvests.

Click here to see more...