DarcyMaulsby/iStock/Getty Images Plus photo

By Chad Fiechter and Jennifer Ifft

Introduction

To manage input costs, many producers take advantage of early pay and other discounts offered by input suppliers. Seed and chemicals often have complex pricing, with a range of pre-pay discounts, volume discounts, rebates and other incentives. On top of that, financing options are almost always available, with their own schedule of discounts and fees. This series addresses the following aspects of seed corn costs: (1) early cash payment and volume discounts (2) discounts under seed company financing options, and (3) the cost of seed company financing relative to traditional financing. In the first article in this series, we use publicly available discount schedules to show the hypothetical range of prices that could be paid for seed corn.

Knowing the payoffs of different input purchase arrangements can help farms manage through tight profit margins. However, purchasing seed corn requires complex accounting for multiple factors that influence the final or actual cost. Prices are typically not known until around Labor Day. Most seed companies offer discounts for early cash purchase beginning as early as September and declining to zero by early winter. Our analysis does not directly account for different base prices being charged by seed companies. That data is largely considered confidential and is more difficult to access across a range of seed companies. Further, the hypothetical discount range is still quite similar across firms, no matter the base price.

Volume discounts are also common: prices can lower substantially if you limit the number of companies you work with. Most seed companies offer financing, usually through Rabobank or John Deere Financial. Furthermore, companies may offer a plethora of additional discounts: early delivery, new customer, growing customer, loyalty, multi-year commitment and others.

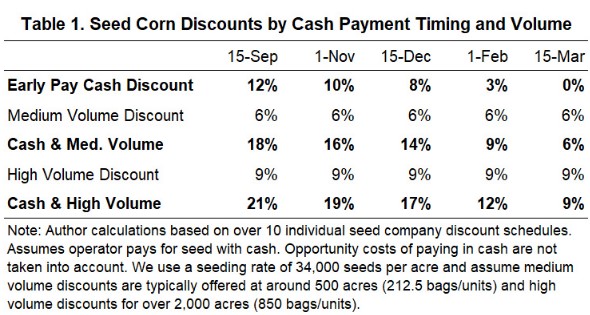

To provide some clarity, we devised a representative schedule for the largest and most common discounts: early pay and volume. We use the actual schedules of over 10 seed companies, but our discount schedule is designed to represent the industry norm instead of an individual company. Our goal is to provide a reasonable approximation for how the seed industry utilizes discounts as incentives for purchase. We intentionally do not discuss any firm-level discount schedules, as our analysis is not intended to disclose information from an individual seed company or provide critiques. Each company has unique programs that should be considered in their entirety—it would be unfair to compare companies based on our simple categories of interest. To create a standard framework, we chose five key dates with intervals of a month and a half and averaged the discount rates of each company during this time period. While discounts are not uniform, we did find mostly consistent patterns.

The volume discounts are similarly estimated. Our base is no volume discount. An average seeding rate of 34,000 seeds per acre is used for the conversion between acres and units of seed corn. We used the threshold of 500 acres (212.5 units) of corn as a “medium volume discount.” The “high volume discount” reflects a threshold of 2,000 acres or more (850-plus units). This is often the top of the published volume discounts. Using our imposed order size standardization, we then tabulated the volume discounts and calculated the average.

Table 1 shows early pay discounts with no volume discount, a medium volume discount and a high volume discount. Discounts are all calculated from the “base” price, so we simply added together the early pay and volume discounts. Our dates of September 15, November 1, December 15, February 1 and March 15 are representative cutoff points; the September 15 cutoff was the earliest we observed. Early pay discounts decline gradually in the fall but more rapidly in the winter. By mid-March, most companies no longer offer an early pay discount. For farms that buy seed in early fall and have some type of volume discount, even with just these two types of discounts, prices should be nearly 20 percent lower than the base. Zulauf and King (1985) found a 10 percent discount in seed price in their survey of Ohio farmers. This could represent a change in the practices of seed companies or the prevalence of larger farms today.

In this article, we show how volume and early pay discounts alone can create a wide range of potential prices for seed purchased from an individual company. Medium volume discounts typically are available at about 500 acres, while high volume discounts would require around 2,000 acres. In our next article in this series, we will discuss discounts under seed company financing.

Source : illinois.edu