By Dr. Don Shurley

Lately, it seems everything that could go wrong has gone wrong. If we were playing backyard football, the cotton market would get a penalty for piling on.

Growers are frustrated. Some growers and agribusinesses are hurting financially after a tough 2015, and 2016 doesn’t look much, if any, better. Keeping with the football theme, as the legendary late University of Georgia football announcer Larry Munson would say, it’s time to “hunker down”.

The History

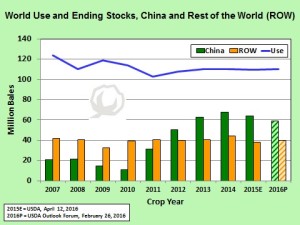

I think the fact that we are currently in a period of low prices can hardly be much of a surprise. When China started accumulating massive stocks and then, almost simultaneously, World demand bottomed and flattened out – well, the warning shot had been fired. It was just a matter of time before the market would take a direct hit.

Prices held pretty well for a couple of years because China was, after all, buying cotton and yet not using it. So although the stock build-up was there, the market – in terms of “effective stocks” – pretty much acted like it wasn’t there.

But now, demand continues to be weak, and, starting with last year’s crop, China is limiting imports and starting to liquidate some of those stocks. China has recently announced that it will begin another round of sales from its stocks beginning next month.

Recently, Turkey has announced it will place a 3% duty on U.S. cotton imports, claiming that imports are hurting Turkey’s own cotton production. The U.S. typically provides 40-50% of Turkey’s cotton imports. This would be about 1¾ million bales of U.S. cotton per year, or about 18-20% of total U.S. exports.

Making all these matters worse – and this seems to be the frustrating part from a grower perspective – all of this comes after the new farm bill in which cotton seems to have lost an edge to other crops due to differences in payments, changes in the safety net and incentives to plant other crops (“covered commodities”) on Generic Base.

And, to keep piling on, last week USDA announced a 2.02 cents decrease in the transportation cost adjustment that calculates the Adjusted World Price (AWP) from the A-Index or Far East (FE) Price. This effectively raises the AWP by 2 cents and results in an equivalent 2 cent drop in the LDP and Loan Gain from what it otherwise would be.

At low prices (cotton less than about 66 cents), an LDP or MLG kicks in and provides additional income for the grower. With this change in the AWP calculation and resultant decline in the LDP/MLG, one wonders what impact this might have on 2016 expected net returns and acreage decisions.

The Hope

Although it’s a painful time for cotton right now, there are potential positive factors on the horizon that could eventually give us better prices. Those things can easily get caught in the current negative environment, but they’re out there.

Stocks in China are on the decline. And, while still very high, at least they are moving in the right direction. This process may take several more years to finally cull the stocks down to a much more reasonable level.

However, questions and uncertainty still exist about the quality and usefulness of this cotton. Despite China’s intentions to sell off this cotton, quality will be the ultimate determining factor. If demand for this cotton is not good, effective stocks will prove to be much less than actual stocks – and this could strengthen the price outlook.

Stocks in the rest of the World (all countries excluding China) have also tightened a bit, although are projected to increase slightly by the end of the 2016 crop marketing year. This tightening in the ROW – plus the quality question regarding China’s stocks – has and will likely continue to push the demand for quality fiber.

Cotton usage (demand) has been essentially flat since 2012. This, in combination with high stocks, has been cotton’s problem. Use is projected to increase slightly (0.8%) for the 2016 crop year. Another possible encouraging sign – in USDA’s April supply/demand numbers, the estimate for 2015 crop year World use was higher than the March estimate. That’s the first time use has been adjusted upward since August. Hey, at this point, we take anything positive we can find.

Also, although Turkey will place a 3% duty on U.S. cotton imports, subsequent reports have suggested that this may not impact U.S. exports to Turkey. Reports suggest that U.S. cotton is desired and needed in Turkey’s textile industry, and that the increased cost imposed by the duty will just be passed on to Turkey’s textile exports. Of course, if this increased cost results in less exports, then ultimately it may curb the use of imports from the U.S. But the point is, we apparently can’t yet know that U.S. exports to Turkey are going to be hurt or how much.

The Heads Up

Cotton growers need to be patient and wait on positive news and better pricing opportunities. This is stressful and difficult to do, particularly after coming off a difficult 2015 crop year. But concentrate on being efficient, getting the most out of every dollar you spend, and producing good yields and – just as important – good quality.

Prices (December futures) have made a nice recovery over the past 3 weeks and have passed the 62-cent mark. It’s likely this 62 to 63-64 cent area could be met with some resistance.

I believe this rally and the 60-64 cent area could be your first pricing decision opportunity. Do we want something better? Absolutely. But at the same time, what if prices move lower?

There are several ways to look at this. If you fixed price contract a small portion of expected production and prices eventually are lower at harvest, you can still collect any LDP. But before you contract, try to get a good basis and try to get premiums for quality. Also, make sure when you have and when you lose beneficial interest and eligibility for LDP.

Click here to see more...