By Sandro Steinbach and Yasin Yildirim et.al

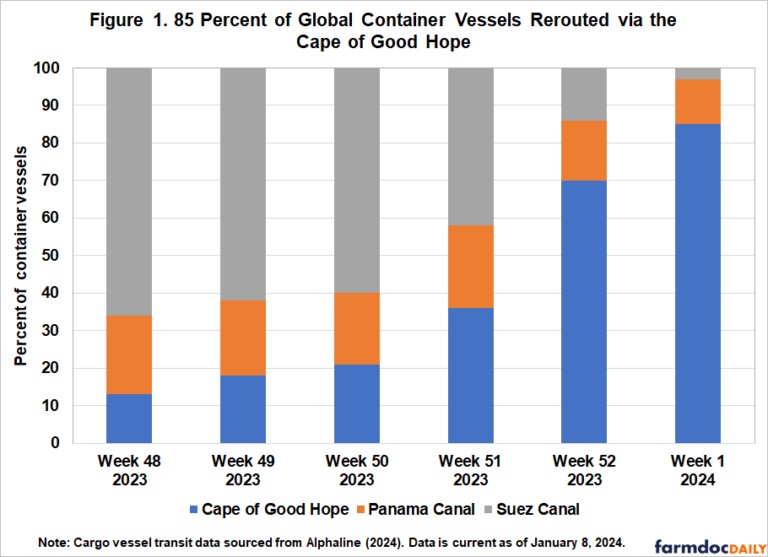

Global agricultural trade, particularly that of key commodities like corn and soybeans, depends heavily on the reliability of major shipping lanes. Recent environmental and geopolitical crises at the Panama Canal and in the Red Sea have brought to the forefront the vulnerabilities inherent to these critical trade routes. The shipping disruptions, marked by the Panama Canal’s worst drought in history and heightened military tensions in the Red Sea due to the attacks of the Houthi terrorist group on commercial shipping lanes, have caused substantial logistical challenges and economic repercussions. Figure 1 shows that since late November 2023, global trade has been rerouted to the Cape of Good Hope, via which 85 percent of global container vessels traveled in January 2024. In particular, the Panama Canal’s drought, which has led to a reduction in the number of daily transits, impacts the timely and cost-effective transportation of U.S. farm products to Asian markets.

Simultaneously, the geopolitical instability in the Red Sea has required the rerouting of shipping lanes, resulting in extended transit times and a dramatic surge in freight rates. These issues have not only underscored the fragility of key maritime routes but also have had a cascading effect on global agricultural supply chains, having the potential to disrupt 2024 U.S. agricultural exports severely. The potential implications for exporters of major crops like corn and soybeans are considerable, encompassing increased transportation costs, potential delivery delays, and a broader reassessment of trade strategies. This situation highlights a critical challenge for global trade, which is the increasing interdependence of environmental stability and geopolitical disruptions and their impact on the flow of agricultural commodities, which are pivotal for U.S. farmers and ranchers.

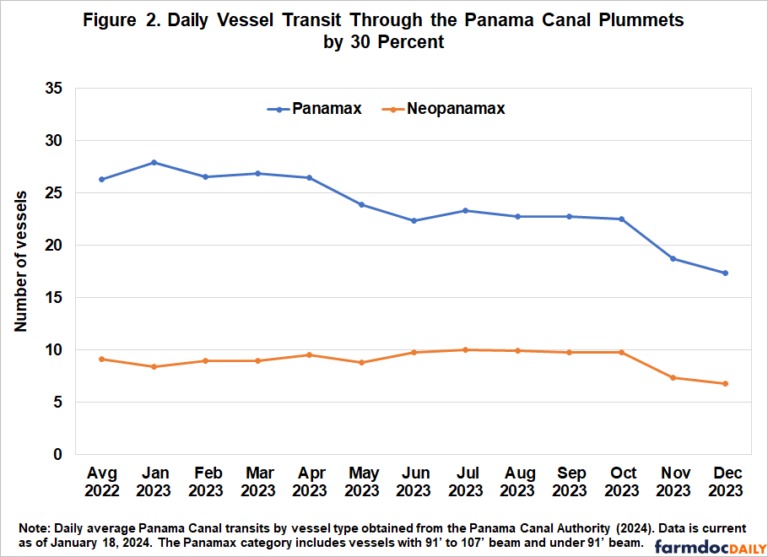

The Panama Canal, an essential trade corridor linking the Atlantic and Pacific Oceans, has been severely impacted by its most severe drought. This environmental crisis has necessitated drastic operational cutbacks, profoundly reducing the canal’s capacity. For instance, the daily transits through the Panama Canal’s Panamax and Neopanamax locks have decreased by 30 percent, marking a substantial reduction in operational throughput, as shown in Figure 2. This decrease in capacity impacts nearly three percent of global maritime trade volumes as they transit through the Panama Canal. This route is predominantly used by dry bulk carriers, container ships, chemical and crude product tankers, and liquefied petroleum gas carriers. Notably, container ships have suffered less from the increase in waiting times for transit, which averaged five days in July and escalated to more than three weeks in January 2024.

The implications of these operational changes are threefold: lower throughput, longer delays, and higher costs. The booking restrictions have reduced the number of vessels passing through, and ships are lightening loads to meet draft reductions. Vessels unable to secure a booking or those missing their bookings due to previous delays may now face waiting times of up to two to three weeks for a new slot at the canal. Moreover, the increased waiting time for transit has led to tighter vessel capacity, which is expected to raise spot rates even further, especially for the route from the U.S. East Coast to Asia. If re-routing is required, substantially higher shipping costs associated with the extra two weeks of sailing around Cape Horn will be incurred. The Panama Canal Authority and ocean carriers have also announced surcharges related to canal transit, which may continue to be implemented or increased.

This development is particularly concerning for U.S. agricultural exporters, as about 40 percent of North American container vessels and bulk carriers pass through the canal annually, carrying key agricultural products such as grains and oilseeds. The Panama Canal is integral to U.S. exports to Asia, with over 26 percent of soybeans and 17 percent of corn exported via this route in the fiscal year 2022. These exports are crucial, particularly considering China’s dependency on grain imports, which may increase due to expected smaller crops in other regions like Australia and South America. The U.S. grain export season typically begins in mid-October and lasts through May of the following year, and persistently low water levels at the Panama Canal could significantly impact these exports.

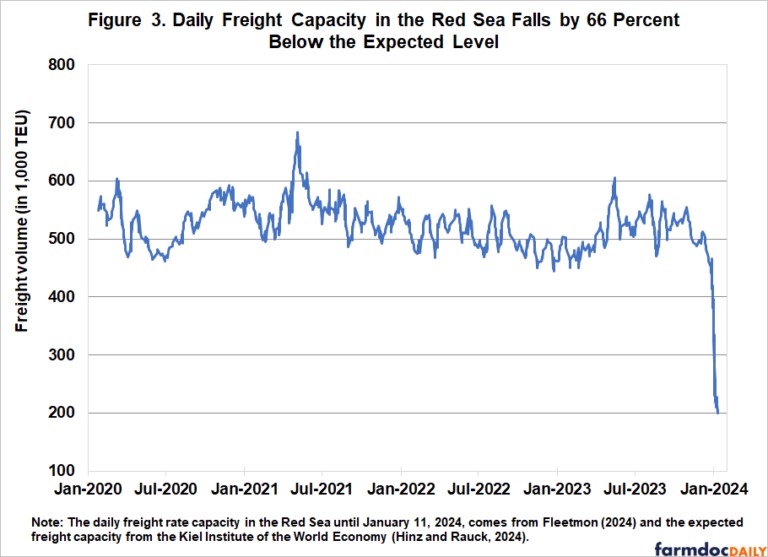

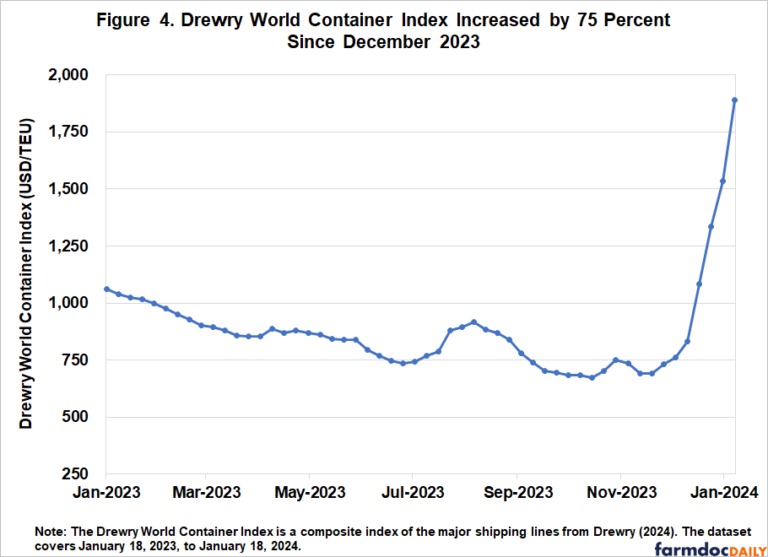

Concurrently, the Red Sea passage has been impacted severely by increased military tensions and attacks on commercial cargo vessels since December 2023, as shown in Figure 3. These geopolitical tensions have necessitated the redirecting of shipping lanes, leading to extended transit times and a dramatic escalation in freight rates. A direct consequence of the blockage has been the surge in ocean freight rates. Figure 4 shows the average cost of transporting a standard container (measured as a twenty-foot equivalent unit, TEU), which has increased from about USD 700 in November 2023 to over USD 1,900 in January 2024. The situation in the Red Sea is expected to push near-term shipping prices even higher, with projections indicating that shipping rates could surpass USD 3,000 per TEU as substantial agricultural shipping volumes shift toward the U.S. West Coast.

The substantial increase in freight rates has resulted in considerable added costs for transporting agricultural commodities, directly impacting U.S. exporters of corn and soybeans. The crisis has led to notable delays in shipping schedules. Median days for vessel schedules running late have increased threefold on some lanes, with approximately 448 vessels rerouted as of January 6, 2024. The estimated delay for impacted vessels has reached three weeks, considerably longer than usual. These shipping delays compound the challenges U.S. agricultural exporters face, as they disrupt the timely delivery of goods and add further complexity to an already strained global agricultural supply chain.

Looking at what to expect in 2024, the agricultural sector faces considerable uncertainties amid ongoing environmental and geopolitical challenges. The Panama Canal grapples with one of its most severe droughts. This has resulted in substantial operational cutbacks. The current water level at Lake Gatún, which feeds into the canal, is about 7 percent below the five-year average. While some improvement is anticipated as the rainy season progresses, water levels will remain below average due to strengthening El Niño conditions and predicted droughts in Central America for the remainder of 2024. The impact of these changes on U.S. agricultural shipments to Asia via the Panama Canal is multifold. Vessels that experience delays may need to wait up to three weeks for a new slot at the canal. This increased waiting time will likely lead to tighter vessel capacity and a consequent rise in spot rates. Some shippers may reroute via Cape Horn or the Cape of Good Hope, resulting in additional shipping costs due to the extra two to four weeks of sailing.

Given these conditions, the 2024 outlook suggests continued challenges for U.S. agricultural exports, particularly for critical commodities such as corn and soybeans. These uncertainties will require stakeholders to adapt to the increasingly uncertain global market environment. This adaptation may involve diversifying logistical plans, exploring alternative shipping routes, adjusting schedules, and possibly seeking new markets to mitigate the risks of reduced canal capacity and disruptions in key shipping lanes. The focus will be on developing more resilient and adaptable trade practices, underlining the need for flexible supply chain solutions that can withstand the pressures of environmental changes and geopolitical instabilities.

The crises in the Panama Canal and the Red Sea have highlighted the vulnerabilities of U.S. agricultural trade to environmental and geopolitical factors. These disruptions have increased transportation costs, prolonged transit times, and potential market losses. It is increasingly clear that the development of sustainable and flexible supply chain solutions is not just advantageous but essential for maintaining and enhancing the flow of U.S. agricultural trade. The U.S. agricultural sector must adopt more robust strategies. Investing in diversified trade routes, alternative markets, and innovative logistics solutions will be key. Understanding the interconnected nature of global supply chains and the external factors that influence them is vital. As the environmental and geopolitical landscapes evolve, the capacity to anticipate, adapt, and innovate is crucial to ensure the continuity and success of U.S. agriculture in an increasingly dynamic and challenging global market environment.

Source : illinois.edu