The value of the dollar versus other countries’ currencies remains strong this year, creating headwinds for U.S. agricultural exports. Since early 2021, the agricultural trade-weighted exchange rate index calculated by the USDA shows the dollar has appreciated 15 percent against customers’ currencies. One consequence of the strong dollar is the projected record deficit for the U.S. in agricultural trade of $32 billion for the fiscal year ending September 30. It would be the second consecutive fiscal year U.S. agricultural trade recorded a deficit. A strong dollar makes U.S. agricultural goods more expensive, weighing on U.S. exports. It also makes U.S. agricultural imports less expensive, incenting imports.

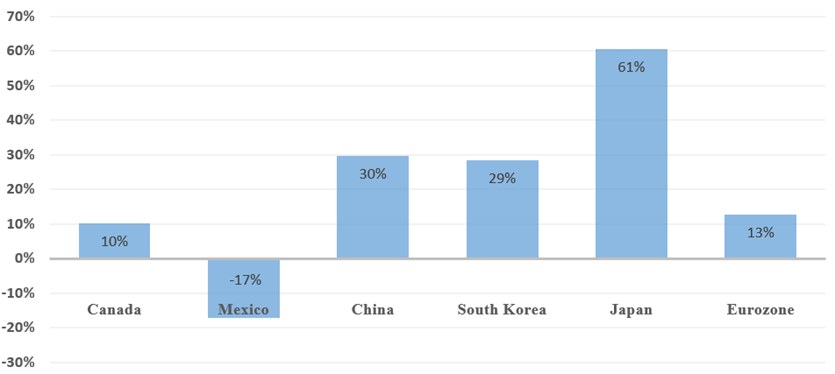

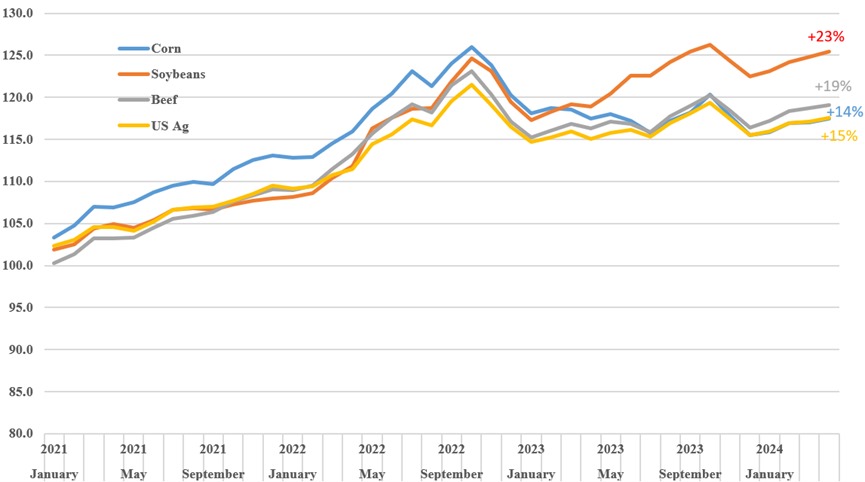

Figure 1 shows changes in the dollar since early 2021 compared to currencies of Nebraska’s largest agricultural customers. Apart from the Mexican peso, against which the dollar has depreciated 17 percent, the dollar has appreciated against the currencies of all other key trading partners ranging from a 10 percent gain versus the Canadian dollar to a 61 percent gain relative to the Japanese yen. The dollar’s appreciation can also be seen in trade-weight exchange rates for specific commodities. Figure 2 shows trade-weighted exchange rate indexes for Nebraska’s three largest commodity exports (corn, soybeans, and beef) and the overall trade-weighted rate for U.S. agricultural exports. The indexes show the appreciation of the dollar against the currencies of importers of corn (+14 percent), soybeans (+23 percent), and beef (+19 percent).

The effects of the dollar’s appreciation relative to Asian currencies and its depreciation against the peso are seen in export figures. U.S. exports to Asia have declined while sales to Mexico have climbed. Beef exports are a good example. In 2023, U.S. beef sales to major Asian purchasers declined by more than 20 percent. At the same time, beef sales to Mexico rose by more than 20 percent. The appreciation of the dollar against Asian currencies, making beef more expensive, and the depreciation against the peso, making beef less expensive, contributed to these export shifts. To be sure, other factors, like supply, demand, and economic conditions, played a role too, but exchange rates contributed as well.

FIGURE 1. CHANGE IN DOLLAR VS. TRADING PARTNERS’ CURRENCIES (JAN. 2021 – APRIL 2024)

FIGURE 2. REAL COMMODITY TRADE-WEIGHTED EXCHANGE RATE INDEXES

Click here to see more...